UPS Leads 5 Top Transportation Stocks Near Buy Points As Economy Revives By Investors Business Daily

Logistics and transportation stocks have been on the rise as e-commerce booms and the real economy recovers from coronavirus shutdowns. UPS (UPS), CSX (CSX), Old Dominion Freight (ODFL), Atlas Air Worldwide (AAWW) and Dada Nexus (DADA) are top logistics and transportation stocks in or near buy range.

These stocks also offered an alternative to tech stocks as the Nasdaq and many giants retreated in volatile fashion over the past few weeks.

The stock market rally is under heavy pressure, so investors should be cautious about many any purchases. But they should be building watchlists of quality stocks holding up well.

Logistics, Transportation Stocks With High Ratings

One way to find the best stocks is to look at their IBD Composite Ratings. The Composite Rating compiles scores on key fundamental and technical metrics: earnings and sales growth, profit margins, return on equity and relative price performance.

Atlas Air Worldwide leads the group with a perfect 99 Composite Rating. UPS has a 95 rating, Old Dominion Freight 91, Dada Nexus is at 89 and CSX stock at 87.

Investors should focus on stocks with a Composite Rating of 90 or higher but it isn’t the only metric investors should keep track of.

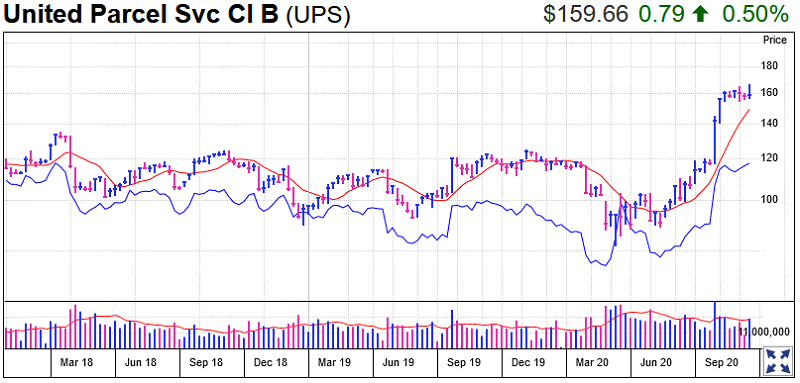

UPS Stock

Americans continue to shop heavily online, a boost for shipping companies. According to the U.S. Census Bureau, e-commerce as a percentage of total U.S. retail sales jumped 44.5% in the second quarter vs. the same period last year.

UPS earnings crushed second-quarter estimates in July, lifting the transportation stock. Holiday sales are starting earlier this year, in October, in an effort to alleviate shipping delays and bottlenecks closer to the holidays. UPS has additional surcharges that will go into effect on Oct. 4 amid the new holiday shopping schedule.

On Tuesday, rival FedEx (FDX) reported that fiscal Q1 earnings unexpectedly jumped 60% to $4.87 per share on revenue of $19.3 billion.

UPS stock is forming a base with a 166.30 buy point. The stock reversed from a record high Wednesday following the FedEx earnings. That normally would throw the base off. But the drop also came amid market volatility. Investors could consider waiting for a pullback to the 10-week line or for the stock to form a more traditional and less messy looking base, but that could take weeks.

UPS rose a fraction for the week to 159.66.

The relative strength line, which compares a stock to the S&P 500, is at the highest level since the start of 2017. That follows a long period of underperformance for UPS. The RS line is the blue line in the charts provided.

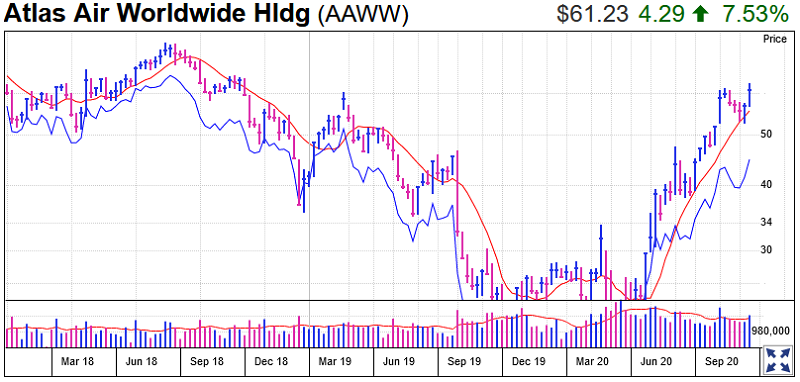

Atlas Air Stock

Atlas Air Worldwide leases aircraft and provides global airport-to-airport services to airlines and freight companies. In May, Amazon (AMZN) signed a deal to lease 20 additional Boeing 727 jets from the company.

The transportation stock briefly cleared a 61.76 buy point on Friday from a short consolidation. Shares pared Friday’s gain to up 0.2% at 61.22, but jumped 7.5% for the week. Investors could also view the current consolidation as a handle on a longer pattern going back more than two years, according to MarketSmith chart analysis. It was added to IBD’s Stock Spotlight list earlier this month.

