Fortinet Stock Didn’t Meet Swing Trading Expectations By Investors Business Daily

Stocks Set Up Expectations. Moves Counter To Expectations Usually Require Action

Every trade starts with an expectation, whether swing trading, day trading or investing for the long-haul. When a stock moves counter to your expectations, that usually requires action. The expectations for Fortinet (FTNT) were different depending on your time frame and your entry. Swing trading FTNT stock could see an exit where a position trade might see a place to add.

Swing Trading Example: FTNT Stock

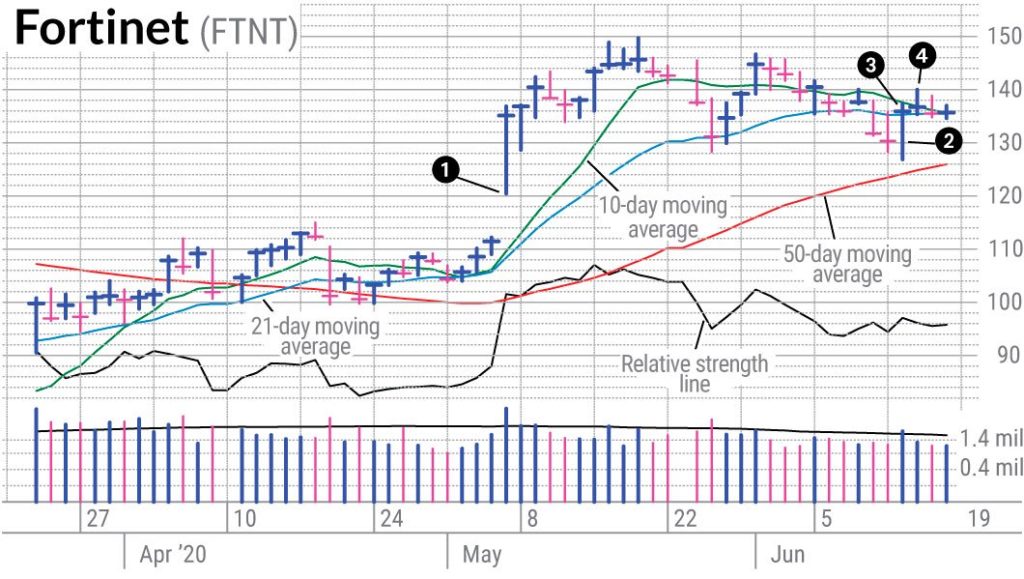

The coronavirus shutdown led to a huge increase in people working from home. Security software was one area seeing a benefit as workers moved from the office to their homes. Everyone wants the security without sacrificing speed, and that’s where Fortinet comes in. On its earnings report May 6, FTNT stock soared 21% the next day (1). The compelling report made it an addition to IBD’s Leaderboard product near the open that day.

Fast forward a little over a month, and FTNT stock looked like it might give another chance for a swing trading entry. It joined SwingTrader as a bounce off its 50-day moving average line (2). We used the close of the previous day to serve as an entry point on the reversal. It also served as an add for the Leaderboard position.

The stock market in general also showed an upside reversal that day, and that added fuel to the move. By the end of the day, Fortinet looked even stronger. The reversal became an outside day. With a 4% gain from our entry, selling a portion into the strength made sense (3). Days like this set up the expectation that the stock will continue higher.

Different Time Frames, Different Expectations

After a strong start May 16, FTNT stock started to fade (4). This was counter to the expectation from the previous day. In the middle of the trading session, SwingTrader shed another portion of the position, still at a profit but off its highs.

The remaining position exited later the same day as it looked like FTNT stock would close in the lower third of its trading range. The downside reversal sets up a different swing trading expectation. You expect to go flat or even a little lower, at least temporarily.

Rather than sit and wait patiently, a swing trading style tends to move on to another trade. Locking in a 4% profit still made it a good trade. FTNT stock also met our swing trading expectation for some slight weakness over the next few days.

Leaderboard was in a different position. The bounce from the 50-day line is still intact and over the next few weeks the expectation is that FTNT stock could power higher. It’s an easy hold for position trading. The stock isn’t doing anything wrong. In fact, Fortinet was on the IBD 50 Stocks To Watch. Different time frames, different expectations.

Specialized Trading Education Courses

Real-Time Elliott Wave Trading Course

Peak Performance Course for Investors Traders