Investing with Leverage: Faster Gains or Faster Losses? By Elliottwave International

Investing with leverage can mean faster gains OR faster losses. (In fact, faster losses are more likely because stocks market selloffs are almost always faster and more vicious than stock market rallies.)

These days, increasing numbers of investors appear to be focused only on the potential positive side of leverage.

These two headlines provide a snapshot of what’s been going on:

- Retail investors snap up triple-leveraged US equity ETFs (The Financial Times, May 4)

- Individual investors buying leveraged ETFs more aggressively (Marketwatch, March 30)

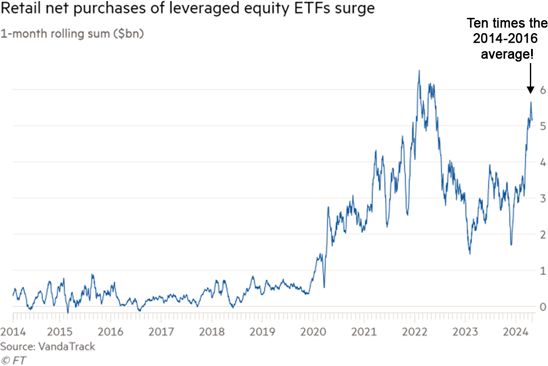

Our May Elliott Wave Theorist showed this chart and said:

Retail investors’ gorging on equity ETFs leveraged by two to three times has approached the 2021 extreme, while the total flow of retail money into the stock market has exceeded that of 2021.

Super bullishness goes beyond Main Street investors. A major bank surveyed institutional money managers and this headline reflects the findings (Reuters, May 14):

Investors ‘most bullish’ since Nov 2021 – BofA survey

The survey was conducted among global fund managers with $562 billion of assets under management and showed that their cash levels dropped to a three-year low of 4%. Of course, this means they are nearly fully invested.

You may ask, “Why not be bullish – why not invest with leverage — the Dow Industrials recently hit 40,000 for the first time?”

Yes, yet keep in mind this quote from our May 22 U.S. Short Term Update:

The DJ Transportation Average did not confirm the Industrials’ new high on [May 20], nor did it confirm the Industrials’ new closing high on March 28, nor the Industrials’ closing high all the way back on January 4, 2022.

This non-confirmation doesn’t mean the Dow can’t go higher in the near-term, yet you may want to get our analysis as to why those who are thinking about investing with leverage may want to re-consider.

Just follow the link below to access our Financial Forecast Service now.