Tesla Rival Nio Soars Into Buy Zone As Electric Vehicles’ ‘Robust Quality’ Touted By Investors Business Daily

Nio‘s (NIO) cash and liquidity positions have improved while strong sales at the start of 2020 underscore the Chinese electric car company’s emerging brand status, Goldman Sachs said. Nio stock tested a buy point.

Meanwhile, Chinese rival Xpeng Motors, backed by Alibaba (BABA), is preparing for a confidential U.S. initial public offering, sources told The South China Morning Post. Xpeng is expected to raise $500 million, the report said. Both Nio and Xpeng are seen as leading rivals to Tesla (TSLA) in China, the world’s biggest auto market.

Liquidity risks are starting to abate for Nio after a challenging 2019, Goldman Sachs analyst Fei Fang wrote June 3. He noted Nio’s cash burn narrowed to 1.6 billion yuan (about $225 million) in the first quarter from 3.6 billion yuan in the second quarter of 2019.

The Shanghai-based maker of premium electric SUVs saw deliveries in the first four months of the year rise 37% year over year, Fang noted. He said this “has highlighted Chinese consumers’ growing recognition of this emerging auto brand.”

“In our view, the robust quality of ES6 and ES8 compared to other premium EV models available in the market, along with the consequent positive customer reviews, has driven the company’s significant demand outperformance,” Fang added. The analyst estimates Nio could achieve operating profit break-even at 10,000-unit monthly sales by 2022 and sell 175,00 units in all of 2023, which would represent 19% of the Chinese premium EV market.

Goldman Sachs upgraded Nio stock to “buy” from “neutral,” raising its price target to $6.40.

In a coronavirus-hit February, Nio’s sales significantly outpaced the overall Chinese market. Nio proceeded to more than double month-over-month sales in both March and April as production recovered.

Nio Stock Clears Buy Point

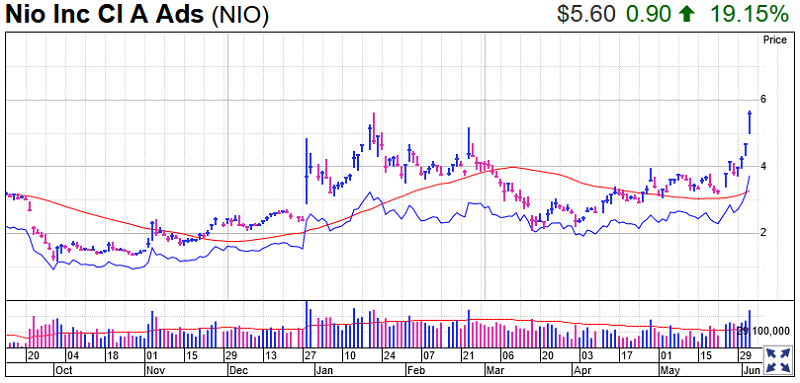

Shares of Nio jumped 19% to 5.60 in Tuesday’s stock market trading. Nio stock cleared a 5.29 buy point off a deep base. The relative strength line, measuring a stock’s performance against the S&P 500, is at its best level in months. The RS line is the blue line in the chart shown.

Alibaba invested in Xpeng Motors in 2017, part of a flood of capital into electric car companies in the world’s most populous country. Xpeng just released the P7, a rival to the Model 3 with a longer range and lower price. Tesla has accused Xpeng of stealing its Autopilot source code.

Alibaba stock rose 2%. Tesla stock climbed 0.2% to 882.96. TSLA stock is in buy range after clearing an 869.92 buy point from a very deep cup-with-handle base on Monday.

Review Purchase Green Energy Electric Cars

Trading Education Online Courses

TracknTrade Trading Software Free Trial