These Are The 5 Best Stocks To Buy And Watch Now By Investors Business Daily

Buying a stock is easy, but buying the right stock without a time-tested strategy is incredibly hard. So what are the best stocks to buy now or put on a watchlist? Target (TGT), Beyond Meat (BYND), LGI Homes (LGIH), Twilio (TWLO) and Freshpet (FRPT) are worth considering as the market gets back into gear.

Since the coronavirus bear market, stocks have rebounded powerfully. The strong action reflected a rising confidence that the economy will eventually recover from the Covid-19-caused shutdown. The market is once again in a confirmed uptrend, after previously slipping into correction territory. The major indexes retreated Friday, especially the Nasdaq, after President Donald Trump tested positive for coronavirus and a weaker-than-expected jobs report. On the other hand, many leading stocks are offering buying opportunities.

Amid these mixed signals, investors should still exercise caution about opening new positions at the moment. Perhaps test the water by buying a smaller position than normal. It is also a good time to be identifying targets for your watchlist.

So why are these five names above the rest to buy or watch? Before turning to that question, it is important to consider how one goes about choosing a stock in the first place. Superior fundamentals and technical action, and buying at the right time, are all part of a shrewd investing formula.

Best Stocks To Buy: The Crucial Ingredients

Remember, there are thousands of stocks trading on the NYSE and Nasdaq. But you want to find the very best stocks right now to generate massive gains.

The CAN SLIM system offers clear guidelines on what you should be looking for. Invest in stocks with recent quarterly and annual earnings growth of at least 25%. Look for companies that have new, game-changing products and services. Also consider not-yet-profitable companies, often recent IPOs, that are generating tremendous revenue growth.

IBD’s CAN SLIM Investing System has a proven track record of significantly outperforming the S&P 500. Outdoing this industry benchmark is key to generating exceptional returns over the long term.

In addition, keep an eye on supply and demand for the stock itself, focus on leading stocks in top industry groups, and aim for stocks with strong institutional support.

Once you have found a stock that fits the criteria, it is then time to turn to stock charts to plot a good entry point. You should wait for a stock to form a base, and then buy once it reaches a buy point, ideally in heavy volume. In many cases, a stock reaches a proper buy point when it breaks above the original high on the left side of the base. More information on what a base is, and how charts can be used to win big on the stock market, can be found here.

Don’t Forget The M When Buying Stocks

Never forget that the M in CAN SLIM stands for market. Most stocks, even the very best, will tend to follow the market direction. Invest when the stock market is in a confirmed uptrend and move to cash when the stock market goes into a correction.

The current stock market is back in an uptrend, but there are some warning signs. The Nasdaq slumped on Friday, the 10th day of its rally attempt. The S&P 500 also ended the week below its 50-day line, a bearish indicator. The Dow Jones managed to close Friday above the low of Wednesday’s follow-through, which prevented its uptrend from coming under pressure.

As you identify stocks, on a technical basis look for stocks with rising relative strength lines.

Remember, things can quickly change, when it comes to the stock market. Make sure you don’t miss out on a rally by keeping a close eye on the market trend.

Best Stocks To Buy Or Watch

Now let’s look at Target, Beyond Meat and LGI Homes stock in more detail. An important consideration is that these stocks all boast impressive relative strength.

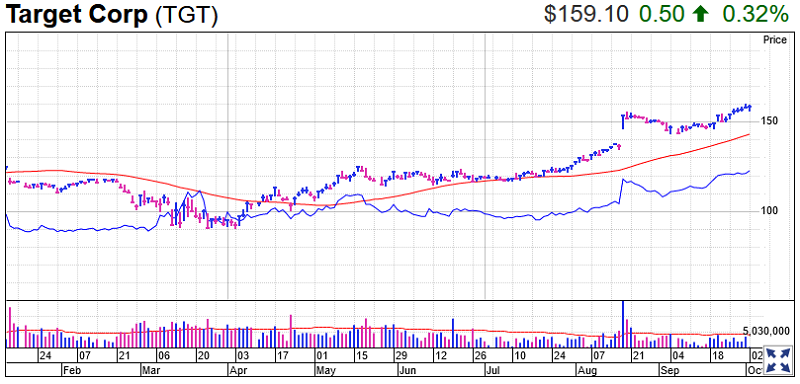

Target Stock

TGT stock is still in range from a 156.20 buy point out of a flat base, MarketSmith analysis shows, testing that entry on Friday but rebounding to close slightly higher. During the brief stock market correction, Target pulled back modestly but soon found support at its 21-day exponential moving average.

That came after a strong rally for Target stock, which included an earnings gap following the big-box retail chain’s strong second-quarter earnings.

The relative strength line is at record highs, as is Target stock itself. The fact that the RS line managed to hit a record high even before breaking out from its base is an especially bullish sign.

Target stock has a strong IBD Composite Rating of 96. Its EPS Rating is a bit weaker, at 76, but the recent trend is improving. The Stock Checkup Tool shows EPS exploded by 86% in the most recent quarter, a decisive rebound from the previous quarter’s 61% decline in earnings.

