Manias Always End Poorly By Elliottwave International

Stocks relative to commodities are historically over-priced. A major sea change appears to be ahead. The September Elliott Wave Financial Forecast elaborates:

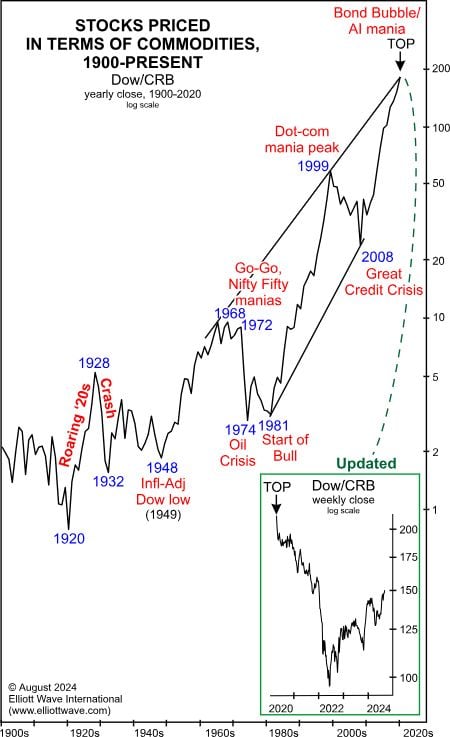

The title of the May 2021 issue of The Elliott Wave Theorist was, “Commodities and the Stock Market: Paradigm Shift Emerging.” The issue included a version of the chart below showing stocks priced in terms of commodities all the way back to 1900. “This ratio has risen to 200 times since 1922, which is 102 years ago,” EWT said. “It is time for a tidal change in both sectors, in the opposite direction.” The inset on the chart shows that the tidal change is underway, regardless of a countertrend rally in the ratio from 2022, when the mania for technology and AI shares went into full blown orbit.

Note how each time the Dow/CRB ratio rallied to meet the top trendline over the past 60 years, a major peak in stocks relative to commodities occurred. The first run up took place before the trendline began, from 1920-1928, coinciding with the Roaring ’20s. The ratio peaked at the end of 1928, and stocks crashed in 1929, which kicked off a bear market lasting until 1932. In inflation-adjusted terms, the bear market ended in 1949, one year after the ratio made a low. The ratio’s rise until the late 1960s and early 1970s culminated with the Nifty-Fifty stock mania. The stock market then plunged amidst an oil crisis until late 1974, while commodity prices soared. Commodities peaked in 1980, at which time stocks started a major bull market. The Dow/CRB’s rise to meet the trendline in 1999 coincided with the top in the dot-com mania and a crash in the NASDAQ. The Great Credit Crisis ended in early 2009, giving way to a bull market in stocks, as the ratio rose to meet the top trendline once again. This time, the push to the peak in April 2020 coincided with a bond-market bubble that resulted in negative yields and all-time highs in bond prices.

As optimism toward equities has reached a historic extreme, bearishness toward commodities is at a multi-decade extreme. As EWT noted, the Dow/CRB ratio is “set to fall back to the ‘sensible’ level of the 1960s-1970s.”

Think AI is smart enough to know what happens when a bubble bursts?

Go Here >>> To See What Our Financial Forecast is Predicting