Nike Leads 5 Stocks To Watch As Market Whipsaws By Investors Business Daily

Nike stock, Chipotle Mexican Grill (CMG), Costco (COST), Lowe’s (LOW) and Copart (CPRT) are top stocks to watch this week as they hold up relatively well as the market swoons again.

Most of the five consumer and retail stocks are extended from recent buy points. That means they are not in buy range. But investors should have them on watchlists, waiting to see if they form new bases, or rebound from key support levels if they fall further. This isn’t a great time to buy stocks, with the market suddenly in flux, but investors should focus on the strong performers for the next clear buying opportunity.

Nike (NKE) stock, Chipotle stock, Lowe’s and Copart are all leaders, with relative strength lines at or near highs. A rising RS line means these stocks are outperforming the S&P 500 index.

The RS line for Costco stock is lackluster by comparison, well below the March high. But aside from that spike during the coronavirus crash, the RS line for Costco arguably has been doing well for the past three years.

Stock Market Rally: Watch The RS Line

The relative strength line is a quick way to spot winners in any market — up or down. It is the blue line in the charts shown.

The Relative Strength At New High stocks list at investors.com is a great place to look for quality names with strong RS lines. IBD’s stock research platform MarketSmith has a screening tool that identifies stocks with RS lines making new highs.

In addition, the best growth stocks have an IBD Composite Rating of 90 or better. Lowe’s stock leads this group with a perfect Composite Rating of 99, followed by Copart with a 93 and Costco with 92. Chipotle has an 87 and Nike stock trails with a 78. The Composite Rating combines five separate proprietary IBD ratings, based on key fundamental and technical criteria, into one easy-to-use score.

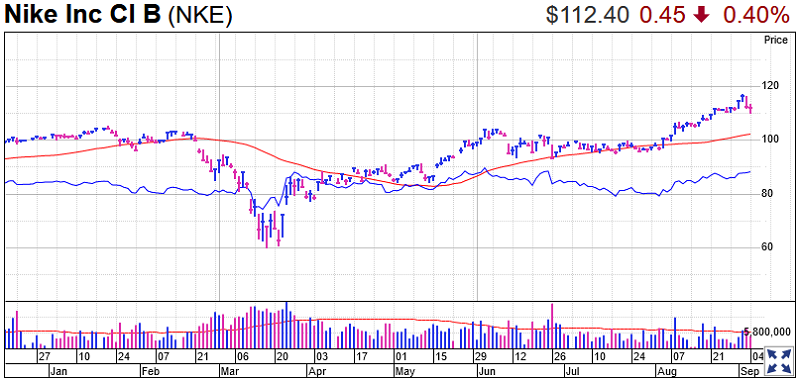

Nike Stock

Shares of the Dow Jones sneaker giant lost 0.4% Friday but edged higher for the week. The S&P 500 lost 2.3% on the week by comparison, in a tech-driven sell-off. Nike stock is extended from a 104.79 cup-with-handle buy point.

The RS line for Nike stock is rising, a sign of resilience and leadership in a challenging market, but just below recent highs.

Nike stock has an EPS Rating of 51 out of a best-possible 99, an RS or Relative Strength Rating of 82 out of 99, and Accumulation/Distribution Rating of B+, on a scale of A+ (best) to E (worst).

The sports apparel and footwear maker grew earnings 1% annually over the past three years and sales 3%, the IBD Stock Checkup tool shows.

The latest Nike earnings were a hot mess, but the company looked strong on e-commerce sales trends and digital engagement with customers.

Analysts expect an earnings rebound, after 2020s decline. Annual EPS is expected to grow 27% in 2021 and a further 43% in 2022.

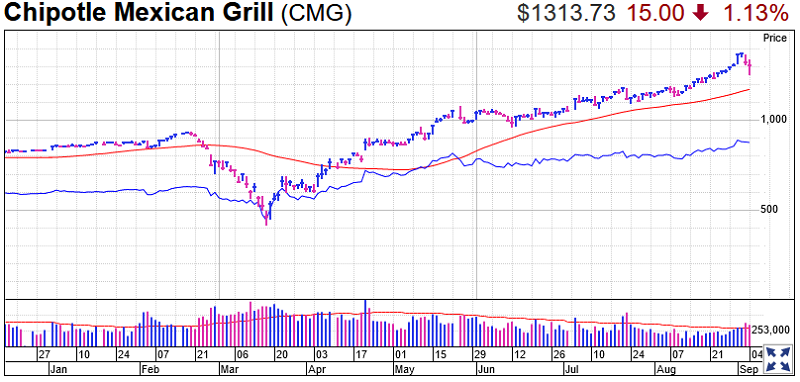

Chipotle Stock

Burrito chain Chipotle rose 0.9% on the week and is well extended from a 1,087.10 flat-base buy point. In fact, shares are in the profit-taking sell zone. The RS line for Chipotle stock made a high Sept. 1 and is just below that level.

Chipotle has an EPS Rating of 35, RS Rating of 93 and A/D Rating of B+.

Dismal earnings in recent years after food safety scares weigh on Chipotle’s EPS Rating, as does the coronavirus pandemic.

Chipotle earnings per share also cratered 90% in its latest quarter, but same-store sales are starting to look positive after the pandemic’s hit to restaurants.

