Datadog Salesforce Lead Hot Software Stocks Riding Work-From-Home Wave By Investors Business Daily

Salesforce (CRM) stock, Cloudflare (NET), Veeva Systems (VEEV), ServiceNow (NOW) and Datadog (DDOG) are five software stocks to watch this week.

Salesforce.com (CRM) is building the right side of a base. Datadog stock, ServiceNow, Cloudflare and Veeva Systems are already in buy zones.

With the coronavirus pandemic keeping employees at home, demand for cloud-based software and other software services has grown. But some cloud service providers face questions about future technology spending trends, as the direction of the pandemic and economy remain uncertain and customers in some industries get hit harder by the crisis than others.

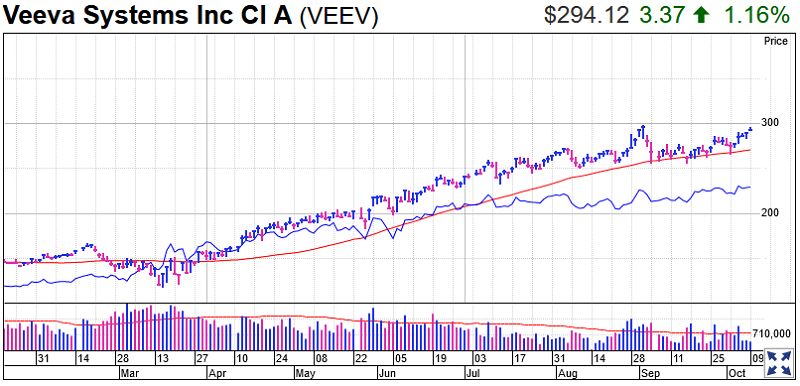

Life Sciences Software Stock Offered Early Entry

Veeva Systems stock rose 6.7% to 294.12 on Friday. The official buy point is 298.86 from a flat base. But the life sciences software maker offered some early entries, including a recent bounce off its 50-day line. On Thursday, shares cleared a 287.28 handle-like entry.

Veeva stock has best-possible 99 Composite and EPS ratings. Its relative strength line, which measures a stock’s performance against the S&P 500, is at an all-time high.

Veeva Systems A Long-Term Leader

The software maker is also on IBD’s Long-Term Leaders watchlist.

Veeva Systems makes software intended to facilitate clinical trials for companies like biotechs. Its customers include Moderna (MRNA) and AstraZeneca (AZN) — companies that are trying to develop coronavirus vaccines. As with the other software stocks, the recent Stock Of The Day, has also benefited from its customers adopting digital technology.

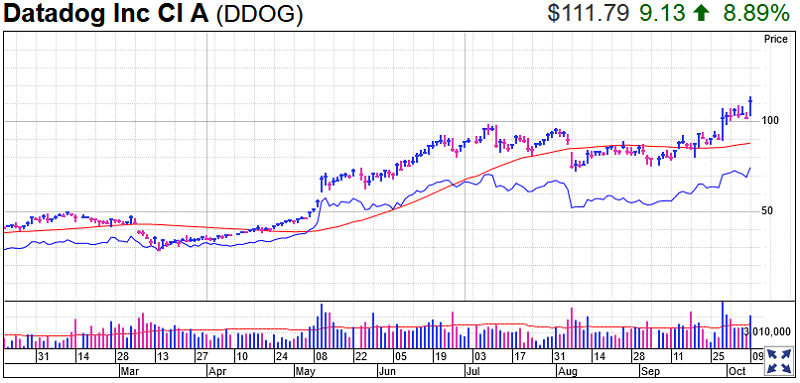

Datadog Stock

Friday’s IBD Stock Of The Day jumped 8.9% on Friday to 111.79. That pushed Datadog stock above the top of its mini-consolidation, offering a new 109.70 buy point. That recent pause came just above a prior base with an official buy point of 99.09, according to MarketSmith analysis.

Datadog provides cloud-based tools to help developers and IT teams monitor computer infrastructure. The pandemic has helped boost demand for its products, as more companies with employees working from home rely on sturdy tech infrastructure to get through the day.

The stock was added to SwingTrader on Friday. Like the other software stocks here, Datadog gets a strong 98 Composite Rating from IBD. Its EPS Rating is 78.

