Tech Giant Revs Up New Buy Zone With Next-Gen Automotive Platform By Investors Business Daily

As Nvidia (NVDA) has shown, self-driving car and AI technology can drive remarkable earnings growth and big stock market gains. Now Taiwan Semiconductor (TSM) is revving up a new buy point after partnering with NXP Semiconductors (NXPI) on a next-generation automobile technology platform.

Qorvo (QRVO), a leading semiconductor sector stock that provides advanced radio frequency (RF) technology for the advancement of 5G technology, has just reentered a recent buy zone on accelerating growth. Qorvo is on IBD Leaderboard and was just featured in a column on recent breakouts.

On May 21, Nvidia posted 105% EPS growth for fiscal 2021 Q1 (ended April 26). It was the chip designer’s second straight quarter of triple-digit earnings growth.

Taiwan Semiconductor, or TSMC, was not far behind, posting Q1 EPS growth of 95%. Sales increased 45%, while Nvidia’s revenue growth dipped to 39%. Earnings and sales growth are impressive for both companies, but Taiwan Semiconductor’s increase is especially noteworthy given its size. In its most recently reported quarter, Taiwan Semiconductor posted over $10 billion in revenue, more than triple Nvidia’s $3.1 billion.

TSMC and Nvidia are both in the IBD Breakout Stocks Index.

TSMC, NXP To Drive Next-Gen Automotive Platform

On June 12, NXP announced it had selected TSMC’s 5-nanometer (5nm) technology for its next-generation, high-performance automotive platform. The companies will collaborate “to further drive the transformation of automobiles into powerful computing systems for the road.”

The two companies are working to create a System-on-Chip (SoC) platform to deliver the advanced automotive processors. According to a joint news release, “using TSMC’s 5nm process, NXP’s offerings will address a wide variety of functions and workloads, such as connected cockpits, high-performance domain controllers, autonomous driving, advanced networking, hybrid propulsion control and integrated chassis management.”

Earlier in May, Nvidia CEO Jensen Huang confirmed reports that TSMC will receive the bulk of Nvidia’s next-generation 7nm GPU orders. Rival Samsung will receive a smaller number of orders.

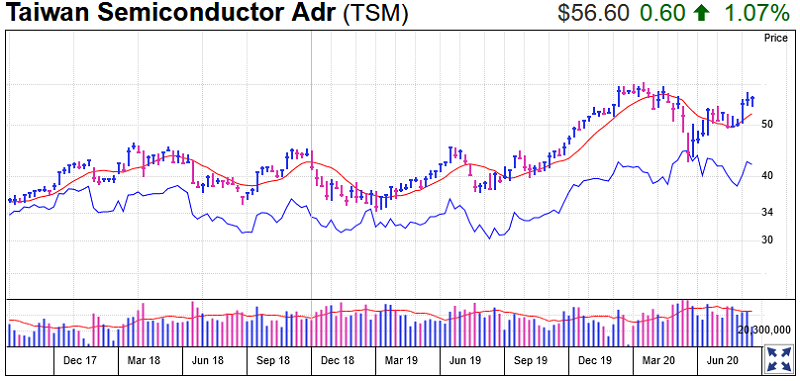

Breakout Watch: TSMC Fabricating New Handle

While TSMC launches next-gen technology with both NXP and Nvidia, it’s also fabricating a new handle, which could offer an early buy point.

It takes a minimum of five days to form a handle, and Tuesday marked Day 4 of the pattern. If TSMC completes the pattern on Wednesday, the buy point will be 58.14, 10 cents above the peak in the handle. Without a handle, the buy point would be 60.74.

TSMC has weathered the extremely volatile coronavirus stock market relatively well. It fell less sharply than the overall market, and formed a more rounded, controlled recovery than the V-shaped pattern formed by the major indexes. Look for TSMC’s relative strength line to again hit a new 52-week high as it tries to break out and return to new-high ground.

TSMC rose around 1.4% Wednesday, as it found support and bounced off its 10-day line. Nvidia also rose just under 2%.

IBD Breakout Opportunities ETF

The IBD Breakout Opportunities ETF from Innovator Capital Management tracks the IBD Breakout Stocks Index. As with other index ETFs, this allows you to essentially invest in the entire index in addition to or rather than buying individual stocks. Learn more about the ETF and Innovator funds.

Review Purchase Green Energy Electric Cars

Trading Education Online Courses

TracknTrade Trading Software Free Trial