Target, Taiwan Semiconductor Lead Five Top Stocks Showing Strength As Market Weakens By Investors Business Daily

Your stocks to watch for the week ahead include e-commerce stocks and tech stocks like JD.com (JD) and Veeva Systems (VEEV). Target (TGT), Intuitive Surgical (ISRG) and Taiwan Semiconductor (TSM) are also names to keep an eye on.

Some of those stocks have pulled back or consolidated. But with the market uptrend under pressure and the Nasdaq below its 50-day moving average, investors should limit buys, if any. Now it’s a time to focus more on building watchlists for when the market improves.

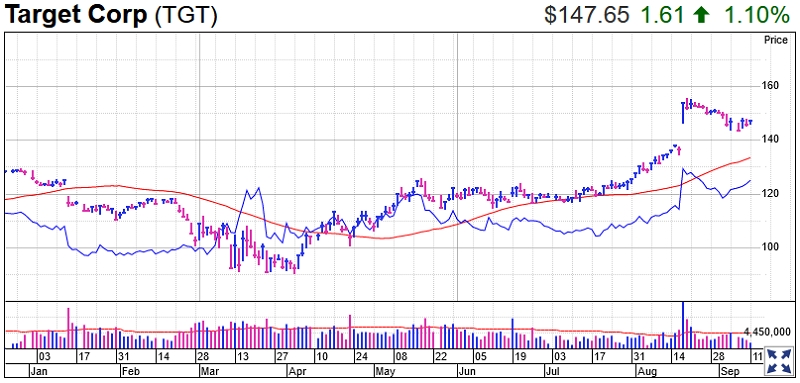

Target Stock

Target has pulled back after the big-box retail chain’s second-quarter earnings catapulted its shares higher last month. But the retreat has been gradual, with TGT stock finding support at its 21-day exponential moving average. Stronger stocks tend to rebound off tests of investor support such as the 21-day line or the 50-day line.

The relative strength line for Target stock is near its recent record high, trending up for the past two months and more broadly for more than a year. That reflects Target’s outperformance vs. the S&P 500 index. The RS line is the blue line in the charts provided.

The ratings for Target stock attest to the company’s strong financial results. The stock has a 94 Composite Rating out of a best-possible 99. Its EPS Rating is a bit weaker, at 76, but the recent trend is improving.

Target’s same-store sales during the second quarter jumped 24.3%. Digital sales climbed 195%. The company initially saw sales increase due to panic-buying ahead of coronavirus lockdowns in the U.S. Since then, its investments in e-commerce have paid off, as more customers stay in and shop online for delivery or curbside pick up.

Shares rose 0.3% to 147.22 in last week’s stock market action. Target was a recent IBD Stock of the Day.

Some of the bigger retail stocks have morphed into e-commerce stocks over the years. Walmart (WMT), which has also built out its online business, said sales started to “normalize” as aid from this year’s stimulus package falls away.

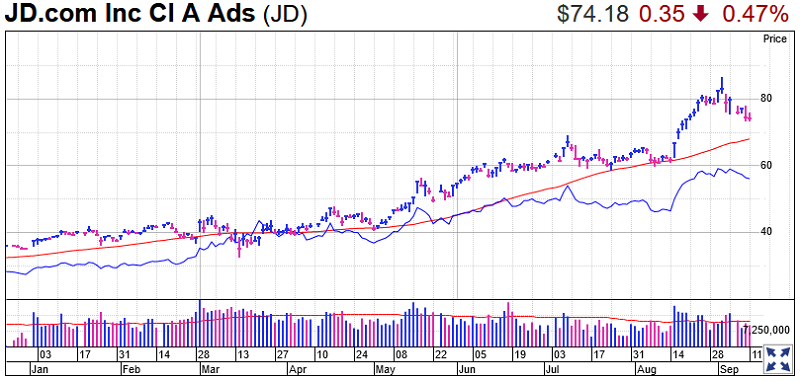

JD.com Stock

JD.com, like Target, is sitting around its 21-day line, though it closed below that short-term average late in the week. The bigger tech stocks sell-off this month pulled shares lower, but JD.com stock still has a best-possible 99 Composite Rating. Its EPS Rating is also solid, at 93.

Shares of JD.com dipped 1.4% to 73.49 on Friday, and skidded 7.3% for the week, which is not ideal. The stock’s RS has also crept higher this year, even as China, where the coronavirus was first detected, locked down its economy in an effort to ward off the coronavirus outbreak.

JD.com’s second-quarter earnings last month beat estimates. User growth for the company jumped 30%.

Alibaba stock, meanwhile, pulled back closer to a flat-base buy point of 268.10. The China e-commerce giant has a best-possible 99 Composite Rating and a 95 EPS Rating. Shares were up 0.7% on Friday and down 3.5% for the week.

