Critical Opportunities FreePass Stocks, Bitcoin, Gold, Oil, FX | 60+ Markets | Nov. 10-12

Nvidia Breaks Out After Early Entry; Microsoft Leads Tech Giants Offering Multiple Buy Points By Investors Business Daily

Your stocks to watch this week include big software stocks Microsoft (MSFT), Adobe (ADBE) and Salesforce.com (CRM). Also chip stocks Advanced Micro Devices (AMD) and Nvidia (NVDA).

Four of those stocks were rebounding toward their October highs. The other, Nvidia, cleared that level on Friday and entered into a buy zone.

The other four stocks were setting up in bases. They were likely still within buy range of their 50-day lines and breaking recent downtrends. Investors, under IBD’s methodology, could have bought all the stocks as they reclaimed or broke above that line. However, investors could also wait until the stocks cleared their more defined base patterns.

The strong action in Nvidia stock and these other leaders comes as the broader stock market delivered huge weekly gains, fueled by a positive reaction to election results. The Dow Jones, S&P 500 index and, later, the Nasdaq composite confirmed their new rallies, giving a green light for stock buys. Not surprisingly, many of these big techs’ stock charts look a lot like that of the Nasdaq and S&P 500.

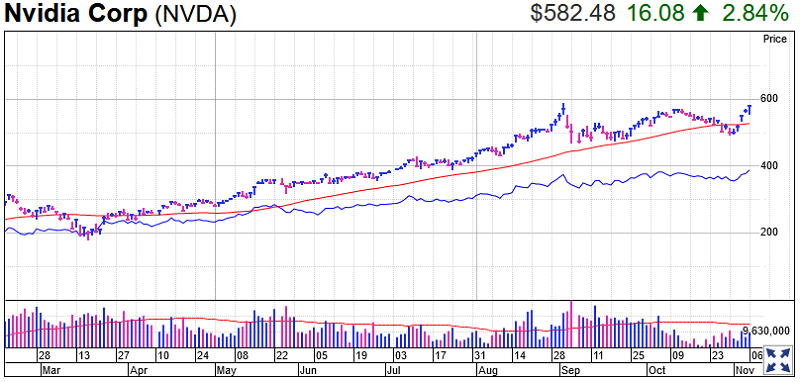

Nvidia Stock

The graphics-chip maker rose 2.8% to 584.48 in Friday’s stock market trading, clearing a 574.04 buy point of a cup-with-handle base. Nvidia stock was also Friday’s Stock Of The Day and is on IBD Leaderboard.

Nvidia makes graphics cards used for PCs and video game machines but also serves data centers and AI applications such as driver-assist programs. AMD is a major rival in graphics and data centers.

NVDA stock, a big winner in 2020, has a best-possible 99 Composite Rating and a 98 EPS Rating.

Investors could have started a position in Nvidia stock on Wednesday as it moved above its 50-day line and broke its downtrend.

For the week, shares soared 16.2%.

The relative strength line of Nvidia stock sat at an all-time high on Friday. The RS line, the blue line in the charts below, track a stock’s performance vs. the S&P 500. An RS line hitting a new high before or as a stock is breaking out is a bullish signal.

Nvidia reports fiscal third-quarter earnings on Nov. 18. If you start a position in Nvidia stock you want to have a decent cushion heading into results.

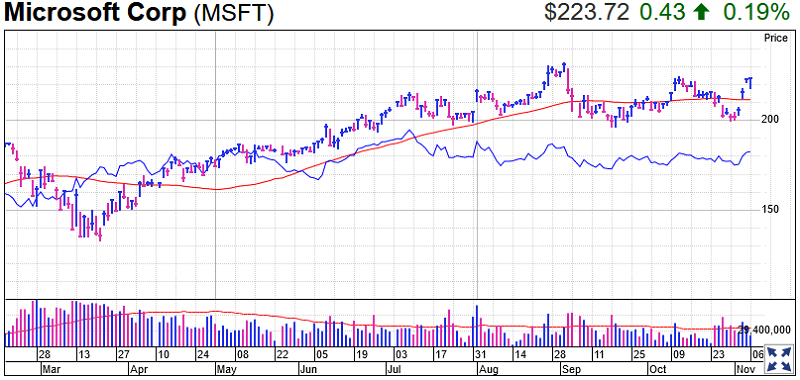

Microsoft Stock

Microsoft stock, a Leaderboard member as well as a Long-Term Leader, rose 0.2% to 223.72 on Friday, erasing intraday losses. Shares rose 10.5% for the week. Microsoft stock is just below a 225.31 entry point from a handle-like formation. The handle is too deep in the base to be a proper handle, but 225.31 would mark clearing a key resistance area.

As with Nvidia stock, the Dow Jones tech giant reclaimed its 50-day line and broke a downtrend on Wednesday, offering an early entry.

And as with the other software stocks here, the stock has a strong Composite Rating, at 92, and a 95 EPS Rating.

The stock’s RS line has drifted slightly lower over the past few months, but is moving higher again. On a long-term chart, Microsoft stock has outperformed the broader market for years.

The software giant has been transitioning from desktop software to the cloud and especially cloud-computing services. Demand for cloud software, in general, has risen as a result of the coronavirus pandemic. Microsoft’s most recent quarterly results beat expectations, lifted by demand for its cloud-computing offerings.

