AMD, Apple Chipmakers Qorvo, Qualcomm Lead 5 Stocks Near Buy Points By Investors Business Daily

AMD stock, Qorvo (QRVO), Qualcomm (QCOM) Analog Devices (ADI) and Taiwan Semiconductor (TSM) are top stocks to watch this week. All but one of the chip stocks are near buy points as the semiconductor industry continues to rebound from a cyclical downturn, thanks in part to demand for ultrafast 5G phones and IoT (Internet of Things) devices.

Qorvo and Qualcomm stock are 5G plays and Apple (AAPL) iPhone chipmakers. Taiwan Semi makes chips for Apple, Qualcomm, AMD and others. It’s on IBD Leaderboard and on the IBD 50 list of top growth stocks.

The relative strength lines for Qorvo, Qualcomm and Taiwan Semiconductor are at or near multiyear highs. A rising RS line means these stock are outperforming the S&P 500 index. In comparison, the RS lines for AMD and especially Analog Devices stock look less inspiring.

Stock Market Rally: Watch The RS Line

The relative strength line is a quick way to spot winners in any market — up or down.

The Relative Strength At New High stocks list is a great place to look for quality names with strong RS lines. IBD’s stock research platform MarketSmith has a screening tool that identifies stocks with RS lines making new highs.

In addition, the best growth stocks have an IBD Composite Rating of 90 or better. AMD stock leads this group with a perfect Composite Rating of 99, followed by Qualcomm with a 98, Taiwan Semi with a 97, Qorvo with a 96 and Analog Devices with an 89. The Composite Rating combines five separate proprietary IBD ratings, based on key fundamental and technical criteria, into one easy-to-use score.

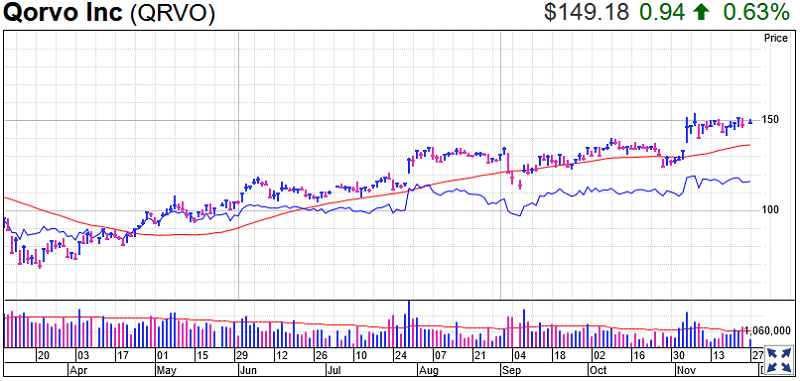

Qorvo Stock

Qorvo stock rose 1.3% on Friday to 150.11, accounting for the bulk of the week’s 1.8% gain. It’s still working on a three-weeks-tight pattern with a 154.53 buy point. Investors could start buying Qorvo stock at 152.70, a dime above Tuesday’s high. The three-weeks-tight pattern is just above a prior consolidation.

Qorvo stock has an IBD Relative Strength Rating of 84. That means it has outperformed 84% of all stocks over the past 12 months. The best growth stocks typically have RS Ratings of at least 80.

Qorvo earnings per share jumped 60% in the September quarter while sales climbed 31%, showing a sharp acceleration from the prior quarter. In addition, the wireless chipmaker’s guidance came in well ahead of views, thanks to 5G chip sales and Wi-Fi 6 wireless demand. Qorvo derives 35% to 40% of revenue from Apple and has benefited from the recent launch of a 5G iPhone.

Qorvo stock earns an EPS Rating of 91 out of a best-possible 99. Earnings per share growth averaged 33% over the past three quarters, above the 25% or higher CAN SLIM investors want to see. Over the past three years, Qorvo earnings per share grew 13% annually with sales up 5%.

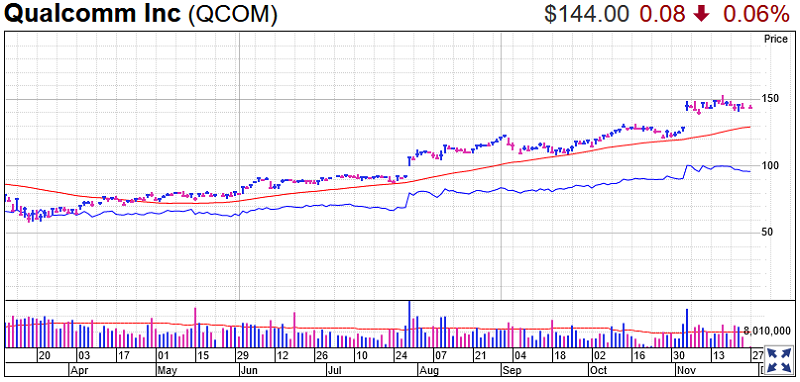

Qualcomm Stock

Another key Apple supplier, Qualcomm’s stock dipped 0.2% to 143.83 on Friday, retreating 1.4% for the week. A three-weeks-tight pattern is now a four-weeks-tight, still offering a 153.43 buy point. Aggressive investors could enter at 150.

Qualcomm delivered a beat-and-raise for its fiscal fourth quarter Nov. 4. On a year-over-year basis, Qualcomm earnings rose 86% while sales climbed 35%. Chips for 5G phones are the biggest driver of Qualcomm’s growth, but its product licensing business is doing well too.

The chip giant owns an EPS Rating of 77 and RS Rating of 92. Qualcomm earnings per share growth averaged 45% over the past three quarters. Over the past three years, Qualcomm grew EPS negatively 2% annually (meaning, earnings actually fell over this period) and sales positive 2%.

