AMD Twilio Novocure Among 5 Stocks Flashing Multiple Buy Signals By Investors Business Daily

Chip leader AMD stock, software makers CrowdStrike (CRWD), Okta (OKTA), Twilio (TWLO) and medical products maker Novocure (NVCR) are flashing multiple buy points.

All five stocks are staging rebounds from their 50-day and 10-week lines as well as breaking above trend lines. All but Twilio stock are testing or crossing additional resistance. The software trio are working on new consolidations, while Novocure and AMD stock have official bases and buy points.

Stocks That Cross Trend Lines

One way to find early buy points is to use trend lines. Stocks breaking above trend lines are clearing technical resistance, and may move higher. Such moves are even more powerful when combined with a rebound from the 10-week line. That’s the case for Okta stock, CrowdStrike, Twilio, Novocure and Advanced Micro Devices (AMD).

Trend lines can be drawn on daily or weekly charts. The best trend lines on a daily chart are found when at least a few recent highs can be connected over at least several months. When a stock breaks out over a trend line, it’s often also breaking out of a downtrend. Downward-sloping trend lines, found by connecting a stock’s recent highs, can also yield actionable buy points. Stocks remain in buy range if they move within 10% of the 10-week line or 5% of the trend line.

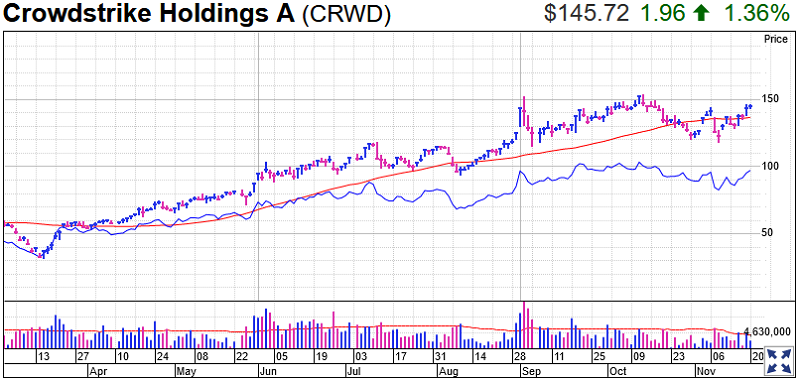

CrowdStrike Stock

CrowdStrike stock rose 10% in last week’s stock market trading to 145.72, finishing 5.9 above its 10-week line. On Thursday, CRWD stock rallied 4.4%, clearly breaking a downward-sloping trend line. On Friday, shares moved above another resistance point, above the Nov. 6 intraday high, offering a 144.29 entry.

The relative strength line for CrowdStrike stock is still off highs but is rebounding somewhat, topping where it was on Nov. 6. The RS line is the blue line in the charts provided.

CrowdStrike ranks No. 3 in IBD’s Computer-Software Security industry group and has an 89 Composite Rating. Sunnyvale, Calif.-based CrowdStrike is a leader in cybersecurity. The CrowdStrike Falcon platform stops breaches by preventing and responding to all types of attacks — both malware and malware-free.

Buoyed by the work-from-anywhere trend, CrowdStrike stock has nearly tripled since the beginning of the year. CrowdStrike posted two quarters in a row of profitability and revenue is up more than 80% for four straight quarters.

Shares jumped 4.7% on Tuesday, after TheFly.com reported that hedge fund Tiger Global Management has just increased the size of its stake in the company. The fund bumped up its ownership of CrowdStrike to 7.5 million shares from just above 5 million.

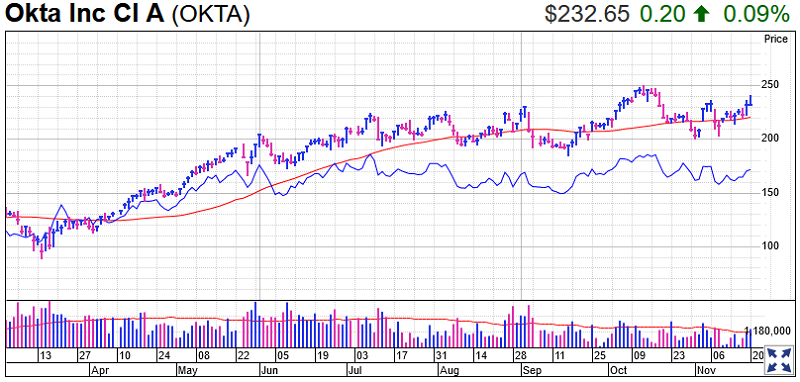

Okta Stock

Okta stock climbed 4.9% to 232.65 last week. That’s 4.3% above its 10-week line. On Thursday, the cybersecurity company broke a downtrend. On Friday, Okta stock topped an additional entry of 237.72 intraday, but gave up nearly all its gains by the close.

Okta is a platform in the Identity-as-a-Service (IDaaS) category. It gives you access to all the software you’re using across multiple devices with one login. The San Francisco-based company is another tech security stock benefitting from the work-from-home trend accelerated by the pandemic.

The consumer identity and access management market is projected to grow from $7.6 billion in 2020 to $15.3 billion by 2025, according to ResearchAndMarkets.com. Okta is among the major vendors in this market.

Okta stock’s RS line has moved sideways since July, with a drop in late October. It ranks right behind CrowdStrike at No. 5 in IBD’s Computer-Software Security industry group. Okta’s Composite Rating is 81.