Atlas air stock’s RS line is nearing its highest level since April 2019. It has a Relative Strength Rating of 97 out of 99.

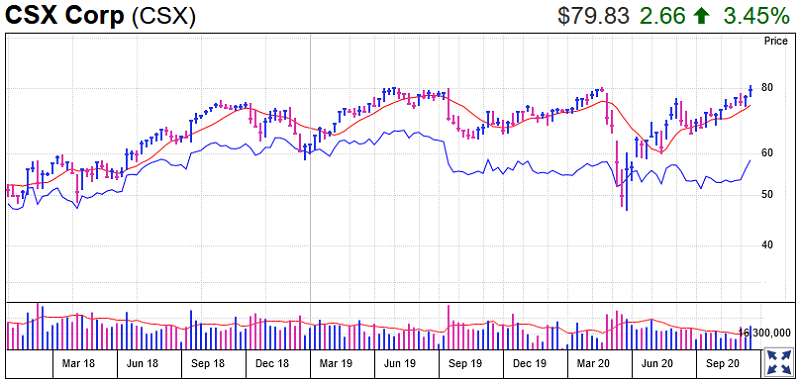

CSX Stock

Railroad company CSX operates 20,000 miles of rail in the U.S. and Canada. Airline stocks have been hit especially hard during the Covid-19 pandemic, but railroad stocks have done surprisingly well as they carry food and other necessities to feed hungry consumers. Kansas City Southern (KSU) CFO Michael Upchurch said Thursday at a J.P. Morgan conference that “volumes are pacing at this point ahead of pre-Covid levels.”

CSX stock is in range after breaking out of a cup-with-handle base with a 76.57 buy point. There is also an alternate entry point for investors at 78.75. The railroad stock’s RS line is on the rise.

CSX is ranked No. 5 in IBD’s Transportation-Rail Group.

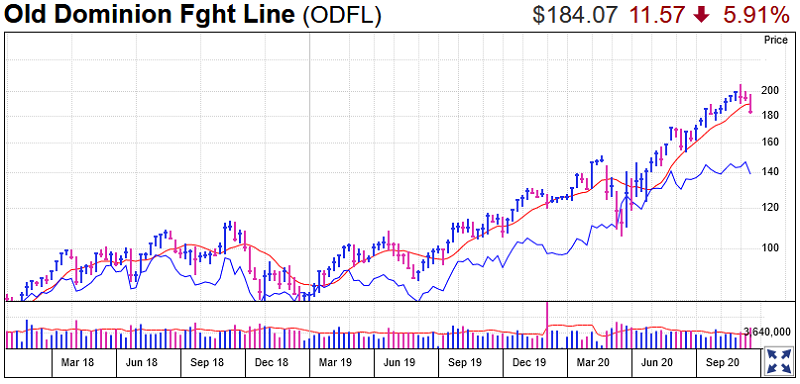

Old Dominion Stock

The trucking company provides less-than-truckload shipping across the U.S. with regional, inter-regional and national service. Old Dominion is the top-ranked stock in IBD’s Transportation-Truck Group.

Old Dominion stock tried to find support at its 10-week line, but sold off Friday, losing 3.4% for the day and 5.9% for the week. The stock could form a potential base with a 207.54 buy point.

Dada Nexus Stock

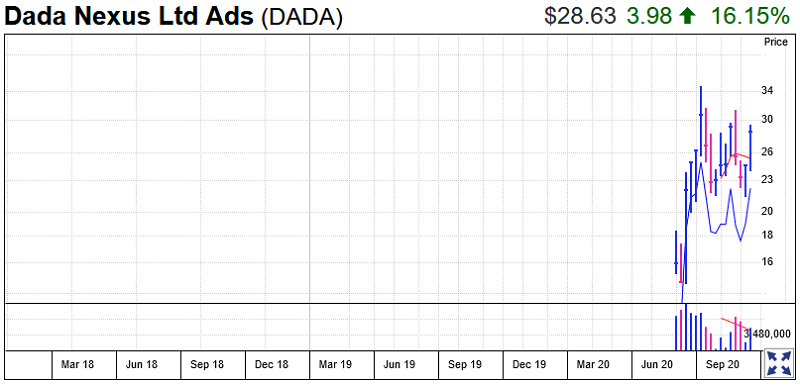

Dada Nexus is a China-based, on-demand delivery and retail platform provider. The company is a JD.com (JD) unit that allows users to order from supermarkets; and Walmart (WMT) owns a stake. Dada stock is a recent IPO and made its Nasdaq debut on June 5.

The stock is forming a double-bottom base with a 31.55 entry point and has an RS Rating of 91. Dada Nexus stock shot up 16% last week to 28.63. Like many IPOs, Dada Nexus is volatile.

Free for 1-Month Introduction to Spotting Elliott Wave Trading Opportunities

TracknTrade Trading Software Free Trial