Even better, digital sales jumped 216% and made up 61% of overall revenue during the second quarter.

Wall Street expects Chipotle earnings to decline 24% in all of 2020, but then rebound 95% in 2021.

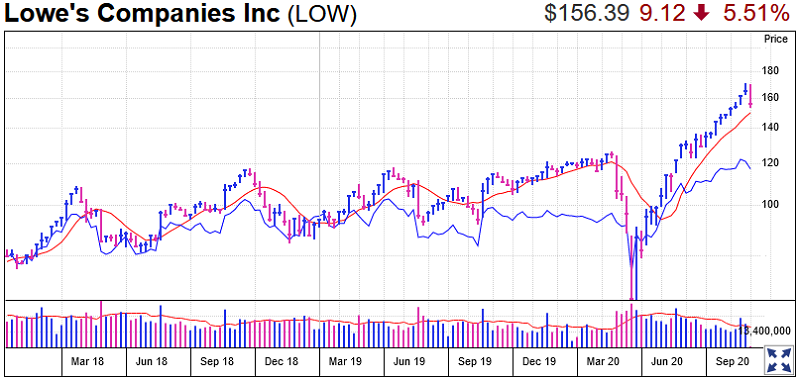

Lowe’s Stock

Lowe’s slid 5.5% on the week, ending a nine-week winning streak. Shares are well extended from a 133.49 alternate entry. The RS line is just below the August high.

Lowe’s stock is not far from its 10-week line, offering a possible future buying opportunity.

The home improvement chain sports an EPS Rating of 98, RS Rating of 90, and A/D Rating of B+.

Lowe’s grew earnings 17% annually over the past three years and sales 4%.

But Lowe’s earnings leapt 74% in its latest quarter and sales jumped 30%, marking the second straight quarter of accelerating growth.

People have been busy sprucing up homes while locked down during the pandemic. As a result, Wall Street sees Lowe’s EPS rising 48% in all of fiscal 2021.

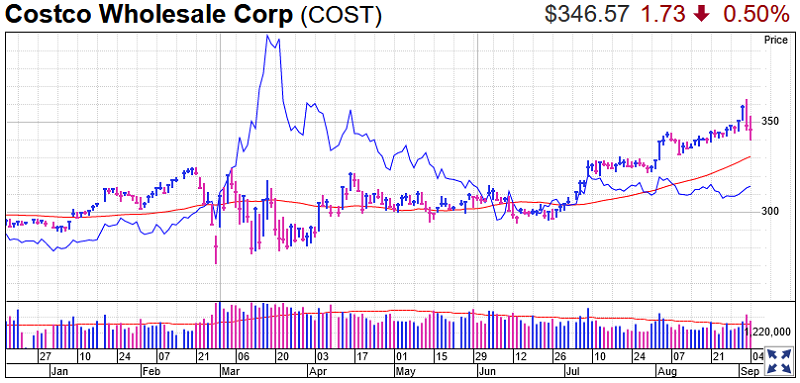

Costco Stock

Costco dipped 0.5% to 346.57 on the week and is in buy range from an alternate 331.59 entry. But its RS line has moved sideways for many months.

The membership warehouse retailer has an EPS Rating of 91, RS Rating of 78 and A/D Rating of B.

Costco grew earnings 18% annually over the past three years and sales 9%.

The latest Costco earnings disappointed as pandemic costs piled up, but net sales rose 7% while e-commerce sales soared 66%.

Same-store sales are now accelerating nicely. Analysts see Costco EPS rising 5% in all of 2020 and increasing 7% in 2021.

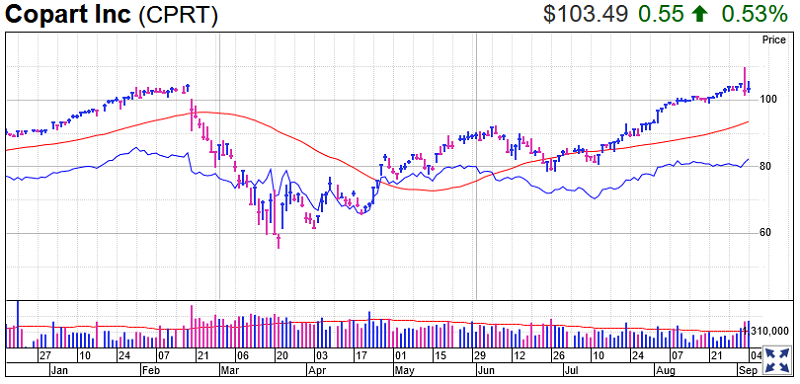

Copart Stock

Copart stock lost 0.6% on the week and is extended from a 92.75 cup-with-handle entry. Its RS line is improving after sluggish action for much of this year. The RS line jumped in prior years.

The salvaged car retailer earns an EPS Rating of 94, RS Rating of 82 and A/D Rating of B.

Copart grew earnings a bullish 27% annually over the past three years and sales 16%.

But Copart’s earnings per share rose 15% in its latest quarter and sales fell 3%. Analysts expect Copart earnings per share to rise 2% in 2021 and 16% in 2022.

Ending September 09 Practical Trading Lessons to Help You Achieve Steady Success