The company initially saw sales increase due to panic-buying ahead of coronavirus lockdowns in the U.S. Since then, its investments in e-commerce have paid off, as more customers stay in and shop online for delivery or curbside pickup.

But costs have also been going up, including wage hikes as well as more protective gear for workers and in-store modifications to mitigate infection risks.

Trends going forward are worth watching closely, as rival Walmart (WMT) crushed expectations in its most recent quarter, but cautioned that sales have started to “normalize” as the coronavirus stimulus fades.

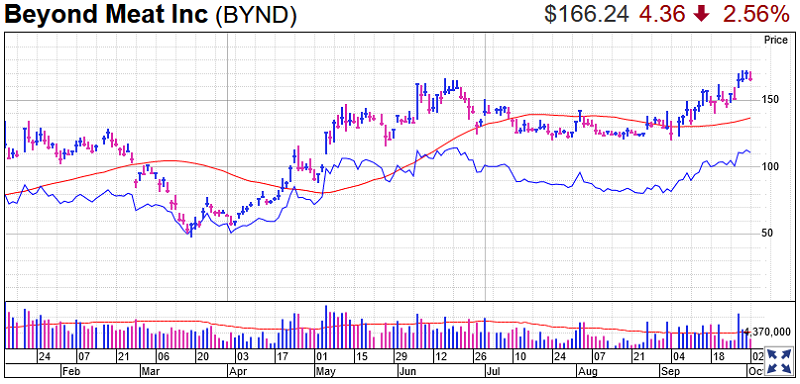

Beyond Meat Stock

Beyond Meat broke out past a cup-base buy point of 167.26, but dipped back below that entry on Friday. Arguably, investors could have entered earlier from a messy handle-like action on a daily chart, but it wasn’t a real handle and didn’t show up at all on a weekly chart.

The RS line has been spiking since the start of September, and the move has coincided with the formation of the right side of its base. Beyond Meat stock is well clear of its 50-day line, a bullish indicator.

The stock has a strong, but not ideal, Composite Rating of 84. The Stock Checkup Tool shows this is largely due to lagging earnings, with its EPS Rating coming in at a skinny 29. This is in stark contrast to its beefy Relative Strength Rating of 92. But it’s worth noting that sales are exploding, jumping by an average of 189% over the past three years.

Beyond Meat is sporadically profitable, but the company is focusing on rapid growth, signing up retailers and restaurants as rivals such as Impossible Foods and many others vie for market share in a new market.

The BYND stock breakout followed news that Walmart will carry Beyond Meat products in far more of its stores.

Beyond Meat is a maker of fake-meat products — plant-based food designed to replicated the taste and feel of real meat. The company reached a major milestone by turning a profit in 2019.

Last month the firm announced the launch of Beyond Meatballs. They are made from plant-based ingredients with no GMOs, soy, gluten or synthetic ingredients.

They are set to launch, rather than lunch, at grocery stores nationwide by early October. Whole Foods Market (owned by Amazon (AMZN), Sprouts Farmers Market (SFM) and Kroger (KR) will carry the product.

In addition, El Segundo, Calif.-based Beyond Meat has announced an agreement to start production of plant-based meat in the China market.

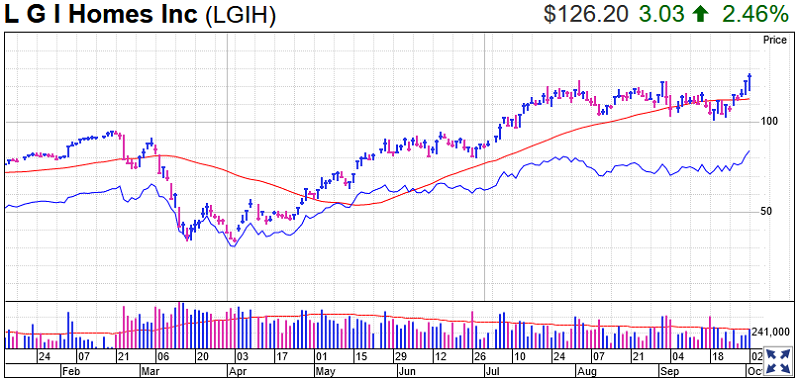

LGI Homes Stock

The Leaderboard stock is in a buy zone after passing a consolidation buy point of 124.04, capping a 17% weekly gain. The base is second stage. IBD research shows such early-stage bases have a higher chance of success than later-stage ones.

In addition the relative strength line for LGI Homes stock is in new high ground, which is a bullish indicator.

The recent IBD Stock Of The Day has a strong Composite Rating of 96. The EPS Rating, a gauge of accelerating profitability, is a best-possible 99. LGI Homes stock’s RS Rating is not far behind.

The Texas-based firm builds entry-level single-family homes. It operates in its home state, and has also expanded into regions including the South and the Pacific Northwest.

In June it closed on its 40,000th home and now has 113 active selling communities.

