Trump’s new tariffs are poised to hit consumers where it hurts them most, right in their wallets. With consumer prices already very high and now higher on imported goods because of Trump Tariffs, the cost of everyday essentials from cars to household items is set to increase even higher. At the same time mounting consumer debt particularly in auto loans, is reaching alarming levels with delinquencies surging to highs not seen since the Great Recession. Faced with tightening credit conditions along with higher costs consumers are pulling back, cutting discretionary spending and focusing on paying off debt. This belt-tightening is fueling movements like “No Buy 2025,” as more Americans realize that avoiding frivolous purchases may be their best financial defense.

Have You Taken the “No Buy 2025” Pledge? By Elliottwave International

If so you’re far from alone. The “no buy 2025” movement is gaining momentum. In case you haven’t heard, the goal is to pay off debt and avoid frivolous spending. Our Elliott Wave Financial Forecast comments on what the growing stinginess among consumers portends for retail prices:

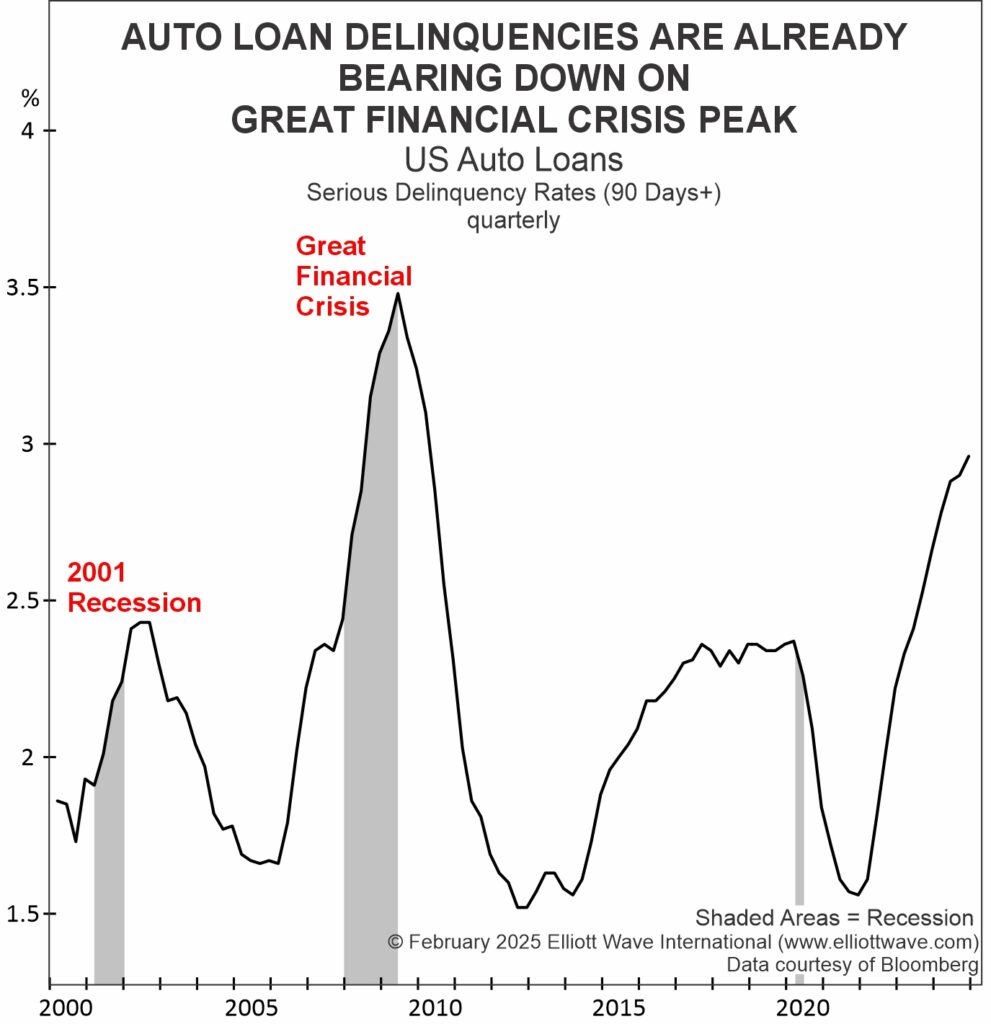

Credit conditions reveal an extreme vulnerability on the part of consumers. In January, for instance, EWFF showed a chart of non-mortgage write-offs soaring to their highest level since the wake of the Great Recession. This chart shows the same rise toward the peak of the great financial crisis in the share of U.S. auto loan payments that are at least 90 days past due:

These and other charts shown in past issues attest to the fact that the smartest thing consumers should have been doing is getting out of debt and cutting back on spending. In late January, The Wall Street Journal reported that consumers are actually starting to make strides in this direction. “A growing number of Americans are taking the ‘no buy 2025’ pledge, committing themselves to buy very little or nothing during 2025,” says the Journal. “People are tiring of overconsumption and want to pay off debt.” It may take a bit for the trend to gather steam, as personal consumption accounted for 68% of U.S. GDP as of December 31. As the economy pinches household budgets further, this new consumer stinginess will become more prominent. In time, retail prices will fall outright when consumer caution reaches epidemic proportions.

Deflation instead of Inflation? The Financial Forecast explains why this notion is not as far-fetched as some people imagine. Get independent analysis which keeps you ahead of the crowd.

Go Here for Free Market Resources