These Are The 5 Best Stocks To Buy And Watch Now By Investors Business Daily

Buying a stock is easy, but buying the right stock without a time-tested strategy is incredibly hard. So what are the best stocks to buy now or put on a watchlist? Dexcom (DXCM), Five9 (FIVN), West Pharmaceutical Services (WST), Teladoc Health (TDOC) and Wingstop (WING) are making moves as the stock market continues to bounce back from the severe coronavirus correction.

Since the coronavirus crash, the stock market has rebounded powerfully, with the Nasdaq recently hitting all-time highs. The rally has been trying to fight off turbulence as fears grow over a spike in coronavirus cases.

Nevertheless, many states are now preparing to come out of lockdown and get their economies firing again. And positive catalysts — such as progress toward a medical breakthrough and a fiscal package, as well as a better understanding of the coronavirus threat — give bulls reason for optimism.

So why are these five names above the rest to buy or watch? Before turning to that question, it is important to consider how one goes about choosing a stock in the first place. Superior fundamentals and technical action, and buying at the right time, are all part of a shrewd investing formula.

Best Stocks To Buy: The Crucial Ingredients

Remember, there are thousands of stocks trading on the NYSE and Nasdaq. But you want to find the very best stocks right now to generate massive gains.

The CAN SLIM system offers clear guidelines on what you should be looking for. Invest in stocks with recent quarterly and annual earnings growth of at least 25%. Look for companies that have new, game-changing products and services. Also consider not-yet-profitable companies, often recent IPOs, that are generating tremendous revenue growth.

IBD’s CAN SLIM Investing System has a proven track record of significantly outperforming the S&P 500. Outdoing this industry benchmark is key to generating exceptional returns over the long term.

In addition, keep an eye on supply and demand for the stock itself, focus on leading stocks in top industry groups, and aim for stocks with strong institutional support.

Once you have found a stock that fits the criteria, it is then time to turn to stock charts to plot a good entry point. You should wait for a stock to form a base, and then buy once it reaches a buy point, ideally in heavy volume. In many cases, a stock reaches a proper buy point when it breaks above the original high on the left side of the base.

Don’t Forget The M When Buying Stocks

Never forget that the M in CAN SLIM stands for market. Most stocks, even the very best, will tend to follow the market direction. Invest when the stock market is in a confirmed uptrend and move to cash when the stock market goes into a correction.

The current stock market rally became a confirmed uptrend after the S&P 500 staged a somewhat lackluster follow-through day on April 2. The Nasdaq’s April 6 follow-through day was more convincing, and breakouts have been flourishing. A successful rebound from a sharp sell-off on May 14 further bolstered its case. It is has been battling to overcome another sharp sell-off on June 11.

The best market gains often come in the first several weeks after a correction or bear market ends, so investors should be looking for stocks with good fundamental and technical performance, ones capable of staging successful breakouts. More quality stocks are also breaking out now. On a technical basis, look for stocks with rising relative strength lines.

Nevertheless, things can quickly change, so investors should keep a close eye on the market trend page here.

Best Stocks To Buy Or Watch

Now let’s look at Dexcom stock, Five9 stock, West Pharmaceutical Services stock, Teladoc Health stock and Wingstop stock in more detail. An important consideration is that these stocks all boast impressive relative strength. Several of these stocks feature on the IBD Leaderboard.