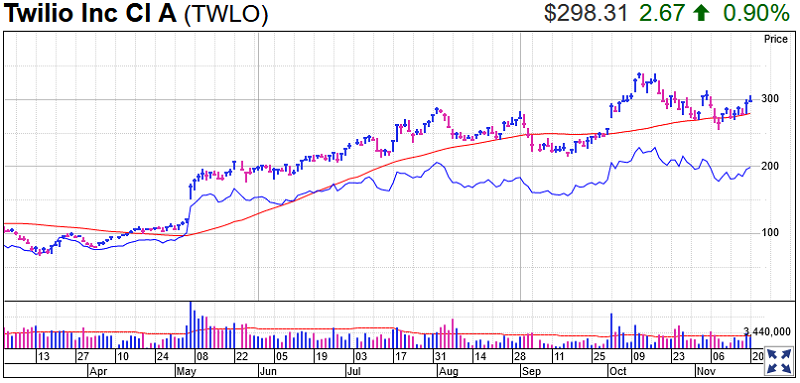

Twilio Stock

Twilio stock rebounded from its 10-week line and around a prior buy point last week, jumping 8.9% to 298.31. It’s now 4.9% above its 10-week. On Thursday, shares leapt 6%, closing right around the trend line. On Friday, TWLO stock topped the trend line but backing well off intraday highs.

Investors might view 314.83, above the Nov. 5 high, as another entry for Twilio stock.

San Francisco-based Twilio is a cloud-based platform that lets businesses and their customers communicate in real time. Its platform helps power DTC initiatives for top global brands like Nike, Lululemon, Walmart and Netflix.

The RS line for Twilio stock is bouncing back after falling from a record high on Oct. 13.

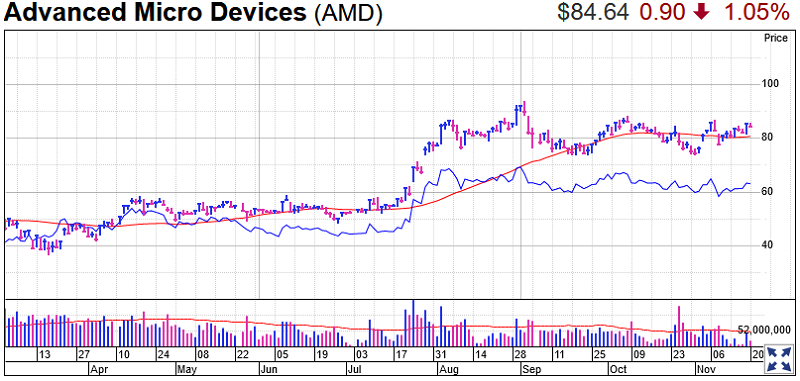

AMD Stock

AMD stock rallied 3.9% to 84.65 last week, clearing an aggressive trend line on Thursday. Shares fell just over 1% on Friday. AMD stock is 4.5% above its 10-week line. Another early entry would be 87.15. AMD has an official double-bottom buy point of 88.82, according to MarketSmith chart analysis.

The RS line has drifted lower since Sept. 1. AMD ranks No. 1 in IBD’s Electric-Semiconductor Fabless industry group with a top-notch 99 Composite Rating.

AMD makes PC microprocessors and graphics chips for PC gaming. A big growth area has been chips in for data centers.

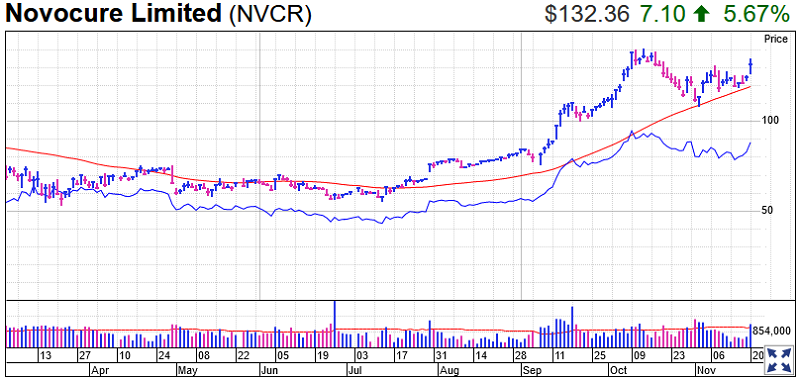

Novocure Stock

Novocure stock leapt 6.3% to 132.36, nearly all on Friday. That’s 7.1% above its 10-week line. On Thursday, NVCR stock rallied past a trend line. On Friday, shares cleared another early entry at 132.08, just above the Nov. 9 intraday peak.

Novocure stock has a newly formed base with an official 140.99 buy point.

U.K.-based Novocure develops cancer treatments, including glioblastoma brain cancer. Its Optune device is a wearable, portable, FDA-approved treatment for glioblastoma that creates low-intensity, wave-like electric fields called tumor treating fields, which disrupt glioblastoma cell division. The same technology is now used in its treatment for mesothelioma, a cancer related to exposure to asbestos. More recently, Novocure has been testing the use of its technology to treat advanced liver cancer.

Several clinical trials could significantly expand Novocure’s potential market in 2021 and beyond.

The RS line for Novocure stock is clearing short-term levels, but off its early October high. Its Composite Rating is 93.

NVCR stock was Thursday’s IBD Stock Of The Day and is the latest New America feature.

Trading Education Online Courses

TracknTrade Trading Software Free Trial