Will the Fed Do an About-Face in 2025? By Elliottwave International

Would you like the ability to predict what the Fed will do with its fed funds rate? Just watch the bond market. Our August Elliott Wave Financial Forecast did just that and predicted the Fed would “play catch up.”

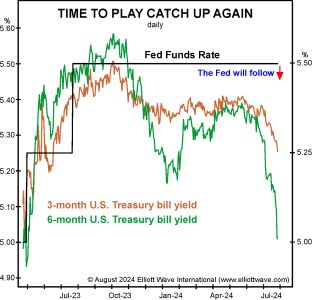

The chart below shows the current fed funds rate relative to the yield on both 3-month and 6-month U.S. T-bills:

This week, the yield on both T-bills closed at their lowest levels in a year and have dropped well below the fed funds rate. Based on the current level of T-bill yields, the pressure is mounting on the Fed to lower the fed funds rate to align with T-bill rates, which again are signaling impending economic weakness. The Fed had its chance on Wednesday to lower its rate but did not act. Why? Because, as Chapter 3 of The Socionomic Theory of Finance notes, the average lag time is five months, and the rate decline began accelerating only a month ago. Of course, the more the Fed waits, the more dramatic their reduction will be as they play catch-up to the market. If U.S. T-bills are at current levels or lower by the time of the next Fed meeting on September 18, our model predicts that the Fed will lower the fed funds rate commensurately with the lower level of T-bill yields. (emphasis added)

Indeed, the Fed lowered the fed funds rate by 50 basis points in September. It was the first time the central bank had cut rates in four years. Two other rate cuts followed (November and December) in 2024.

What decisions will the Fed make in 2025?

Follow this link to get our current bond market insights by reviewing our new January Elliott Wave Financial Forecast.