Here’s Why This Bear Market is a “Global Story” By Elliottwave International

“The decline started in emerging market stocks way back in February 2021”

A widely accepted measure of a bear market is a drop of 20% or more in a major index from an all-time high.

By that measure, both the S&P 500 index and the Dow Industrials have entered bear market territory since their January peaks.

Yet, Robert Prechter’s Conquer the Crash offers a message for those entirely focused on U.S. stocks:

The emerging bear market is a “global story.”

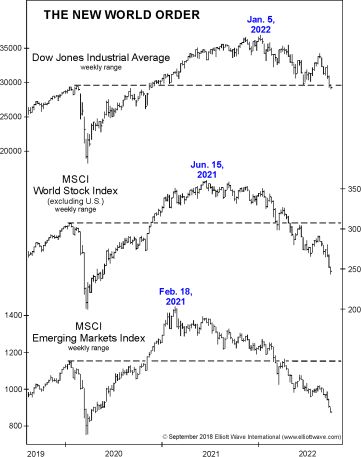

That assessment is certainly validated by this chart and commentary from the October Elliott Wave Financial Forecast, a monthly publication which covers major U.S. financial markets and more:

The decline started in emerging market stocks way back in February 2021. It spread to major world stock markets, excluding the U.S., in June 2021. Both these indexes fell below their early 2020 peaks earlier this year. The top graph shows the Dow Jones Industrial Average, which peaked on January 5 of this year and in the week of Sept. 19-23 declined below its early 2020 high.

Another message which Conquer the Crash emphasized is the “all the same market hypotheses.” As the book notes:

When stocks turn down, it will signal a major liquidity contraction, and all major asset classes should decline together.

This message is also being currently confirmed. Let’s return to the October Elliott Wave Financial Forecast:

Clearly, liquidity is waning as normally disparate assets are starting to trend together. In the last half of September, for instance, the decline in stocks was joined by a decline in bond prices, precious metals, FOREX, commodity indexes and oil.

There’s even been a correlation between Stocks and Bitcoin.

Now is the time to prepare for what is likely ahead.

An ideal way to prepare is to become familiar with the Elliott wave patterns of major global stock market indexes, including the U.S.

If you’re unfamiliar with Elliott wave analysis or need a refresher, you may want to read Frost & Prechter’s Wall Street classic, Elliott Wave Principle: Key to Market Behavior. Here’s a quote from the book:

In the 1930s, Ralph Nelson Elliott discovered that stock market prices trend and reverse in recognizable patterns. The patterns he discerned are repetitive in form but not necessarily in time or amplitude. Elliott isolated five such patterns, or “waves,” that recur in market price data. He named, defined and illustrated these patterns and their variations. He then described how they link together to form larger versions of themselves, how they in turn link to form the same patterns of the next larger size, and so on, producing a structured progression. He called this phenomenon The Wave Principle.

Although it is the best forecasting tool in existence, the Wave Principle is not primarily a forecasting tool; it is a detailed description of how markets behave. Nevertheless, that description does impart an immense amount of knowledge about the market’s position within the behavioral continuum and therefore about its probable ensuing path.