Profiting from Trading Stocks that are Going Down in Price

What Is Stock Short Selling?

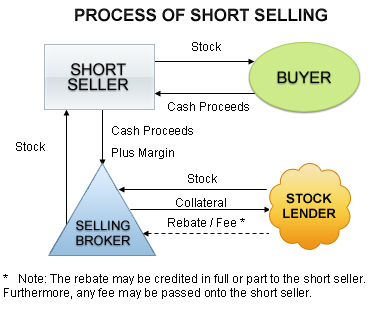

The selling of a stock equity security that the seller does not own, or any sale that is completed by the delivery of a security borrowed by the seller. Short sellers assume that they will be able to buy the stock at a lower amount than the price at which they sold short.

Selling a stock short is the opposite of buying a stock long. Short sellers make money if the stock goes down in price. Short selling is an advanced trading strategy with many unique risks and pitfalls. Novice investors are advised to avoid short sales until they are properly educated in doing it.

Short selling has been around ever since the beginning of the stock market. But many people don’t think short selling is good for companies and the market. They think its un-patriotic or damaging to the economic health health of companies and the country they are based in. The reality is that stocks go up and they go down for a multitude of reasons. Fair equal treatment to buy or sell short a stock provides liquidity and the best balance of fair value for the price of the stock.

People who don’t invest or trade the markets at all, blame short sellers for some of the worst company failures in the world’s financial markets. Company executives have accused them of driving down their company’s stock prices. Governments have before and still do from time to time, temporarily halted short selling to help markets recover and have strengthened laws against some short selling techniques. Some governments have banned short selling completely. Some governments have even gone as far as proposing and implemeting strong legal actions against short sellers. This has happened throughout history in various countries and industries.

William O’Neil the founder of Investor’s Business Daily and the CANSLIM Stock Investing Method, wrote about short selling in his book “How To Make Money Selling Stocks Short”, and concluded that “few investors really understand how to buy stocks successfully. Even fewer understand when to sell stocks. Virtually no one, including most professionals, knows how to sell short correctly.”

The fact is that if done proprerly, the risks of short selling are about the same to the risk of buying long stock positions,.

In the stock options, futures and forex markets buying and selling short is normal practice. Let the free market have its freedom to do what it will. In the long term, all people will benefit much more than letting markets move parabolicly higher creating huge bubbles that end up in price collapses anyway.

What Is A Bear Market in the Stock Market?

Trending in the stock market is often referred to as either bullish or bearish. A bull market is a period when stock prices are surging, while in a bear market, stock prices are declining. Investors use a rule of thumb to define bear markets, but a bear is usually pretty obvious to investors who see their investments going down in value.

Bear Market Definition

The rule of thumb is that the stock market has experienced a bear market if the major stock indexes have declined by 20 percent or more from a recent market high. Stock market historians use the value of the Dow Jones industrial average to calculate whether the market is experiencing a bear market or just a correction, which is a decline of 10 to 20 percent. The Dow is used because the index has been in existence since before 1900, providing a historical picture of bull and bear markets.

Bear Market Types

Two types of bear markets can be found when looking at the long-term chart of the stock market. Primary or cyclical bear markets meet the standard definition of a 20 percent drop in the Dow, followed by a recovery from the low. These are shorter-term bear markets as the stock market swings from periods of moving up toward downturns. A secular bear market is a longer, multi-year slump that produces a much larger decline in the value of the market or is a string of bull and bear market cycles in which the end result is a lack of any meaningful gain in the stock market indexes.

Frequency

A cyclical bear market occurs on average every few years. The bottom of the 2008-2009 bear market signaled the end of the 33rd 20 percent-or-greater decline in the market since 1900. The end of a bear market is determined when the stock market has moved up by 20 percent off a low, then that low is counted as the end of the bear market. Most market observers count five secular bear markets from 1900 through 2010. A secular bear market will include a series of cyclical bear markets in which the recovery does not reach the previous market high.

Statistics

The length and depth of bear markets vary significantly, but some averages give an idea of what the typical bear market might look like. Of the 33 primary bear markets to date, the average length was about eight months, with a range of just a couple of months to almost two years. The average bear market decline was 34 percent, and more than one-third of the historical bear markets dropped by more than 40 percent. The stock market crash of 1929 to 1932 was the biggest decline, with the market losing almost 90 percent of its value. Secular bear markets have averaged five years in length, with an average decline of 54 percent. The longest secular bear market to date took nine years to run its course.

“How To Make Money Selling Stocks Short”

TracknTrade Trading Software Free Trial