Candlestick Pattern Trading Strategies By Trend Spider

Candlestick patterns are a popular tool used by traders to analyze market trends and make informed decisions about buying and selling assets. These patterns provide valuable information about the behavior of buyers and sellers in the market, and can help traders identify potential trading opportunities.

In this article, we will explore some of the most commonly used candlestick patterns and how they can be used as part of a trading strategy. We will also discuss the importance of combining candlestick pattern analysis with other technical indicators to increase the accuracy of trading signals. Whether you are a beginner or an experienced trader, understanding candlestick patterns is an essential part of any successful trading strategy.

What Is a Candlestick Pattern?

A candlestick pattern is a visual representation of price movement in financial markets, typically used in technical analysis to identify potential trading opportunities.

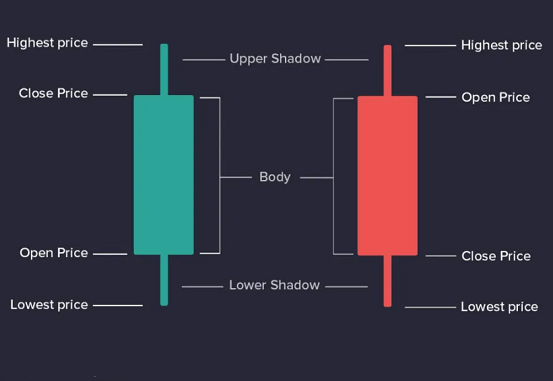

To understand candlestick patterns, you need to first understand the different components of a candlestick. Here is how to read a candlestick:

Body: The body of the candlestick represents the price range between the opening and closing price during the period. If the closing price is higher than the opening price, the body is usually colored green or white. If the closing price is lower than the opening price, the body is usually colored red or black.

Wicks: The wicks (also known as shadows or tails) represent the highest and lowest prices of the asset during the period. If the wick is long, it indicates that the price moved a significant distance from the opening or closing price. If the wick is short, it indicates that the price didn’t move much during the period.

Candlestick patterns are formed by the combination of one or more candlesticks and can be useful for traders to identify potential market trends and trading opportunities.

Candlestick Pattern Strategies

Here are some different ways to use candlestick patterns in a trading strategy:

Identify trend reversals: Candlestick patterns can help traders identify potential trend reversals. By analyzing the patterns and formations of the candlesticks, traders can spot whether a trend may be about to change direction.

Confirm support and resistance levels: Candlestick patterns can also confirm support and resistance levels. By looking at the patterns that occur at key price levels, traders can gain an understanding of the market’s sentiment towards those levels.

Entry and exit points: Traders can use candlestick patterns to determine entry and exit points for trades. By analyzing the patterns that occur at key price levels, traders can decide when to enter or exit a trade, depending on whether the pattern suggests a continuation or reversal of the trend.

Combine with other indicators: Candlestick patterns can be combined with other technical indicators to create a more robust trading strategy. By using candlestick patterns in combination with other indicators such as moving averages, traders can get a more comprehensive view of the market.

Timeframe analysis: Candlestick patterns can be analyzed across different timeframes to gain a more complete understanding of the market. By looking at patterns that occur over different timeframes, traders can identify potential short-term and long-term trends.

It’s important to remember that candlestick patterns should not be used in isolation, but in conjunction with other technical analysis tools and market fundamentals.

Popular Candlestick Patterns

Below are some of the most popular single-candlestick, double-candlestick, and triple-candlestick patterns as well as a few additional candlestick patterns in which the number of candlesticks varies.

Single-Candlestick Patterns

Hammer Candlesticks: A hammer is a bullish reversal pattern that forms at the end of a downtrend. It has a small real body near the top of the candlestick, with a long lower shadow.

Doji Candlesticks: A doji is a candlestick pattern that has the same opening and closing prices, resulting in a small real body. It indicates indecision in the market and can signal a potential reversal.

Spinning Top Candlesticks: A spinning top is a candlestick pattern with a small real body and long upper and lower shadows. It indicates indecision in the market and can signal a potential reversal.

High Wave Candlesticks: A high wave is a candlestick pattern with a long upper and lower shadow and a small real body. It indicates indecision in the market.

Hanging Man Candlesticks: A hanging man is a bearish reversal pattern that forms at the end of an uptrend. It has a small real body near the top of the candlestick, with a long lower shadow.

Star Candlesticks: A star is a candlestick pattern with a small real body and a long upper or lower shadow. It can indicate potential reversal or indecision in the market.

Shooting Star Candlesticks: A shooting star is a bearish reversal pattern that forms at the end of an uptrend. It has a small real body near the bottom of the candlestick, with a long upper shadow.

Long Shadow Candlesticks: A long shadow is a candlestick pattern with a long upper or lower shadow relative to the real body. It can indicate potential support or resistance levels.

Shaved Candlesticks: A shaved candlestick has no upper or lower shadows, indicating strong buying or selling pressure.

Big Body Candlesticks: A big body candlestick has a large real body relative to other candles, indicating strong buying or selling pressure.

Marubozu Candlesticks: A marubozu is a candlestick pattern with no shadows and a long real body. It indicates strong buying or selling pressure.

Belt Hold Candlesticks: A belt hold is a bullish or bearish reversal pattern that has a long real body with no upper or lower shadow, indicating strong buying or selling pressure.

Double-Candle Patterns

Engulfing Candlesticks: An engulfing pattern is a reversal pattern that involves two candlesticks. The second candlestick completely engulfs the real body of the first candlestick, indicating a potential change in direction.

Thrusting Candlesticks: A thrusting pattern is a continuation pattern that has a small real body and a long lower shadow that does not fully penetrate the previous candlestick’s real body.

