Best Stocks To Buy Or Watch This Week Include Taiwan Semiconductor Holding Above Buy Point By Investors Business Daily

The best stocks to buy or watch for this week include Taiwan Semiconductor (TSM) and Whirlpool (WHR). Both TSM stock and Whirlpool are holding above recent buy points, consolidating bullishly and setting up new buying opportunities.

Other top stocks to watch for the Oct. 30 week include Idexx Laboratories (IDXX) and Pool (POOL).

When buying a breakout, investors want to see stocks run up sharply. But often stocks will pause just above or below the buy point. That can provide another opportunity to start a position or add a few more shares.

In the current environment, with the stock market rally pulling back and some recent breakouts fizzling, leading stocks holding tightly around buy areas is especially bullish.

Taiwan Semiconductor stock is on IBD Leaderboard. Idexx stock and Pool Corp. are the two newest IBD Long-Term Leaders.

So let’s take a closer look at the best stocks buy or watch this week.

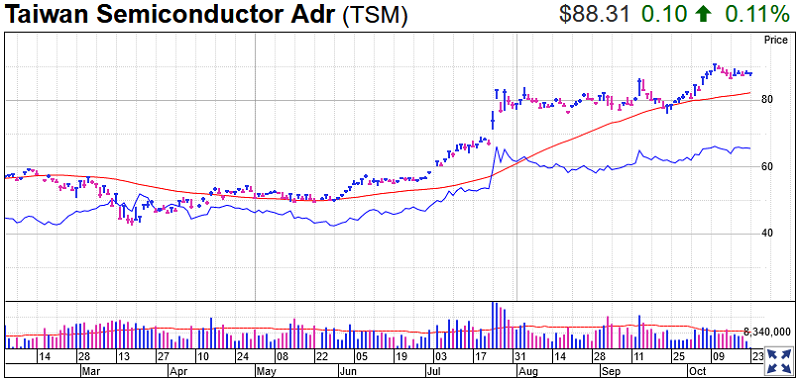

Taiwan Semiconductor Stock

TSM stock broke out on Sept. 15, clearing an 84.10 buy point from a flat base, hitting a record 86.79 that day. But with the stock market falling sharply over the next two weeks, Taiwan Semi quickly fell back. Shares fell more than 7%-8% from the buy point, an automatic sell rule. But Taiwan Semiconductor stock found support at its 50-day line and quickly rebounded, moving back above the old entry on Oct. 5 and then hitting a new high on Oct. 7.

Since reporting strong earnings, TSM stock has consolidated tightly. Shares climbed 1.9% last week to 88.31. Shares are in range for either an 84.10 or 86.89 entry. But investors might want to wait for a move to 91.37, clearing the Oct. 12 peak.

The world’s largest chip foundry on Oct. 15 reported that third-quarter earnings rose 46% per ADR while revenue swelled 30% to $12.14 billion.

Taiwan Semiconductor ranks No. 1 among its peers in IBD’s Electronics-Semiconductor Manufacturing Group. It makes chips for the likes of Apple (AAPL), AMD (AMD), Nvidia (NVDA), Qualcomm (QCOM) and more.

It has an RS Rating of 92. Its EPS Rating is also 92, while its Composite Rating is 98.

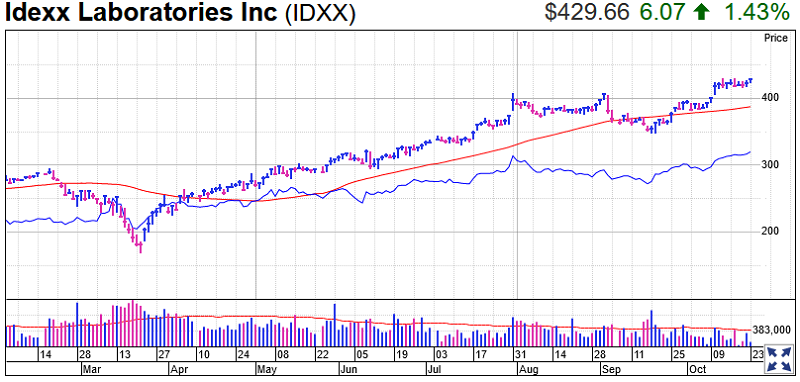

Idexx Stock

Veterinary medical products maker Idexx is the next stock to buy or watch for the coming week.

The company is benefiting from increased spending on pets during the pandemic. A recent LendingTree survey shows that a third of pet owners said their pet-related spending has increased during the COVID-19 pandemic. Also, nearly half of the 2,000 people surveyed said they’d consider either getting a first pet or adding to their brood.

Idexx stock rose 1.4% to 429.66 last week, setting a record close. That’s just beyond the 5% chase zone from a 407.96 buy point out of a flat base. If Idexx can clear its mini-consolidation, 431.25 would be a new entry point.

