May Reversals Gave Multiple Swing Trading Chances By Investors Business Daily

May was a busy month for swing trading. The upside reversals in multiple stocks, as well as entire sectors, gave many chances for solid gains in just weeks. With such favorable setups, we played it hard to take advantage and went back to some names multiple times.

Swing Trading ETFs

We used some exchange traded funds (ETFs) to increase our exposure while limiting our risk. It’s always best to get the leader of the group. But sometimes the logical stop loss and volatility of the single stock might make swing trading the leader tougher. Or you might need something broader to balance out the other high-octane names in your portfolio.

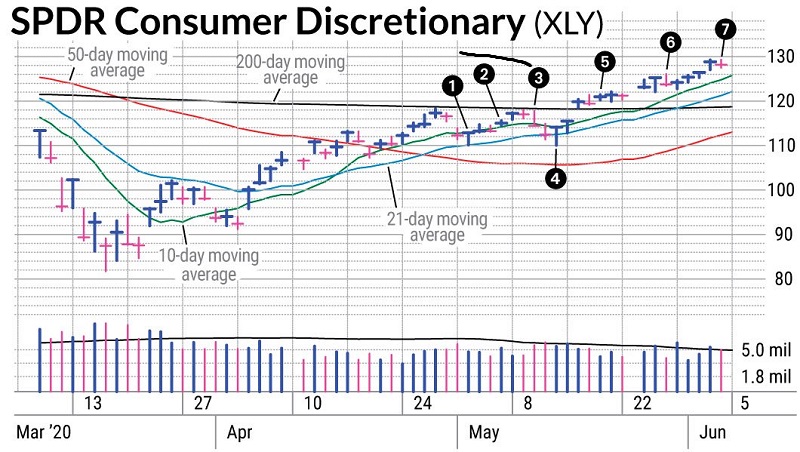

As the market pulled back at the end of April, it set the stage for reversals. May 4 saw a big positive reversal in the market, individual stocks and broad sectors. We put SPDR Consumer Discretionary ETF (XLY) on SwingTrader (1) due to its classic reversal qualities. It had a larger spread between the high and low of the day, undercut the previous day’s low and closed high in its trading range. We also wanted some exposure outside of our heavy weight in the technology sector.

Swing trading is also about managing expectations. We didn’t have high expectations so we started taking partial profits when we were up nearly 3% a few days later (2). As XLY started to approach its 200-day moving average line, along with the S&P 500, it started getting turned away. As it began pulling back, we took the remainder off when we were up 3.6% to protect our profit (3). Had we held, we easily could have exited below our original entry a couple days later.

Play It Again, Sam

Just because you sell, doesn’t mean you should forget. XLY gave us another upside reversal chance. Same swing trading setup as before. Larger spread, undercut of previous day’s lows and closing high in the trading range. We put it back on SwingTrader for another run (4). Sure, our entry was a couple of percentage points above our previous entry. But with the higher entry we had avoided the big drawdown by taking our profit early in the prior trade.

The second time around we gave the ETF more room. Our usual swing trading rule is to take profit automatically at our 5% profit goal. Instead, we gave it more room and took a third off the next day (5). Not only was XLY strong, but we were getting good gains on other trades and wanted to keep our exposure up with the market’s wind at our back. Once we had an 8% gain from our entry, we peeled off another third (6). Selling into strength frees up capital to deploy on new setups and naturally reduces exposure before pullbacks.

Our intention was to let XLY run a bit longer this time. With the sector rotation, it seemed poised for further gains. But June 4 was a hard hit to growth (7). XLY didn’t escape completely unscathed and we removed the remaining position still up 11% from our entry. A number of the largest components of XLY looked vulnerable, such as Amazon.com (AMZN) getting turned away at 2500. Our expectation was for further weakness. We had an expectation breaker to the upside on Friday after a strong jobs report. So we missed out as XLY powered higher to end the week. That will happen with swing trading. But we still captured an average gain of 8.2% for the trade.

Trading Education Online Courses

TracknTrade Trading Software Free Trial