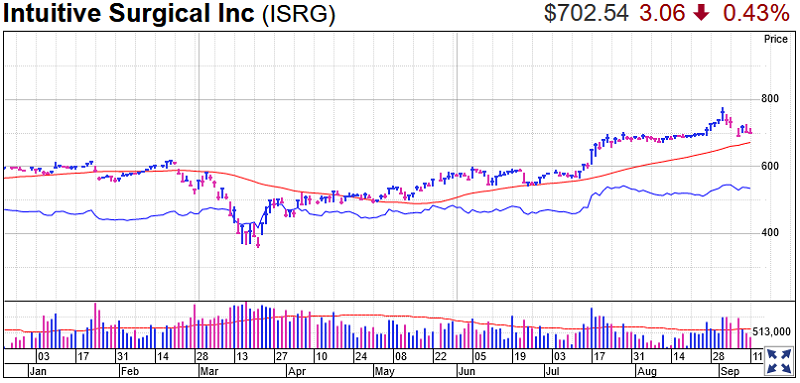

Intuitive Surgical Stock

Intuitive Surgical, which makes robotic-assisted surgical equipment, is just below a 704.10 buy point from a four-weeks-tight pattern. The stock dipped 0.5% to 702.20 on Friday, retreating 4.45% for the week

The stock’s 10-week line is close to catching up with its actual price, indicating further strength, as long as shares don’t undercut that level of support.

Intuitive is best known for its robotic da Vinci Surgical System, used for procedures in urology, gynecology and elsewhere. The narrower trading for the stock comes even as the coronavirus pandemic casts uncertainty over the elective surgery business. Shares have trended higher as coronavirus cases and hospitalizations have come off highs, raising expectations for a return to elective surgeries.

ISRG stock has a 90 Composite Rating and a 78 EPS Rating.

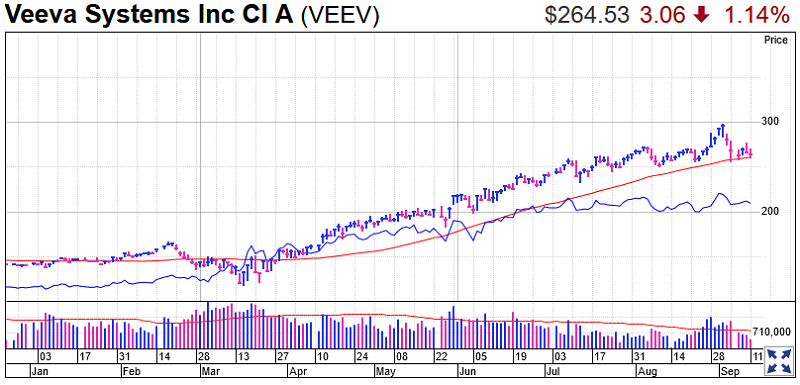

Veeva Systems Stock

Veeva Systems stock is on IBD’s Long-Term Leaders watchlist. The stock has a best-possible Composite and EPS Ratings of 99. Shares fell just 1.9% for the week, just above their 50-day line. The RS line is hovering at record highs.

The company, whose software helps biotechs navigate drug trials, reported quarterly earnings and sales last month that beat expectations. Veeva also hiked its full-year outlook.

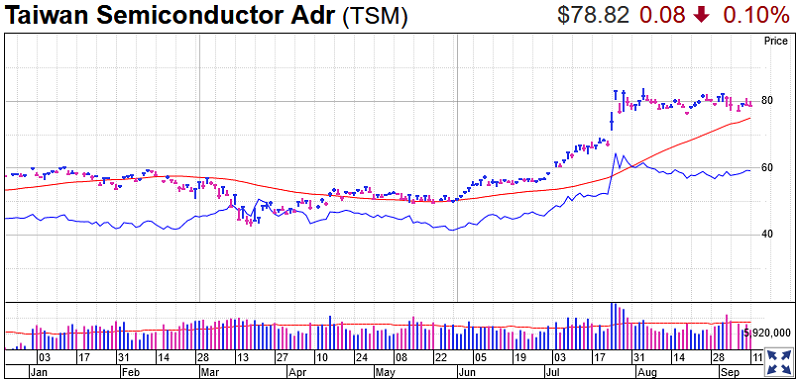

Taiwan Semiconductor

While other tech stocks slide, Taiwan Semiconductor is in a new flat base with an 84.10 buy point. Shares slipped 0.1% to 78.80 on Friday and for the week. The stock has Composite and EPS ratings of 97 and 93, respectively.

The current flat base follows a strong breakout and rally for TSM stock.

If shares trade sideways for another week or two, the 10-week line could catch up.

Taiwan Semiconductor was an IBD Stock of the Day this past week. The world’s largest chip foundry reported that August sales jumped 16% vs. a year earlier.

Trading Education Online Courses

TracknTrade Trading Software Free Trial