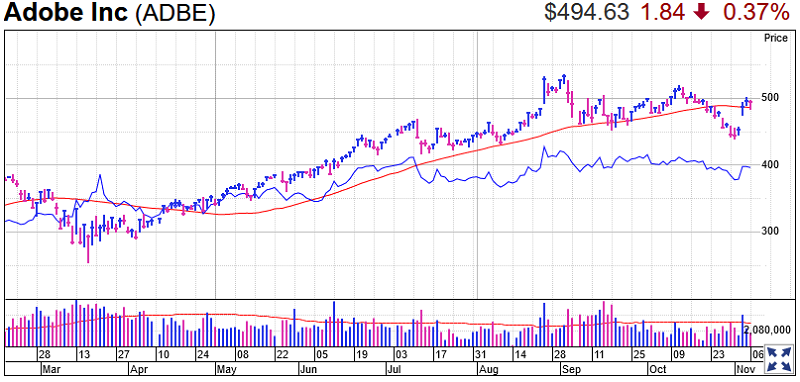

Adobe Stock

Adobe stock fell 0.4% to 494.63 on Friday, but rallied 10.6% for the week. The stock was in a double-bottom base with a 519.70 buy point.

Adobe, like Microsoft stock, is a Leaderboard member and a Long-Term Leader.

Adobe broke a downtrend on Wednesday, then closed above its 50-day line on Thursday. That offered an early entry, even as shares tested their 50-day line on Friday. The 50-day line can be a good place for investors to start a position in Long-Term Leaders.

The company, known for products like Photoshop, Illustrator and analytics, is also a strong performer among software stocks. As more people work from home in the pandemic, demand for Adobe’s subscription software has grown.

Adobe stock has a 95 Composite Rating and a 98 EPS Rating.

The stock’s RS line touched an all-time high in August. But the line has moved lower since.

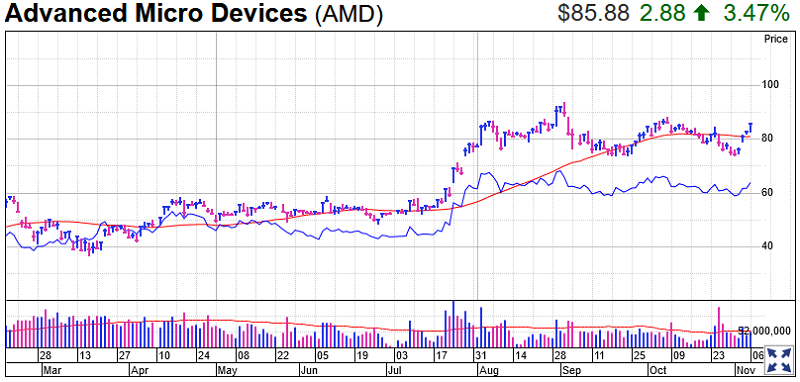

AMD Stock

Advanced Micro Devices rose 3.5% to 85.88 on Friday, capping a 14% weekly surge. The chipmaker is in a double-bottom base with an 88.82 buy point.

The company, which makes graphics processing units and central processing units for computers, is a leader among chip stocks, with a best possible 99 Composite Rating and EPS Rating.

AMD stock moved above its 50-day line on Wednesday, but didn’t break its trend line until Thursday. Investors could buy AMD from that early entry or from 85.07. That’s just above its Oct. 26 intraday high, when AMD stock briefly tried to break a downtrend.

Unlike with Nvidia stock, the RS line for AMD has drifted lower since Sept. 1, but has recently improved.

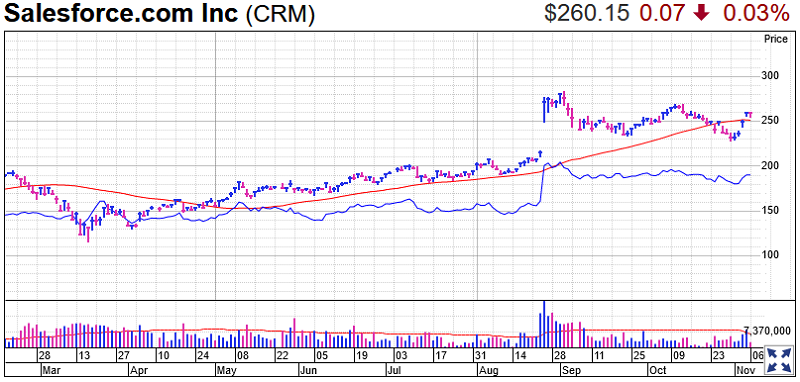

Salesforce Stock

Salesforce stock fell 7 cents on Friday to 260.15, but rallied 12% for the week. CRM stock is in a double-bottom base with a 270.26 buy point.

Shares broke a downtrend on Wednesday, but it didn’t clear its 50-day line until Thursday. That offered an early entry for CRM stock.

Salesforce stock has a 99 Composite Rating and a 95 EPS Rating.

The company makes subscription-based cloud software that helps a company’s sales, customer-service and marketing staff track relationships with customers.

Salesforce has grown on acquisitions. Some analysts also say more businesses will begin spending on projects to digitize their workplace when the pandemic begins to pass, a potential positive for the stock.

Like fellow software giants Microsoft and Adobe, Salesforce stock is a Long-Term Leader.

Trading Education Online Courses

TracknTrade Trading Software Free Trial