Markets Get Slammed: Some Things to Remember By Van Tharp Trading Institute

The huge sell-off early on Tuesday, September 13, 2022, had both the perma-bulls and the end-of-the-world gang pushing their agendas hard and fast. In particular, I had just read a piece, late last week, from an investor and writer that I really like. But, it was pushing the bullish agenda, big-time. And to be honest, bad news sells. So touting yesterday’s market slam as the biggest down day since 2020 was easy headline fodder.

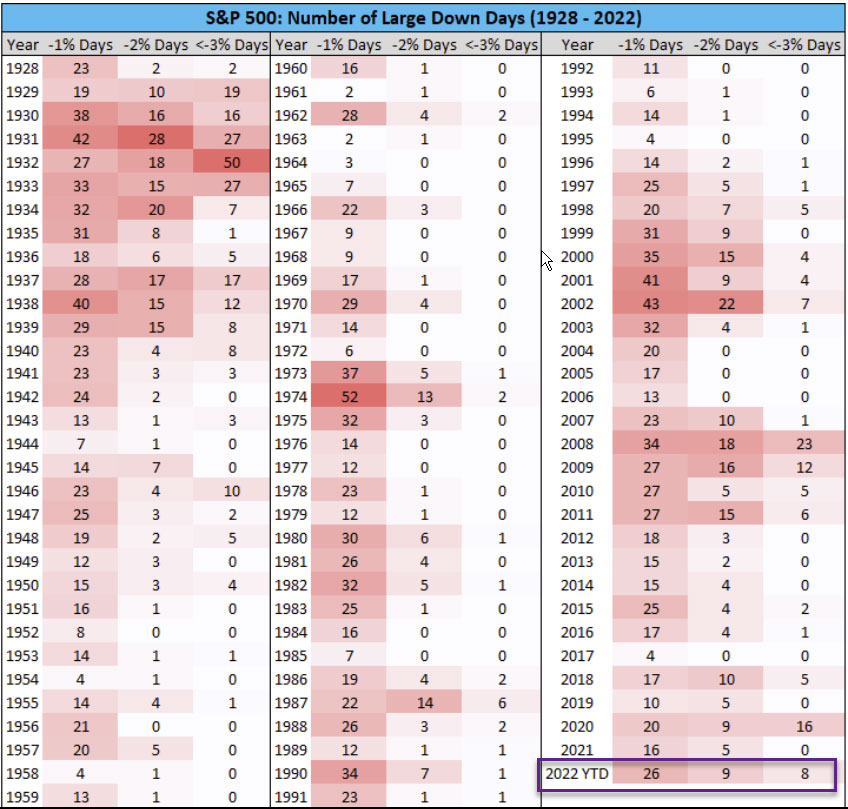

Persistent inflation news sent the Nasdaq down by -5.2%, with the S&P off -4.3% and the Dow dropped -3.9%. All were the biggest one-day declines since June of 2020. Everyone I talked to today, both personally and professionally, had this topic as top-of-mind. Some were downright indignant. But I just reminded each of them that we are in a very high volatility market. Here are the numbers from Compound Advisors:

In just over eight months, 2022 has already had eight days where the S&P 500 was down -3%. If we have no more, that will still be more big down days than every year since the 1930s except for 2008, 2009, and 2020.

So many big, fast moves down have people getting emotional about what’s happening. But as Van always taught, a measured and unemotional approach to analysis is useful in times like this.

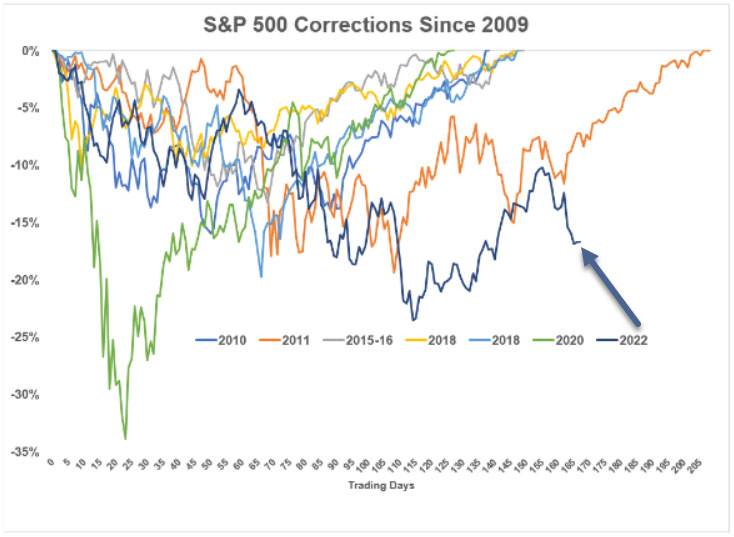

Because there is so much negativity going around now, I changed article topics today. Especially because this one chart from Ritholtz Advisors’ Michael Batnick is really worth studying. The chart is pretty busy, but it shows the end percent move from the first day of each market correction we’ve had since 2009:

The bottom line is this: The current correction is fairly normal, if not already a bit drawn out. The average intra-year drawdown dating back to the 1920s is over 16 percent. This one may not be over yet, but it has the feel of a pretty ugly drop for a couple of reasons.

- First, drawdowns since 2011 have been fairly tame by historic standards, so our recency bias makes this one stand out (especially since the Covid drop and recover in 2020 was so fast).

- This drop has been longer than the faster correction and recovery patterns that we’ve seen.

- And most importantly, the global macroeconomic picture is very ugly, with much bigger inflation than we’ve experienced in decades and a shooting war in Europe that we haven’t experienced in a still longer time.

While investors are trying find a lower-risk footing in cash or investments with some sort of yield, short and intermediate-term traders have some opportunities to lasso the bucking bronco that is the market. Here are some thoughts for the traders out there.

- In volatility expansions, swing traders need to monitor stop levels and profit target objectives very closely. Perhaps even intra-day. The stop distances used in a slowly creeping up market just won’t work in a high-volatility market like this one.

- In the 34-year period from 1992, until mid-2016, (when I last did an exhaustive look) the 20 biggest down days all happened during these three periods: The internet bubble bursting in 2000- 2002, the real estate/debt bubble in 2007-2009 and the U.S. debt downgrade of 2011.

- But here’s the thing you might not know: 19 of the biggest up days also happened in those same bear runs!

The bottom line for traders is that volatile down markets also include violent swings up, even if for short periods of time!

If you’re not comfortable in these markets that swing violently intraday, it’s perfectly fine to keep your powder dry until the volatility drops a bit. Know what you can handle from a risk perspective and adjust position sizes according to current (not historic) volatility.

Van Tharp Trading Institute Live Online Workshops Books Home Study Courses Free Resources Blog