Understanding the Risk-to-Reward Ratio To Minimize Risk and Maximize Returns

In the world of trading every decision involves a balance between potential gains and possible losses. Traders must continuously assess this balance to maximize profits while minimizing setbacks.

This is where the risk-to-reward ratio comes into play, serving as a valuable tool to quantify this trade-off. Let’s explore how to calculate this important metric and leverage it for informed trading decisions.

The Importance of Risk Management in Trading

Effective risk management is vital for several reasons:

Capital Preservation: It ensures you have the funds to continue trading.

Minimizing Losses: It helps limit losses from individual trades.

Emotional Stability: Good risk management keeps emotions in check, leading to better decision-making.

Consistent Returns: It allows for steady, reliable profits over time.

Long-term Survival: It ensures you can remain in the market and seize new opportunities.

In essence proper risk management safeguards your capital, curbs losses, maintains emotional resilience, generates steady returns, and supports long-term success.

What Is the Risk-to-Reward Ratio?

The risk-to-reward ratio compares the potential profit of an investment to its potential loss, calculated using the formula:

Risk-to-Reward Ratio = Expected Profit / Potential Loss

For instance, a risk-to-reward ratio of 1:3 means that for every dollar at risk, the potential reward is three dollars.

Why the Risk-to-Reward Ratio Is Important

This ratio provides an estimate of potential gains versus possible losses, helping traders manage risks effectively and pursue better outcomes. A favorable risk-to-reward ratio justifies the risks taken, encouraging more disciplined and strategic investing. This metric is crucial in an industry where 95% of traders struggle to achieve long-term profitability, often due to inadequate risk management.

Key Components of the Risk-to-Reward Ratio

Before diving into calculations, let’s break down the two main components of the risk-to-reward ratio:

Risk: The potential for loss or variability in outcomes, representing uncertainty and negative consequences.

Reward: The potential positive outcomes or gains, signifying the benefits and profits achievable.

Types of Traders Based on Risk Profiles

Understanding your risk profile can help inform trading strategies. Traders generally fall into three categories:

Risk-Averse Traders: These traders seek maximum gains with minimal losses. They prefer investments with lower risk for the same expected return.

Risk-Neutral Traders: Focused solely on maximizing expected returns, these traders disregard the associated risks.

Risk-Seeking Traders: Actively seeking high-risk, high-reward opportunities, these traders are often drawn to volatile markets like cryptocurrencies.

By understanding these profiles and calculating the risk-to-reward ratio for each trade, traders can tailor their strategies to align with their risk tolerance and financial goals.

Methods for Calculating the Risk-to-Reward Ratio

To calculate the risk-to-reward ratio, follow these steps:

Identify Potential Risk: Determine the difference between your entry price and your stop-loss price.

Identify Potential Reward: Determine the difference between your entry price and your target price.

Calculate the Ratio: Divide the potential reward by the potential risk.

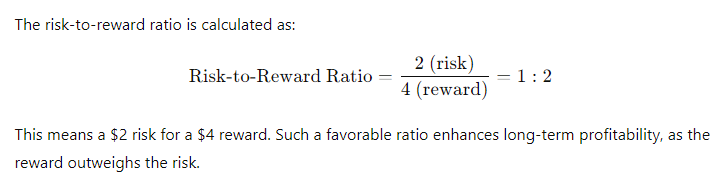

Example Calculation:

Entry price: $50

Stop-loss: $48 (risk = $2)

Target profit (1:2 ratio): $54 (reward = $4)

Risk-to-Reward Ratios Across Trading Strategies

The risk-to-reward ratio can vary by trading strategy. Here are some common strategies and their typical ratios:

Day Trading: 1:2 or higher – Focuses on short-term movements with tight stop-losses.

Swing Trading: 1:3 – Involves holding positions for days or weeks to capture medium-term swings.

Position Trading: 1:4 or higher – A longer-term approach targeting significant market trends.

Scalping: 1:1.5 – Based on minute price changes with multiple trades each day.

Trend Following: 1:2 or higher – Involves capitalizing on established market trends.

Mean Reversion: 1:1 to 1:2 – Assumes prices will return to an average over time.

To minimize risk and maximize reward try not to risk more than 1% to 2% of your capital on any trade and seek opportunities with at least a 3:1 to 5:1 or more risk-reward ratio.

Advanced Techniques for Enhancing Risk-to-Reward Ratios

As traders gain experience, they often explore advanced methods to refine their risk-to-reward calculations:

Technical Analysis: Utilize indicators to identify trends and key support/resistance levels, enhancing entry and exit strategies.

Market Sentiment Analysis: Gauge overall market mood to predict potential price movements and adjust risk-reward ratios accordingly.

Risk Management Tools: Employ sophisticated algorithms and machine learning techniques to improve risk assessment and reward calculations.

Summary

The risk-to-reward ratio is essential for successful trading, providing a framework for informed decision-making and effective risk management. A trader knowledgeable in calculating and applying this metric is better equipped to navigate dynamic markets consistently.

Ready to elevate your trading game? Start incorporating the risk-to-reward ratio into your strategies today. Explore our comprehensive resources, including video tutorials, webinars, and expert-led courses, designed to help you unlock your trading potential.

Success in trading requires discipline, patience, and a deep understanding of risk management principles. Let the risk-to-reward ratio be your guiding principle on the path to achieving your trading objectives.

Frequently Asked Questions (FAQs)

How can I improve my risk-to-reward ratio in volatile markets?

In volatile markets tighten stop-loss orders and set more conservative profit targets to improve your risk-to-reward ratio. Consider using hedging or other risk management tools to mitigate potential losses.

What is a good risk-to-reward ratio for beginner traders?

A common recommendation is a 1:2 ratio, meaning the potential reward is double the potential risk. This balance allows beginners to gain experience while managing risks effectively.

How often should I reassess my risk-to-reward ratio?

Regularly reassess your risk-to-reward ratio, especially after significant market shifts or when implementing new strategies, to ensure alignment with your trading goals and current market conditions.