Demand for entry-level homes is expected to rise, as more millennials start buying houses and having families. Historically low mortgage rates are also boosting home sales.

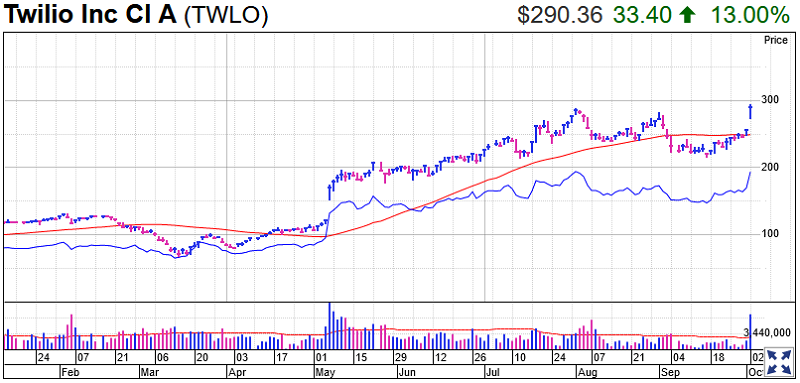

Twilio Stock

Twilio stock is in the buy zone after breaking out from a double-bottom base. The ideal buy point is 283.44. In addition, the RS line has just hit a new high.

The internet cloud communications firm is booming in the age of Covid-19.

The stock gapped up into the buy zone Friday, after the communications software maker predicted it’ll beat just-ended Q3 revenue targets and predicting strong long-term growth. At Twilio’s investor day event Thursday, executives said they expect the company’s sales growth to exceed 30% in each of the next four years. Wall Street had been modeling 25% growth in 2021 and 23% growth in 2022.

Twilio stock has a very strong IBD Composite Rating of 97. At the moment, earnings have not quite caught up on stock market performance, but they have accelerated for the past three quarters.

The Stock Checkup Tool shows earnings have grown by an average of 73% over the past three quarters, and by 108% over the past three years. It is well clear of CAN SLIM requirements for 25% growth in both these metrics.

RBC Capital Markets analyst Alex Zukin reiterated his outperform rating on Twilio stock and upped his price target to 375 from 320.

“Twilio is the clear market leader in one of the largest markets in enterprise software,” Zukin said in a note to clients. “Twilio is benefiting from two key end-market trends: the growing pressure on companies to build their own software to drive greater customer satisfaction; and the increasing importance of digital agility in sectors across the economy.”

Freshpet Stock

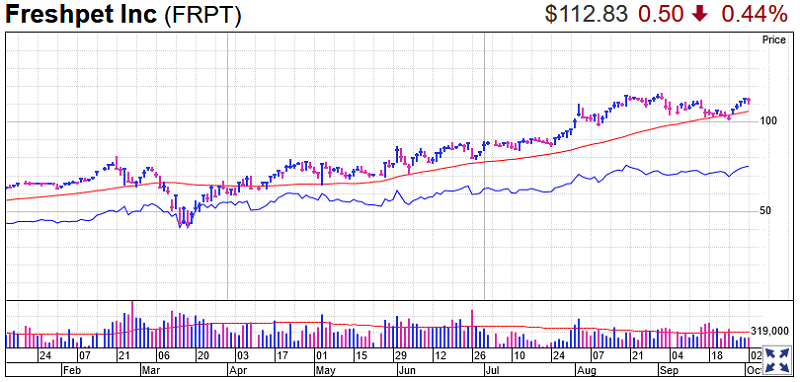

Freshpet has forged a new flat base. The dog-food disruptor is now chasing a buy point of 116.70. It is moving upward after finding support at its 50-day line, which is a bullish, rather than bulldog-ish, indicator.

The stock’s RS line has been making very good progress throughout 2020, and is now close to hitting a new high. The stock is up a mighty 91% so far this year.

However, weak earnings have impacted the Composite Rating, which now sits at a good 81 out of 99. The IBD Stock Checkup tool shows earnings are improving, jumping by 106% in the most recent quarter. While Freshpet has been consistently losing money annually, analysts predict it will earn 24 cents per share in 2020. This is seen jumping by 142% in 2021.

Freshpet boasts cat and dog food made of real, fresh meat combined with vitamin-rich vegetables, leafy greens and fruits rich in antioxidants. It says it does not use preservatives, additives or artificial ingredients.

The company says it sources 100% of the electricity used in its kitchens through wind power. It says it is a landfill-free facility and plants trees to offset its carbon emissions.

Freshpet says it strives to improve its energy-use profile by continuously increasing the efficiency of its Freshpet Fridges. It has donated more than 5 million fresh meals to pets via shelters, charitable organizations and humane societies.

All of these are values the company thinks relate to the new generation of pet owners, people who believe their pets “deserve to eat the kind of fresh, healthy food that we do,” according to the company’s 2019 10-K filing.

Trading Education Online Courses

TracknTrade Trading Software Free Trial