Humana, One Medical Clear Buy Points; Are These Three Next? By Investors Business Daily

Managed-care stocks are looking healthier again. Humana stock, One Medical stock, UnitedHealth stock, Centene stock and Cigna stock are your stocks to watch this weekend.

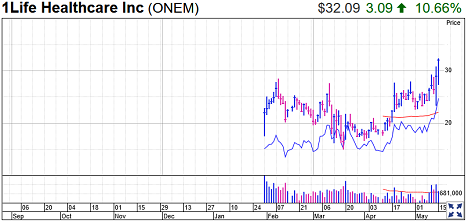

Humana (HUM), fueled by Medicare Advantage growth, moved into buy range on Thursday and built on those gains Friday. Ditto for One Medical stock, though it’s now extended from its IPO base. San Francisco-based 1Life HealthCare (ONEM), which operates One Medical clinics, reported impressive membership trends late Wednesday.

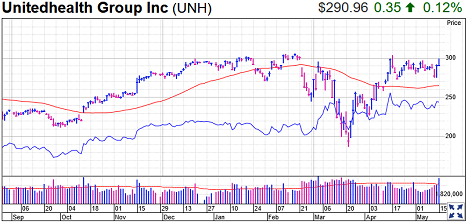

The Medical-Managed Care group was among the earliest industry groups to recover from the coronavirus stock market crash. But momentum flagged after an initial burst of excitement over first-quarter earnings April 15 from UnitedHealth Group (UNH), the nation’s largest insurer and a Dow Jones component. Now, a month later, there are tentative signs the group could be setting up for a run.

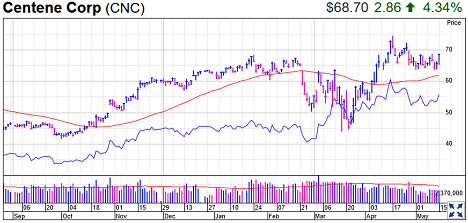

UnitedHealth stock is near a buy point. Centene stock — the ObamaCare upstart that became a big-six insurer with its purchase of WellCare — is back near buy range after a Q1 earnings miss. Cigna (CI) is trying set up again after an earnings day breakout attempt fizzled last month. Molina Healthcare (MOH) is extended beyond a buy range, helped by its Medicaid managed care focus that is well suited to a time of double-digit unemployment.

Coronavirus Hit Arrived As Medicare-For-All Fears Waned

After lagging for most of 2019, UnitedHealth stock and peers charged higher as worries over Democrats’ Medicare-for-all plans faded late last year. Strong showings by Bernie Sanders in the early presidential contests, capped by his dominance of the Nevada caucus on Feb. 22, helped halt the rally.

While Joe Biden’s sudden resurgence put that issue to bed for the time being, the coronavirus stock market crash took down the group. As cases spiraled along with hospitalizations, concerns grew that insurers could see a surge in medical costs potentially much worse than a bad flu season. But Americans are deferring elective procedures, more than offsetting coronavirus costs. Surging unemployment raised another worry: Insurers like UnitedHealth with a big commercial market presence could see a big hit to membership.

UnitedHealth Earnings Relief

A better-than-expected UnitedHealth earnings report for the first quarter, coming amid signs that coronavirus cases in the U.S. were near a peak, provided a sigh of relief. There were negatives: Commercial insurance members served by UnitedHealth fell 720,000 to 27.04 million, worse than expected. But they were offset by positives: Medical costs were lower than expected, falling to 81% of premiums, down from 82% a year ago.

UnitedHealth predicted a significant rise in medical costs in the second half of the year due to pent-up demand from deferred procedures and untreated conditions. But that will be at least partly offset by an increase in revenue for its Optum health services empire that includes 45,000 primary care physicians and 200 surgery centers. The loss of commercial insured members will be offset to some extent by increases in its Medicaid managed care programs.

While acknowledging major uncertainty about how the coronavirus pandemic will play out, UnitedHealth management stuck by full-year guidance.

UnitedHealth stock ran into resistance at 300 on Friday, closing up 0.3% at 291.61. That’s 4% below a 304.10 handle buy point.

The relative strength line for UNH stock is just below record highs. The RS line, the blue line in the charts below, tracks a stock’s performance vs. the S&P 500 index.

So why did the managed-care stock rally stall over the past month? While big tech stocks have kept rising, the broader stock market has marched in place. Beyond that, various concerns have weighed on individual stocks in the group.

The week after UnitedHealth topped Q1 estimates on lower health costs, Centene missed on higher-than-expected costs among ObamaCare exchange customers. Molina’s ObamaCare exchange enrollment looked soft.

