We’re Watching 30+ Potential Third Waves Right Now: Here’s Why By Elliottwave International

“Third waves usually generate the greatest volume and price movement”

Main trends in financial markets develop in five waves — whether that trend is up or down — and the most powerful is the third wave.

As Frost & Prechter’s Elliott Wave Principle: Key to Market Behavior says:

Third waves are wonders to behold. They are strong and broad, and the trend at this point is unmistakable… Third waves usually generate the greatest volume and price movement…

So, third waves present potential opportunity, or a big reason to “get out of Dodge,” depending on which side of the market an investor is positioned.

A memorable third wave in the stock market which leaps to mind is the one which unfolded between May and November 2008, which was the worst period of the 2007-2009 bear market.

Let’s briefly look at a couple of other examples of third waves from recent history in other markets, one of which also occurred during a downtrend in 2008 and the other unfolded in an uptrend.

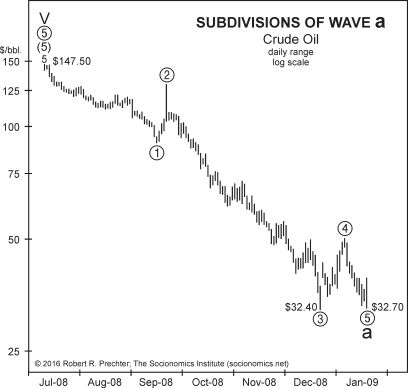

Our first stop is the crude oil market — which was in the news in 2008 as much as today because the price had zoomed to $147.50 a barrel.

This chart from Robert Prechter’s landmark book, The Socionomic Theory of Finance, shows the downtrend which followed:

Notice the third wave which stretched from circle wave 2 to circle wave 3 (or the end of wave 2 to the end of wave 3). In that third wave, the price dropped from north of $125 all the way down to $32.40.

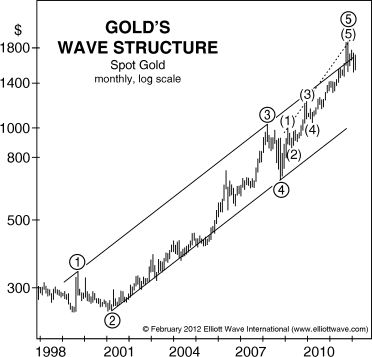

The next third-wave example is during gold’s nearly seven-year uptrend at the start of the new century. Here’s a chart from Elliott Wave International’s monthly Global Market Perspective, which covers 50-plus financial markets:

So, you’ve seen why it’s a good idea to do one’s best to identify a third wave around the time it starts.

This requires constant review of markets’ Elliott wave patterns and that’s what Elliott Wave International’s global analysts do.

Keep in mind that there are no guarantees with any method of market analysis, including the Elliott wave model.

Having said that, our experienced team has identified 30-plus Elliott wave patterns which appear to be at or near the beginning of third waves.

You can see what our global analysts see via a limited-time offer which is described below.

Why Third Waves in Financial Markets Are “Wonders to Behold”

Remember a time when a bull market was firing on all eight cylinders — or, when prices were relentlessly plummeting in a bear market?

Chances are — in both instances, third waves were underway.

Frost & Prechter’s Elliott Wave Principle: Key to Market Behavior put it this way:

Third waves are wonders to behold. They are strong and broad, and the trend at this point is unmistakable… Third waves usually generate the greatest volume and price movement and are most often the extended wave in a series.

Here’s what you need to know: Elliott Wave International’s global analysts have identified 30-plus Elliott wave patterns which appear to be near or at the beginning of third waves.

The word “appear” is used because no analytical method bats 1000 and the Elliott wave method is no exception.

That said, we invite you to read our January Global Market Perspective for financial insights you will not find anywhere else.