Market Mania: Sorting the Historical From the Hysterical Again By Van Tharp Trading Institute

Almost exactly 12 years ago to the day, I wrote in this same space that the market was dropping precipitously due to a downgrade. Except that time, in early August of 2011, it was the Standard and Poor’s Global Ratings that downgraded U.S. credit. Interestingly, the context for the two downgrades was both very much the same and very different.

The ”same” parts come from the rating agencies themselves and their reasons for the downgrades. I won’t get into the “insider” politics, but both the 2011 and 2023 downgrades came on the heels of a prolonged debt ceiling negotiation in U.S. Congress. Let’s look at how similar these reasons are from the reporting of the Wall Street Journal.

First, from 2011:

The downgrade “reflects our opinion that the fiscal consolidation plan that Congress and the administration recently agreed to falls short of what, in our view, would be necessary to stabilize the government’s medium-term debt dynamics.” It also blamed the weakened “effectiveness, stability, and predictability” of U.S. policy making and political institutions at a time when challenges are mounting.

The Treasury Department responded, “A judgment flawed by a $2 trillion error speaks for itself.”

And from the Wall Street Journal today (August 2nd, 2023):

The downgrade reflects an “erosion of governance” in the U.S. relative to other top-tier economies over the last two decades.

“The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management,” the agency said.

“The change by Fitch Ratings announced today is arbitrary and based on outdated data,” Treasury Secretary Janet Yellen said in a statement.

To be honest, you just can’t make this stuff up. In fact, you could flip the dates on the two and eliminate names and have a difficult time telling them apart.

Outside the Washington DC Beltway – Quite a Different Story

What led up to the downgrades from the macroeconomic and technical analysis chart context are quite different, however. In the summer of 2011, Europe was in the midst of a debt crisis with the weakest countries sitting at risk of debt default (anyone remember the main countries involved in the earliest part of the crisis? Portugal, Italy, Ireland, Greece, Spain). My article 12 years ago included the old trader’s saying:

“The market crawls up the stairs – then leaps out the window.”

—Classic market wisdom

The 2011 article then shows this chart that illustrated the principle to a tee:

The European debt Crisis had set the table with ongoing bad news and the markets had already responded with a big drop of around 10 percent leading up to Standard and Poor’s downgrade. In fact, the CBOE Volatility Index (VIX) saw a high in the days before the 2011 downgrade of 39.

The lead-up is quite different this time. The Dow Jones Industrial Average had just been higher for 16 out of 17 days. And the day before the 2023 Fitch downgrade of the U.S. credit rating, the VIX closed at a very depressed level—below 14 (as I write this on Wednesday, August 2nd, the fear gauge has failed to climb higher than 16.4).

So Where Do We Go From Here?

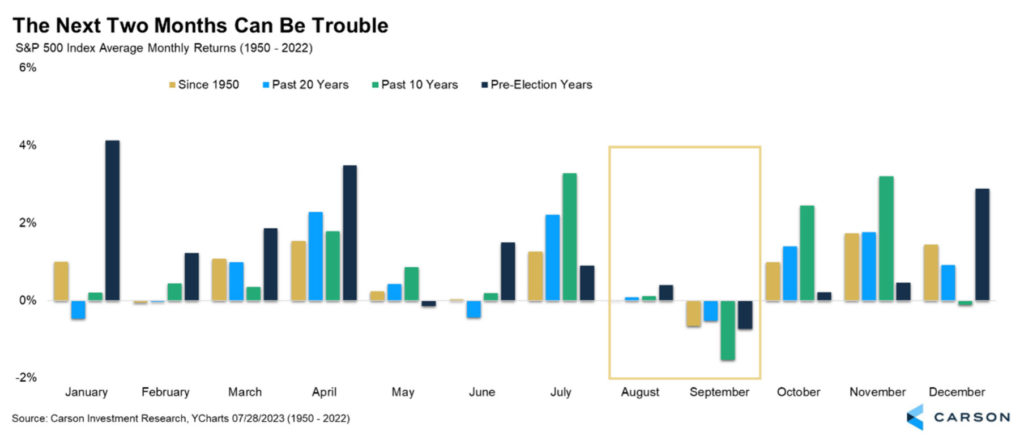

We have two very weak seasonal months ahead of us. Here’s data from Carson Investment Research’s Ryan Detrick that shows how weakly the summer usually ends:

Based on seasonality alone, we could be in for a market pullback or at least consolidation. If 2011 is any guide, the downgrade could prove just that trigger. Balancing that news, the market has had a strong earnings season so far and some are considering the battle against inflation to be nearing its end.