How To Spot A Power Trend And Make More Money In Growth Stocks By Investors Business Daily

Sir Isaac Newton would be a huge fan of the IBD Market School’s Power Trend. A market in motion tends to stay in motion. Power trends help to get you in and to keep you in when the stock market is in an unusually strong uptrend.

Uptrends, Downtrends And The Chop

The market has three basic states: uptrends, downtrends and the dreaded rangebound motion.

Using our methodology, downtrends are easy; you just stay out.

Rangebound markets earned the nickname, “the chop fest.” Besides losing some money, these are very frustrating for trend-followers.

It’s all about the uptrends. Not all are created equal. Some are longer and stronger than others.

IBD researched the strongest uptrends throughout the trading history of the Nasdaq composite and came up with IBD’s Market School black and white rules to recognize them as early as possible.

How To Recognize A Power Trend

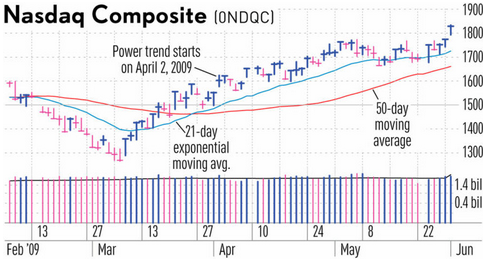

A power trend starts when these four things take place simultaneously on a major index:

- The low is above the 21-day exponential moving average (EMA) for at least 10 days.

- The 21-day EMA is above the 50-day simple moving average for at least five days.

- The 50-day line is in an uptrend (one day is sufficient).

- The market closes up for the day.

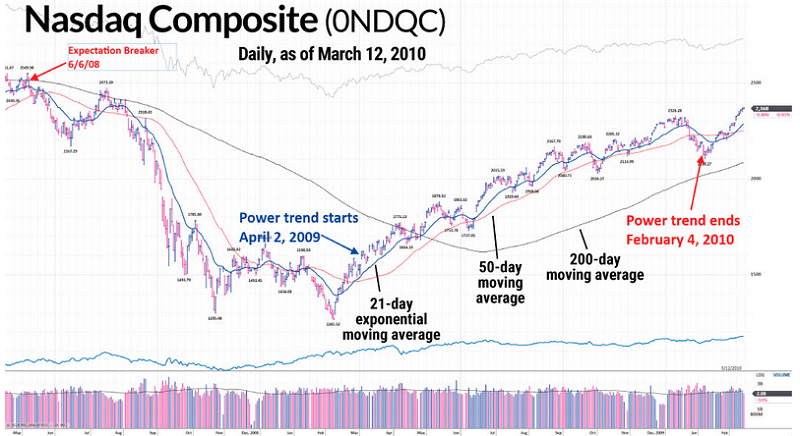

A power trend typically ends when the 21-day crosses back below the 50-day.

There are two rare cases that can turn a power trend off early: 1) a circuit breaker; and 2) a follow-through day failure. The details on these can be found in IBD’s Market School Home Study Kit. Most circuit breakers trigger with a break of the 50-day line and being more than 10% from the recent highs.

How To Make Money From A Power Trend

Like that famous country singer once crooned, know when to hold them, and know when to fold them.

Downtrends demand aggressive defense. Power trends are the times to play aggressive offense.

Aggressive offense still means 100% discipline.

One should be open to more aggressive growth names breaking out of sound bases and being open to pyramiding into those positions that are showing progress. If you use margin, this would be the only time to use it.

The 2009 Power Trend

A great example to study is from April 2, 2009 to Feb. 4, 2010.

As mentioned in IBD’s Weekend Stock Market Update, the most recent power trend started on May 8, 2020 and remains intact.

Trading the Line – How to use Trendlines to Spot Reversals and Ride Trends

Specialized Trading Education Courses

Real-Time Elliott Wave Trading Course

Peak Performance Course for Investors Traders