As befits a Long-Term Leader, Idexx stock has a relative strength line at record highs. The RS line, the blue line in the charts provided, tracks a stock’s performance vs. the S&P 500 index.

Keep in mind that Idexx will report Q3 earnings on Thursday. Idexx earnings are expected to rise 14.5% to $1.42 a share. Revenue is seen up 11% to $670.7 million.

Its RS Rating is a solid 89. Its EPS Rating is 97, while its Composite Rating is 94. Shares rose slightly to 424.65 on Friday.

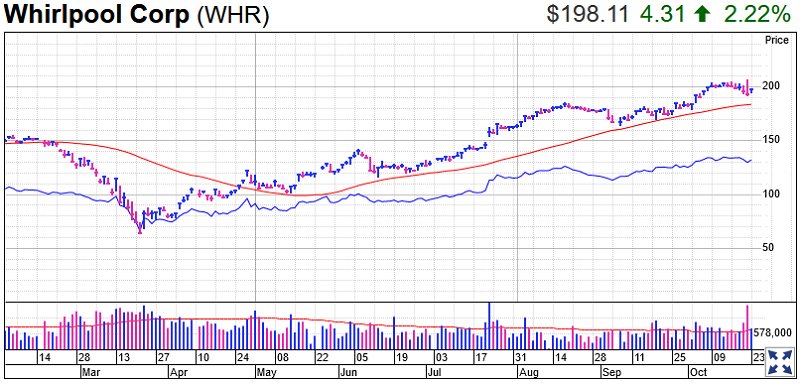

Whirlpool Stock

The maker of household appliances is riding a home-improvement trend among consumers who are stuck at home during lockdowns. Last week Whirlpool reported third-quarter earnings of $6.91 a share, a 74% increase from the year-ago quarter. Revenue rose 4% to $5.29 billion.

Shares hit a record high Thursday morning following earnings, but reversed lower. But shares found support at their 21-day exponential moving average. For the week, WHR stock slid 1.7% to 198.11.

That’s just out of range from a 186.96 buy point from a flat base, according to MarketSmith analysis.

Whirlpool stock has an RS Rating of 88. Its EPS Rating is 78, while its Composite Rating is 91.

While the RS line for Whirlpool stock has been trending higher since the coronavirus crash lows, that follows a multiyear downtrend. While Whirlpool earnings boomed last quarter from coronavirus trends, the history is patchier.

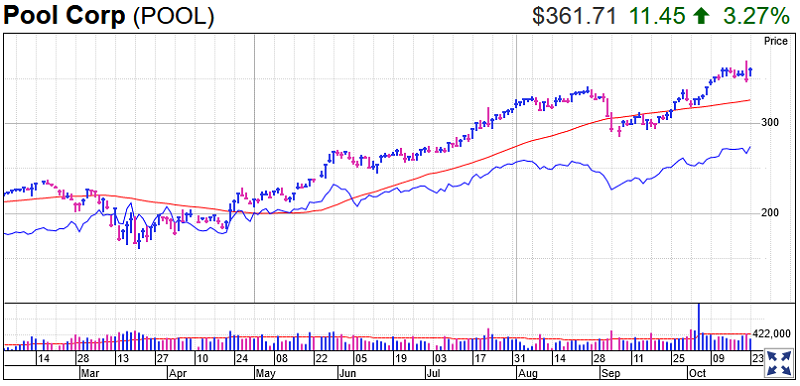

Pool Stock

Pool is the final stock to buy or watch this week.

The pool equipment and supplies retailer saw another quarter of increased demand for its products as stay-at-home orders spur homeowners to keep their pools open longer than usual into Fall.

Pool reported quarterly earnings on Oct. 22 of $2.71 a share, 47% more than a year ago. It posted revenue of $1.14 billion, a 27% increase from a year ago.

Pool stock was added to the S&P 500 index earlier this month. That didn’t do much for shares immediately. But a few days later, Pool stock cleared a 338.98 buy point from a very short cup-with-handle base. The next day, shares closed above the old high, clearing a 345.25 buy point from a cup base on a weekly chart.

After running up for a few more days, shares have been moving sideways.

As with Whirlpool, Pool stock jumped to a record high Thursday on earnings, then reversed lower. But shares rebounded on Friday, hitting a record close like Idexx stock. For the week, Pool closed up 0.6% at 361.71, just beyond range from either the 338.98 or 345.25 entries.

If Pool stock can clear its new consolidation, that would offer a new entry.

Pool has a 99 Composite Rating and holds the No. 1 rank in the Retail-Leisure Products industry group. Its RS Rating is 91 and trending upward. Its EPS Rating is 98.

Trading Education Online Courses

TracknTrade Trading Software Free Trial