If Commercial Real Estate is in Trouble Can Residential Be Far Behind? By Elliottwave International

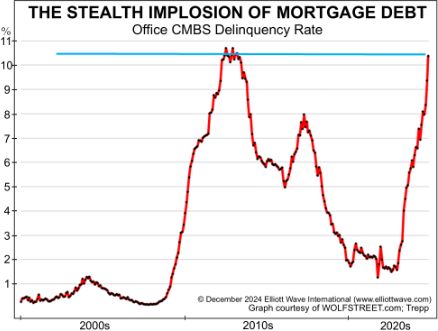

Long-standing global real estate weakness is a fundamental parallel to the Great Recession of 2007- 2009, when housing stocks topped two years ahead of the stock indexes. This time, the epicenter is China, where home prices fell again in October. The year- over-year changes in Chinese new and existing home prices fell to new lows of -6% and -9%, respectively. Year-over-year prices peaked more than five years ago, in the second quarter of 2019. In the U.S., a steady decline in home sales continued through September as existing home sales hit a 14-year low. Existing home sales are down 42% from a peak of 6.6 million in January 2021, the front edge of the latest peaking process. Commercial real estate is another basket case. EWFF first identified this sector’s bearish potential in October 2022 when we showed a five-wave rise having ended in the Green Street Commercial Property Index. The peak in that index occurred in December 2021, shortly before a dramatic upturn in the delinquency rates of commercial mortgage-backed securities, as shown on the chart below. In fact, delinquency rates have been screaming higher since January 2023. The chart shows that the latest reading of 10.4% is higher than all but two readings in the aftermath of the last housing crisis:

Is it time to get YOUR house in order? Global Market Perspective covers more than 50 markets and many of them are poised for major shifts. Get our detailed analysis now by following this link.