Sector Rotation and What It’s Telling Us About Market By Van Tharp Trading Institute

For a couple of years before covid, my lovely and talented wife and I made an annual trek to Scotland. I wrote about it back then in this same space (in 2018 and 2019). Today I get to write about this favorite country of mine again.

Since international travel is getting back to normal, we got to go back to Scotland six weeks ago. This time, we visited the Isle of Skye and St. Andrews. And with all that’s going on in the U.S. markets recently—a double-digit gain (16% in the S&P 500) off of the June 17th lows—I thought that a look at how sectors are rotating could give us some insight into whether this move can continue.

On my first travel across the Atlantic Ocean since 2019, I was again delighted by the people, landscape, and fine beverages in Scotland (we got to visit several Scotch distilleries in the highlands and Isle of Skye). But once again, it was the food that was the most unusual cultural revelation. Yes, the single most striking cultural insight I got there came from…menus.

My wife and I, along with two very close friends, ran and hiked on the Isle of Skye and in the Highlands on the Speyside Way Trail. All that exercise means we didn’t skip many meals. And after looking at menus morning, noon and night for over a week, I was once again struck by the pervasiveness of that uniquely Scottish dish—haggis.

If you’re not familiar with this culinary oddity, let’s turn to Encyclopedia Britannica for a definition:

Haggis, the national dish of Scotland, is a type of pudding composed of the liver, heart, and lungs of a sheep, minced and mixed with beef or mutton suet and oatmeal and seasoned with onion, cayenne pepper, and other spices. The mixture is packed into a sheep’s stomach and boiled.

Whether you found that description gut-wrenching or mouthwatering (I’m guessing more the former than the latter…) I believe that this is the most ubiquitous main dish of any culture I’ve visited.

The Scots love them some haggis. They eat it for breakfast, lunch and dinner. And that’s no exaggeration. Here is a fact: Haggis was on every menu for every meal we ate in Scotland. From the fanciest five-star restaurant to breakfast at the tiny B&B, there was haggis.

But back to the haggis. I’ll write about whether I tried it (and whether I actually hurled it) in an upcoming article. For today, there is a great reason I’m writing about organ meats wrapped in a sheep’s stomach: This quintessential “consumer staple” of Scotland connects directly to a big change happening in the markets right now. Let’s see how.

Current Sector Rotation – Where the Money Is Going

The term “consumer staple” is not one that we use every day. But it is the name of a very important sector in the market.

The broader market has been subdivided into sectors so that investors can understand, and invest in, more focused areas. One of those sectors is called “consumer staples”. And, being a risk-off or defensive sector, it was a good place to be in the first half of the year. Here’s how Investopedia.com describes this sector:

Consumer staples are essential products, such as food, beverages, tobacco and household items. Consumer staples are goods that people are unable or unwilling to cut out of their budgets regardless of their financial situation.

Think of companies like Walmart (WMT), Coca-Cola (KO), Pepsi (PEP), Procter & Gamble (PG) (maker of Tide, Pampers, etc.) and Philip Morris (PM).

These are companies that are typically defensive investments—they go down more slowly than most stocks during market pullbacks, but they also typically don’t grow as fast in up moves.

Earlier this year, when the market was diving down off of all-time highs thanks to inflation, war, and supply chain problems, the Consumer Staple segment outperformed the risk-on Consumer Discretionary sector:

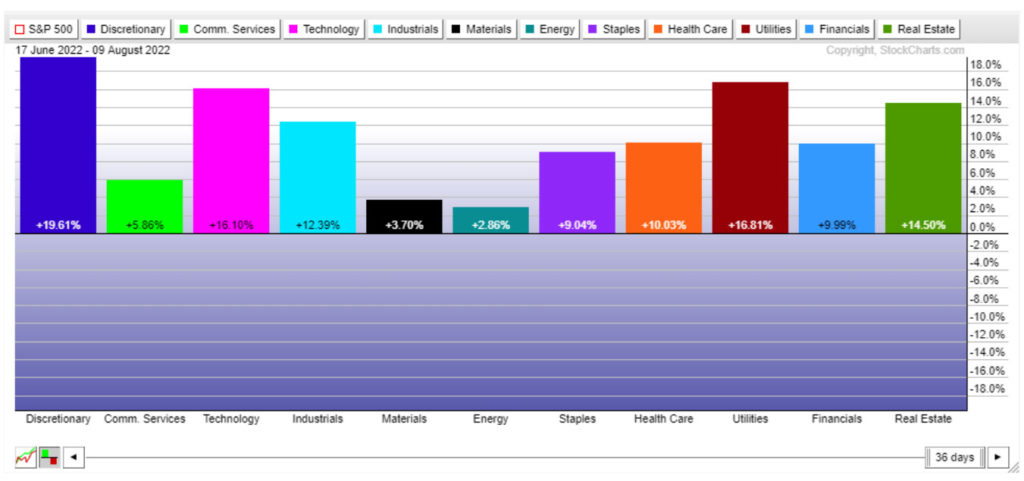

But since the June 17 lows in the market, we’ve seen quite a different story:

In this seven-week period of time, we see that the Consumer Discretionary sector is outperforming the Consumer Staples by a two-to-one margin.

In fact, the Consumer Discretionary sector is outperforming ALL of the other 10 S&P sector ETFs since June 17th:

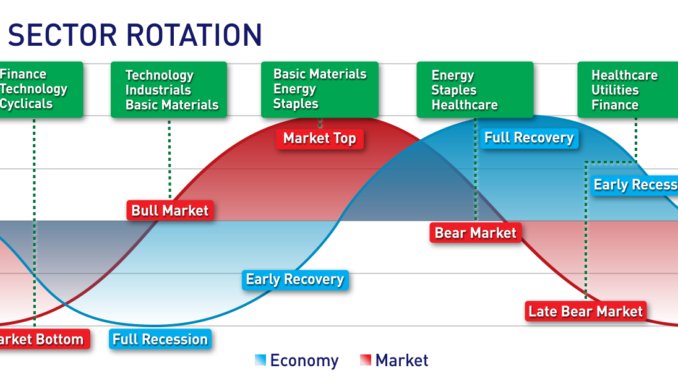

What is this telling us? For now, the move from exceptionally poor performance by a risk-on sector like Consumer Discretionary to very strong performance actually tells us good things about this market move up. In particular, market participants are finally ready to add a bit more risk to their portfolios, at least in the intermediate term. We see this in other risk-on assets like cryptocurrencies and the tech sector as well.

And the Consumer Staple sector, representing the products that we’re going to use no matter what (much like haggis for my Scottish friends), is one of the few sectors that has managed to break even so far this year. Only energy and utilities are positive for 2022. And this should come as a surprise to no one, when we look at the U.S. Consumer Price Index (CPI) inflation numbers that were announced this morning. The top five categories for inflation over the past year were either, energy, utilities (natural gas and electric), or consumer staples like food.

Price increases over last year (CPI report)…

- Fuel Oil: +75.6%

- Gasoline: +44.0%

- Gas Utilities: +30.5%

- Electricity: +15.2%

- Food at home: +13.1%

- New Cars: +10.4%

- Transportation: +9.2%

- Overall CPI: +8.5%

- Food away from home: 7.6%

- Used Cars: +6.6%

- Shelter: +5.7%

- Medical Care: +5.1%

Van Tharp Trading Institute Live Online Workshops Books Home Study Courses Free Resources Blog