Finding Your Trading Short Game: Key Tactics for the Upcoming Risk-Free Challenge By Trade Ideas

With Trade Ideas’ exciting Portfolio Challenge coming up from February 26th to 28th that allows only short-selling entries, traders of all skill levels may be searching for tips on spotting solid shorting opportunities. As an experienced trader well-versed in long and short setups, I want to provide some invaluable dos and don’ts when shorting stocks.

First and foremost, new traders should consider the challenge a risk-free educational experience, not necessarily a competition to finish on top of the leaderboard. Simply ending the tournament net positive through multiple trades would be a significant win in building your short-side proficiency.

Now, onto the tactics!

The first key is utilizing scanner filters to find prime short candidates setting up. For example, I will frequently scan for names that have recently gapped significantly on the daily chart. Stocks that make overnight moves of 10-15% or more to the upside often fail later in the day as quick momentum fades. The “Stocks that Gapped Up over 7%” filter is perfect for locating these extended setups.

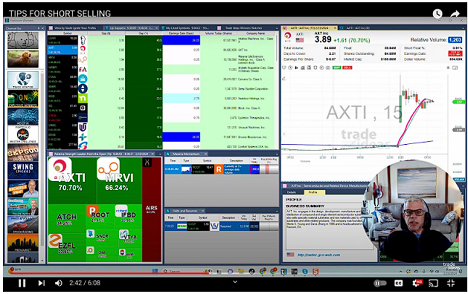

Once I have a watchlist of potential shorts, I analyze the 15-minute intraday chart to identify where the momentum has started to stall. Specifically, I want to see the stock price break below rising support like the 10 or 20-period simple moving average; this signals that bullish interest and buying pressure are beginning to wane.

It’s also crucial to avoid shorting into new intraday lows, as these breakdowns snap back violently in short order. Instead, experienced short sellers prefer to wait for counter-trend bounces into prior support-turned-resistance. This entry aligns much closer with my rules for buying dips when going long – I don’t chase new 52-week high breaks but seek time retracement pullbacks coming off new highs.

A few real examples from my gap scanner clearly show these short sale setups:

AXTI: After gapping up over 25% yesterday morning, it ground slowly lower before breaking below 10SMA support just before noon. This rejection provided the short entry, with a stop above the moving average.

CVNA: Similar setup with a solid open that buyers couldn’t sustain. The clean breakdown through rising 20SMA support signaled optimal short-entry timing, allowing sellers to capitalize on the ensuing slide.

As the practice short-selling challenge approaches next weekend, check out the free daily livestreams on our Trade Ideas YouTube channel. I and other experienced traders will be providing tips all tournament long, answering questions on maximizing success playing solely from the short side in this risk-free practice environment. Use this time to develop confidence shorting and expand your overall trading skillset!