On Neck and In Neck Candlesticks: On Neck and In Neck patterns are continuation patterns that have a small real body and a long lower shadow that closes near or on the previous candlestick’s real body.

Homing Pigeon Candlesticks: A homing pigeon is a bullish reversal pattern that has a long lower shadow and a small real body that closes within the previous candlestick’s real body.

Harami and Harami Cross Candlesticks: Harami and Harami Cross patterns are reversal patterns that involve a small real body candlestick inside the previous candlestick’s real body. The Harami Cross has a doji candlestick as the second candlestick.

Falling and Rising Window Candlesticks: Falling and Rising Windows are also known as gaps in the market. A Falling Window is a gap that occurs after an uptrend, and a Rising Window is a gap that occurs after a downtrend.

Tweezer Tops and Bottoms Candlesticks: Tweezer Tops and Bottoms are reversal patterns that have two or more candlesticks with the same high or low price level.

Dark Cloud Cover Candlesticks: A dark cloud cover is a bearish reversal pattern that has a long upper shadow and a real body that closes below the midpoint of the previous candlestick’s real body.

Piercing Line or Piercing Pattern Candlesticks: A piercing line is a bullish reversal pattern that has a long lower shadow and a real body that closes above the midpoint of the previous candlestick’s real body.

Judas Candlesticks: A Judas is a bullish reversal pattern that has a large bearish candlestick followed by a bullish candlestick with a small body and a shadow about the same size as the previous candlestick.

Inside and Outside Bars and Candlesticks: An inside bar or candlestick is where the high and low are contained within the range of the preceding bar/candlestick. An outside bar or candlestick is where the high and low exceed the range of the preceding bar/candlestick.

Counterattack Candlesticks: A counterattack is a bearish or bullish reversal pattern that has a long real body that closes beyond the midpoint of the previous candlestick’s real body.

Gap Candlestick Patterns: Gap Candlestick Patterns occur when there is a break in the price between the closing and opening prices of two consecutive candlesticks. It can indicate a change in market sentiment or a continuation of the current trend.

Triple-Candle Patterns

Evening Stars and Abandoned Babies: Evening Star is a bearish reversal pattern consisting of a tall white candlestick, followed by a small real body candlestick that gaps up, then a third black candlestick that closes well into the first candlestick’s real body. Abandoned Baby is a bullish reversal pattern that occurs at the bottom of a downtrend, and consists of a long black candlestick, followed by a doji (a candlestick with a very small real body) that gaps below the previous candlestick, then a long white candlestick that opens above the doji.

Stick Sandwich Candlesticks: A bullish candlestick pattern that occurs when a bearish candlestick is followed by a bullish candlestick, and then another bearish candlestick, with the bullish candlestick in the middle appearing like a “sandwich.” A bearish version of this pattern occurs when a bullish candlestick is followed by a bearish candlestick, and then another bullish candlestick.

Advance Block Candlesticks: A bearish reversal pattern that occurs in an uptrend, consisting of three consecutive white candlesticks, each with a progressively smaller real body.

Three Crows Candlesticks: A bearish reversal pattern consisting of three long black candlesticks with consecutively lower closes, each opening within the real body of the previous candlestick.

Three Soldiers Candlesticks: A bullish reversal pattern where three long white candlesticks appear in succession, with each candlestick opening above the previous day’s close.

Other Candle Patterns

Mat Hold Candlesticks: A continuation pattern where a long white candlestick is followed by a period of consolidation with small candlesticks, before another long white candlestick appears.

3-Method Formations: A continuation pattern that occurs within an existing trend and involves a series of candlesticks that form a rectangle or flag-like shape. It can be bullish or bearish depending on the trend direction.

Island Reversal Candlesticks: A reversal pattern that occurs when a gap appears on both sides of a short period of congestion, forming an “island” of price action separated from the surrounding price movements.

TheStrat Candlestick Patterns: A collection of candlestick patterns based on #TheStrat, which includes a variety of bullish and bearish reversal and continuation patterns.

These are just some of the many candlestick patterns that traders use in their strategies.

Pros and Cons of Candlestick Patterns

Like any other trading tool, candlestick patterns have their own set of pros and cons.

Pros:

Easy to read: Candlestick patterns are easy to interpret and understand compared to other forms of technical analysis.

Provide valuable information: Candlestick patterns provide valuable information about market sentiment, trend direction, and potential reversal points, which can help traders make informed decisions.

Widely used: Candlestick patterns are widely used by traders around the world, which means they can be a useful tool for identifying patterns in price action.

Can be used in conjunction with other tools: Candlestick patterns can be used in conjunction with other technical indicators and tools to create a more complete trading strategy.

Cons:

Not always accurate: Candlestick patterns are not always accurate and can give false signals, which can lead to losses for traders.

Subjective interpretation: Interpretation of candlestick patterns can be subjective and vary between traders, which can lead to conflicting signals and confusion.

Limited time frame: Candlestick patterns are based on price action over a specific time frame, which means they may not be useful for long-term traders.

Can be influenced by market conditions: Candlestick patterns can be influenced by market conditions such as volatility and liquidity, which can affect their accuracy.

Example Scanners and Strategies that use Candlestick Pattern

Candlestick Patterns can be used in both Scanning the market and Testing Strategies. The scanner searches the market for stocks using this indicator, and the strategy tests buying and selling rules built around this indicator.

The Bottom Line

In conclusion, candlestick patterns can be a valuable tool for traders in developing a trading strategy. These patterns provide insight into market sentiment, trend reversals, and potential entry and exit points. By using candlestick patterns in combination with other technical analysis tools and market fundamentals, traders can make informed trading decisions and manage risk more effectively.