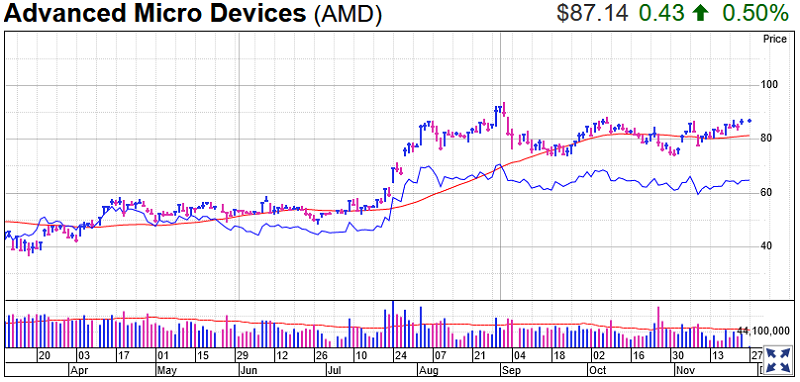

AMD Stock

Chipmaker AMD added 0.55% to 87.19 Friday, capping a 3% weekly gain. AMD stock sits below an 88.82 double-bottom buy point. But on Friday, shares closed above an 87.15 early entry.

The RS line for AMD stock has trended lower since Sept. 1, but that follows a long, powerful uptrend.

AMD, Friday’s IBD Stock Of The Day, on Oct. 27 announced a deal to buy Xilinx (XLNX) for $35 billion in stock. Fabless chipmaker AMD could remain rangebound for a while as a result, but holds a long-term growth opportunity, analysts say.

AMD stock sports an unbeatable 99 EPS Rating and 91 RS Rating. Earnings per share growth averaged 151% over the past three quarters. Over the past three years, AMD grew earnings per share 108% annually and sales 14%.

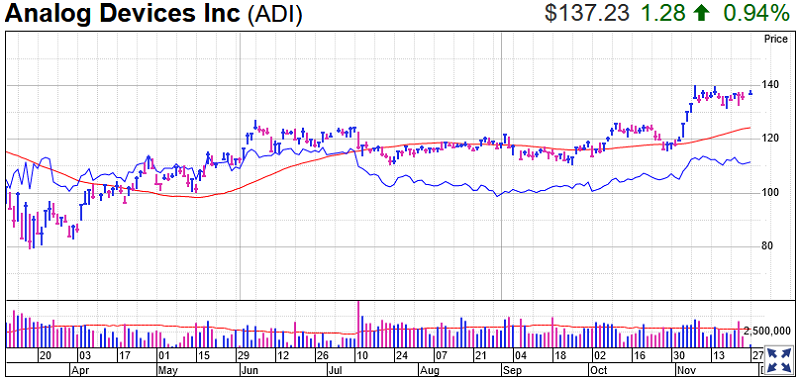

Analog Devices Stock

Analog Devices gained 1.3% to 137.75 on Friday, advancing 1.9% last week. ADI stock has formed a shelf above a prior base, with a new 140.48 buy point.

The RS line for ADI stock is still below its July 2019 high and has been treading water for more than a decade.

On Nov. 24, Analog Devices reported a beat-and-raise, with sales returning to growth after seven down quarters amid the chip industry downturn. Automotive chip sales drove results. Its boss expressed hope that “a broad-based recovery is underway.”

Analog Devices has an 87 EPS Rating and 68 RS Rating. Earnings per share growth averaged 2% over the past three quarters. Over the past three years, ADI grew earnings per share a negative 5% annually and sales a negative 1%.

Those fundamental and technical factors raise concerns. Investors should be cautious with ADI stock.

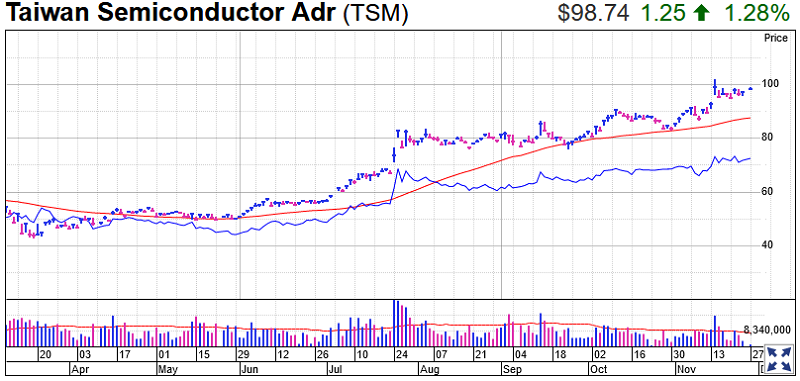

Taiwan Semiconductor Stock

Taiwan Semiconductor gained 1.3% to 98.74 on Friday, with TSM stock up 3.5% for the week. The chip stock continues to act well near highs. It has now a rare ascending base, according to MarketSmith analysis. The buy point is 102.54.

The world’s top chip foundry, Taiwan Semi, on Oct. 15 announced third quarter earnings that beat views. It cited strong demand for 5G smartphones as well as IoT devices. The latter includes smart speakers and smartwatches like Amazon Alexa, Google Home and Apple Watch.

Taiwan Semiconductor stock earns a 91 EPS Rating and 92 RS Rating. Earnings per share growth averaged 78% over the past three quarters. Over the past three years, Taiwan Semi grew earnings per share by 9% annually and sales 9% as well.

Trading Education Online Courses

TracknTrade Trading Software Free Trial