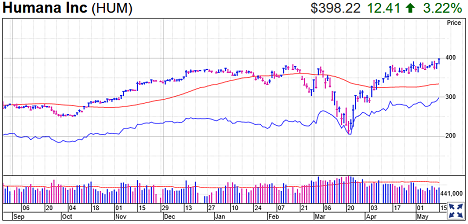

Humana Stock

Humana (HUM) seemed to be the company that gave investors the least to worry about. While nudging up its Medicare Advantage enrollment outlook, Humana blew past Q1 estimates with 21% EPS growth.

Humana stock tested a buy point of 385.10 multiple times over the past three weeks. But the two-day move on Thursday and Friday seemed to carry more conviction, lifting Humana stock to a record high. Humana is still within the 5% chase zone beyond which investors face a higher risk of being shaken out of a position.

Humana stock has a best-possible 99 IBD Composite Rating, which combines technical and fundamental factors into a single measure for investors.

One Medical Stock

For One Medical, which came public on Jan. 31, its full exposure to members with commercial insurance was a concern amid surging unemployment. Yet One Medical, despite offering weaker-than-expected revenue guidance for Q2, convinced investors that its model has staying power — even in a bad recession.

One Medical membership rose 25% from a year ago to 455,000 in Q1, and the company boosted its year-end guidance to a range of 500,000-515,000.

“Even with rising levels of unemployment, we remain confident in our value proposition to members,” CFO Bjorn Thaler said.

Management has proved to be agile in One Medical’s few months as a public company, launching 18 outdoor Covid-19 testing sites, billable remote visits, virtual behavioral therapy consultations and a worksite re-entry program to help employers safely transition workers back to shared spaces.

The growth of telemedicine could deliver long-term benefits, increasing the number of patients it can serve per square foot.

On Thursday, One Medical stock broke through a buy point at 28.68, according to MarketSmith analysis, despite an initial sell-off after its Q1 earnings report. One Medical stock continued to explode higher on Friday, rising 11% to 32.17. Initial breakouts from an IPO can be powerful. ONEM bears watching to see if it pulls back to within buy range.

One Medical stock has an OK 71 Composite Rating, reflecting its lack of earnings.

Centene Stock And Molina Stock

Centene and Molina, which have long competed in the Medicaid managed care market, were early winners on the ObamaCare exchanges. Yet Molina spread itself too thin and scaled back its exchange presence under new management. Centene, meanwhile, has become the biggest exchange player, with more than 2 million members.

Analysts see Medicaid and, to a lesser extent, the exchanges as relative safe havens amid the coronavirus recession. If temporary job losses turn permanent, Medicaid enrollment should grow.

That big picture has supported both stocks, despite what analysts perceived as minor Q1 hiccups.

Centene stock closed pennies below a 68.74 buy point Friday. CNC stock originally broke out in mid-April and quickly rose to 74.70, but then reversed lower. Technically, that 68.74 entry is still valid. In another week, Centene stock will have a flat base with a 74.80 entry.

Molina stock is far extended, rising 17% since an April 8 breakout.

Centene stock has a 97 Composite Rating, while Molina stock is at 96.

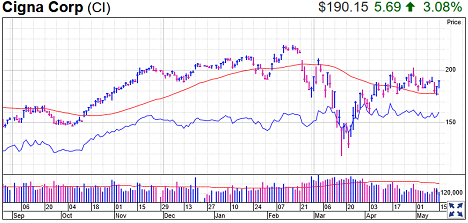

Cigna Stock

Cigna stock rose 3.1% on Friday to 190.15, a day after rebounding from its 50-day line and reclaiming its 200-day line. The insurer has a 202.85 handle buy point.

Cigna stock briefly cleared a 199.45 buy point on April 30, after reporting better-than-expected EPS and revenue growth. But shares reversed lower and ultimately fell to 176.52 intraday on May 14.

Unlike the other managed-care stocks discussed here, the RS line for Cigna stock has not made much progress in the past few months. It hasn’t made progress for more than a year.

Cigna stock has a 93 Composite Rating.

What’s Ahead For UnitedHealth Stock, Humana Stock?

Still, there a couple of issues that health care investors should keep on their radar. A key unknown is how much pent-up demand for health care services will boost medical costs later this year. Since Americans have been staying away from the doctor as much as possible, some may be in worse shape when they finally get care.

While a negative for insurers such as UnitedHealth, Humana and Cigna, pent-up demand could boost results for One Medical.

Second, political headlines could come back to bite the group ahead of the 2020 election. While Medicare-for-all never looked especially realistic, Biden supports a public option that would have a Medicare-like government plan compete against private insurers. If Biden wins — and Democrats win the Senate — a public option could conceivably debut as early as 2023.

Trading Education Online Courses

TracknTrade Trading Software Free Trial