You’re Paying Way Too Much For 10 Major Stocks, Analysts Warn By Investors Business Daily

Does the S&P 500’s 36% rally from the low look too good to be true? It might be in some cases — at least according to analysts.

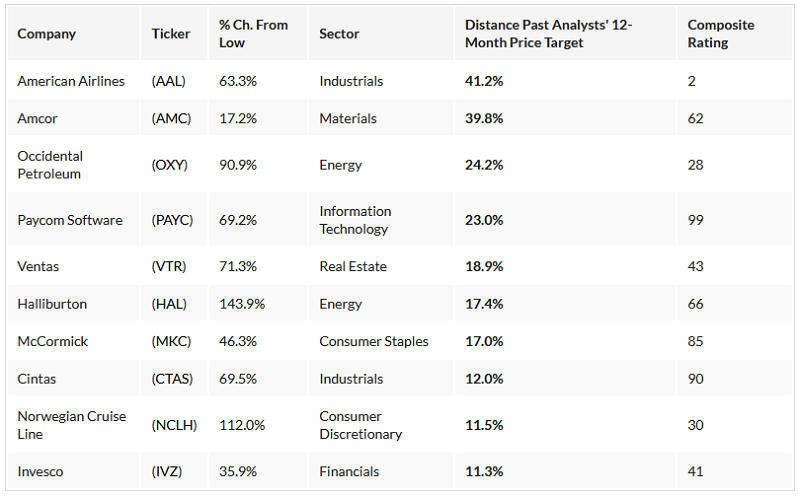

Ten S&P 500 stocks, including American Airlines (AAL), energy firm Occidental Petroleum (OXY) and information technology company Paycom Software (PAYC), are now trading for 11% or more than what analysts say they should be worth — in 12 months. That’s based on an Investor’s Business Daily analysis of data from S&P Global Market Intelligence and MarketSmith.

What’s causing the disconnect between investors and analysts? It’s partly from investors’ scramble into beat-up stocks like airlines, where the fundamentals still look terrible. Investors are hoping to win from the reopening of the economy.

But it’s a different story with leading stocks carrying high IBD Composite Ratings like Paycom. There it may be a sign analysts still need to boost their price targets to catch up with reality.

“Investors (are) rethinking the contours of the recovery and realizing the underlying fundamentals remain weak,” said Jessica Rabe, cofounder of DataTrek. “Cruise lines are experiencing a milder than expected comeback; airlines are seeing low demand.”

S&P 500 Races Ahead Of Analysts

Investors’ focus shift from panic to profit happened practically overnight. In the market’s best 50-day rally ever, all 11 sectors skyrocketed from March lows.

The Energy Select Sector SPDR ETF (XLE) alone is up nearly 70% since the March 23 low in the S&P 500.

And that’s causing some major disconnects between what investors think some S&P 500 stocks and worth and what analysts think. Nearly 100 S&P 500 stocks trade for more than analysts’ 12-month price targets.

In the energy sector, shares of Occidental Petroleum are up 90% from the low to 18.50 a share. The problem is that’s 24% more than analysts say the stock will be worth in 12 months.

And it’s hard to argue with analysts on this one. It’s not a leading stock, with a Composite Rating of just 28. And the company is seen losing $4.03 a share in 2020, $2.24 a share in 2021 and 56 cents a share in 2022.

S&P 500 Travel Stock Mania

If there’s a corner of unfounded speculation in the markets, in analysts’ eyes, it’s with travel stocks.

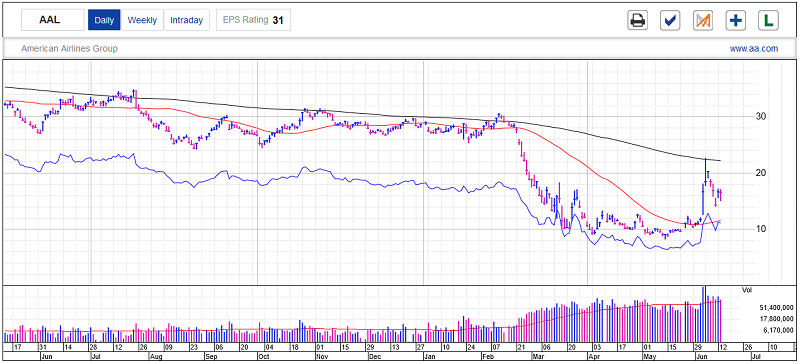

Shares of American Airlines are up 63% from the lows, to 16.74. Investors pouring into the S&P 500 stock pushed it 41% past analysts’ average 12-month price target of 11.86. And much of that buying is coming from individual investors speculating on a recovery.

American Airlines is the third most popular holding with Robinhood investors, says Robintrack. Individuals are buying while pros like Warren Buffett sold.

And the fundamentals and chart look terrible, explaining the low 2 Composite Rating, on a 1-99 scale with 99 best. Analysts think American will lose $16.44 a share this year and another $1.55 a share in 2021. Before you speculate on American stock, make sure you know what to consider.

Some S&P 500 Targets Need To Rise

Clearly, the markets will be faster to see value in some top S&P 500 stocks before analysts do. And that means in some cases, analysts will bring up the rear and boost price targets to match what investors already saw.

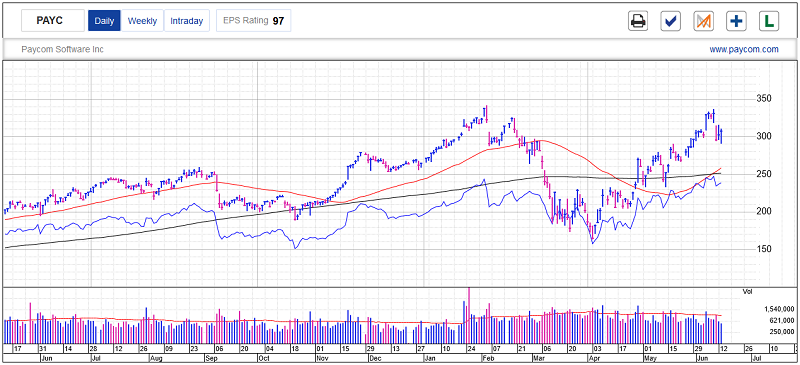

Some of the S&P 500 stocks to storm past targets have high ratings. Two, including Paycom and Cintas (CTAS) sport sky-high Composite Ratings of 90 or higher.

Shares of Paycom shot up nearly 70% from the lows to 302.80. They’re now 23% higher than analysts’ 246.13 price target for 12 months out. But were talking about a well-managed cloud-based provider of employee data. Paycom’s profit is seen growing nearly 3% this year, as S&P 500 profit contracts. And Paycom’s bottom line is expected to jump 27% in 2021.

Analysts are already playing catch-up. The average price target on Paycom is up more than 35% since April 1. And that could just be the start of price target hikes if the company keeps delivering.

But for many others, analysts are adamant investors are overpaying. And last week’s freak-out shows how much money can be lost.

S&P 500 Stocks Way Past Analysts Targets

Trading Education Online Courses

TracknTrade Trading Software Free Trial