TANSTAAFL! By Elliottwave International

As in, “There Ain’t No Such Thing As A Free Lunch” – a word to the wise which many investors today are ignoring, as explained by our February Elliott Wave Financial Forecast:

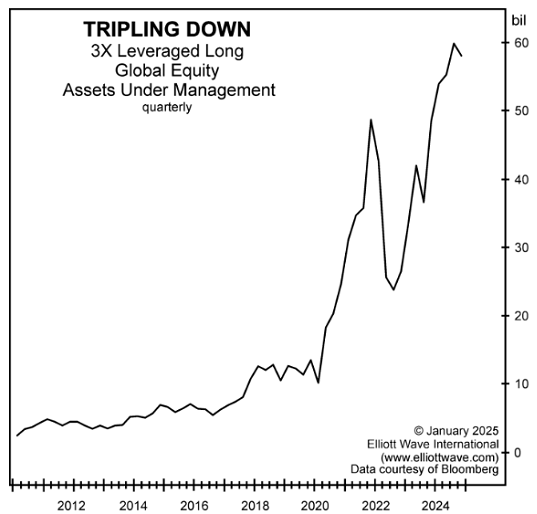

The chart below shows what can only be described as investors’ lust for risk in the form of a bet on a triple return on stocks. The very idea of tripling stock returns is not something that could happen outside a bull market top of great significance. The much higher degree peak that is now forming is clear by the total assets under management in 3X leveraged long equity funds, which are six times the level of 2018:

Over the course of the fourth quarter, there was a steady registration of bullish extremes. Subscribers may want to comb through the charts shown here and in The Elliott Wave Theorist as they constitute a veritable mountain range of all-time highs. As we’ve shown, stocks are over-owned, over-loved and over-valued.

Don’t YOU learn the lessons of leveraged investing the hard way. Go here to learn how you can access both our monthly publications now.

If you would like to learn the details of Elliott wave analysis before subscribing, read the online version of Frost & Prechter’s Wall Street bestseller, Elliott Wave Principle: Key to Market Behavior – FREE!