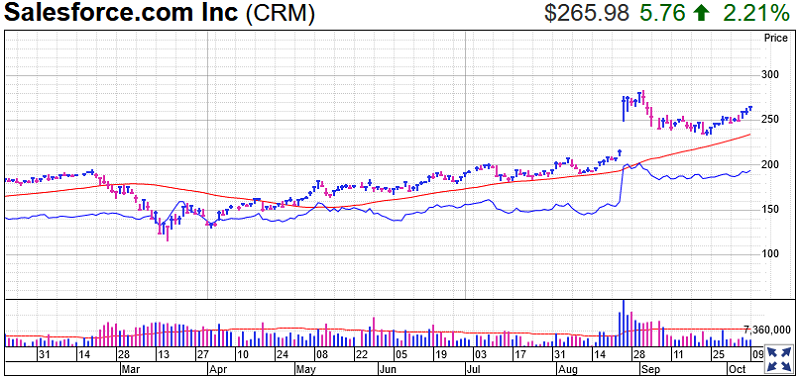

Salesforce Stock

Salesforce stock, a Long-Term Leader and on SwingTrader, rose 7.3% to 265.98 last week. Shares of the company, which makes software intended to improve businesses’ interactions with customers, reached a high of 284.50 last month.

CRM stock has now formed a cup base with a 284.60 buy point.

Salesforce stock has a 99 Composite Rating and a 95 EPS Rating.

Shares of the company jumped in late August after quarterly results beat estimates, results it attributed to “ongoing customer prioritization of digital transformation initiatives, with the Covid-19 pandemic driving even greater urgency to engage customers in new ways.”

However, Salesforce faces competition from Adobe (ADBE) and Microsoft (MSFT).

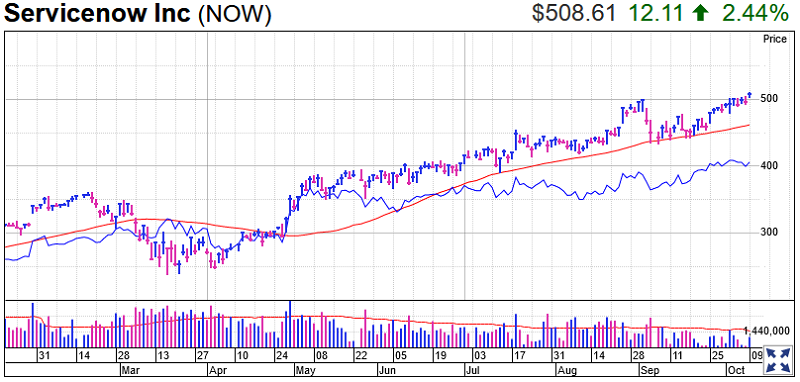

ServiceNow Stock

ServiceNow stock climbed 3.1% to 508.61 last week, with nearly all of the gain on Friday. NOW is now in a buy zone, rising past a 501.92 entry of a pattern resembling a flat base. The stock got a lift off its 50-day line last month, offering an early entry.

Its shares have Composite and EPS ratings of 99, making it a leader among software stocks. The stock’s relative strength line is just off recent highs. ServiceNow, like Salesforce stock, is a Long-Term Leader.

ServiceNow makes software that helps to digitize administrative procedures in the workplace, and facilitate tasks for Human Resources and customer service management. In late July, the company’s second-quarter earnings beat analyst estimates. But its outlook for subscription billings came in below expectations.

Analysts say demand in financial services, health care and government agencies has helped the company. But industries like transportation, hospitality and retail, which have been hit hard by the pandemic, have turned into a possible vulnerability.

Cloudflare Stock

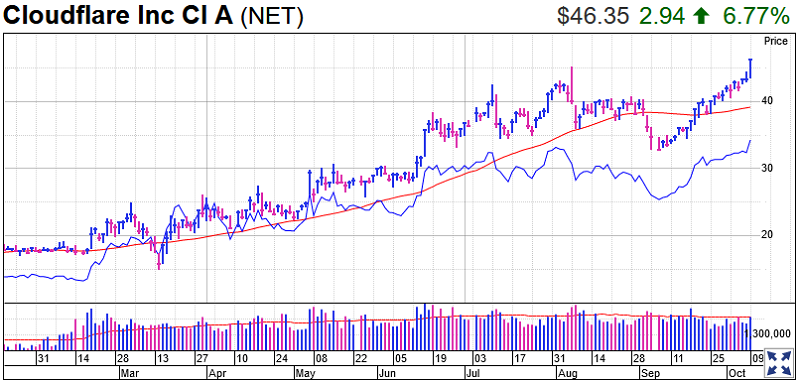

Cloudflare stock rallied 11% last week to 46.35. Friday’s 6.8% surge pushed shares above a 45.38 buy point from a cup base.

The stock had already cleared an early entry of 40.94.

Cloudflare develops a cloud platform that helps businesses with security and other network services. The company went public last year.

Similar to the other software stocks here, shares have a 92 Composite Rating. Cloudflare’s EPS Rating is weaker, at 57. The stock’s relative strength line is at an all-time high.

Trading Education Online Courses

TracknTrade Trading Software Free Trial