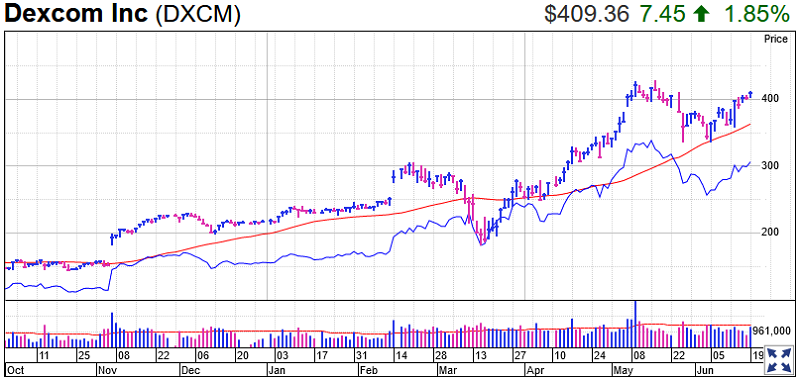

Dexcom Stock

The diabetes treatment company’s shares are looking to hit a potential buy point of 428.69, following a bullish rebound from 50-day and 10-week lines. That rebound offered a buying opportunity, but is now extended from that entry. The consolidation needs another week to be a proper base, but DXCM stock is racing up toward highs. Shares leapt nearly 11% to 409.36 last week.

The relative strength line has turned positive once more over the past couple of weeks after a recent decline. Overall, the RS line for DXCM stock has very strong since late October.

Dexcom stock has a IBD Composite Rating of 99. The IBD Stock Checkup tool shows earnings growth is not as strong as the firm’s technical performance. Nevertheless, average earnings growth of 448% over the past three quarters is mighty impressive. It also accelerated to 980% growth in the most recent quarter.

Dexcom stock previously shot to a record high following the medical product firm’s big earnings beat in early November. Dexcom earnings exploded 261% to 65 cents a share, more than triple analyst estimates for 20 cents. Revenue of $396.3 million also crushed views for $347.9 million.

Dexcom sells continuous glucose monitors, or CGMs, for patients with diabetes. Its newest CGM is called G6. These devices are bringing rapid changes to the way doctors treat diabetes Many patients are now receiving the medical devices through pharmacies. This has lowered the barriers to adoption and led to a spike in demand.

For patients with Type 1 diabetes and insulin-intensive Type 2 diabetes, glucose monitors and insulin pumps can offer a technological replacement for finger sticks and multiple daily injections. Dexcom, Abbott (ABT) and Medtronic (MDT) sell glucose monitors. Tandem Diabetes (TNDM), Insulet (PODD) and Medtronic make insulin pumps.

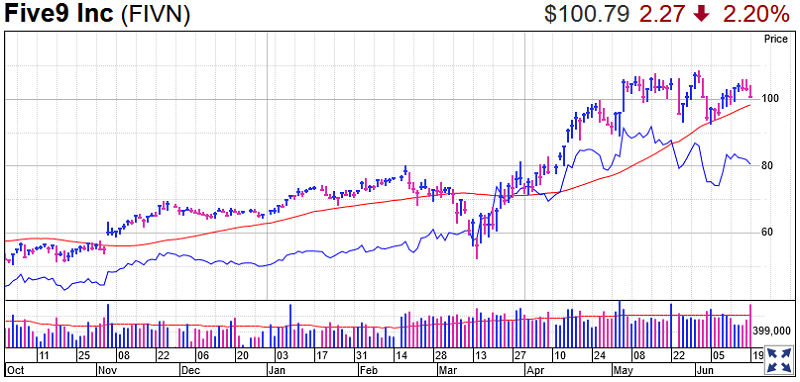

Five9 Stock

MarketSmith analysis shows Five9 stock has been finding support at its 10-week line It was even able to rise modestly as the overall market suffered significant losses earlier this month. The first or second successful test of the 50-day or 10-week line after a breakout provides an opportunity to add shares or even start a position. Investors may want to wait for FIVN stock to clear its June 11 intraday high of 103.12.

Five9 stock has been consolidating for a few weeks after its April breakout from a cup base.

It has a near-perfect Composite Rating of 97. But the Stock Checkup tool shows that earnings are lagging its stock market performance. Over the past three quarters, EPS has grown by an average of 11%, which is shy of CAN SLIM requirements. Yearly earnings are seen contracting 48% in 2020 before rebounding with a 134% gain in 2021.

The recent IBD Stock Of The Day competes with RingCentral (RNG), Twilio (TWLO), startup Talkdesk and others. The corporate shift to work-from-home arrangements has impacted customer support, giving a boost to RingCentral stock as well as Five9.

The firm is benefiting from the fact that the coronavirus crisis has prompted more companies to explore a shift to cloud-based software. But even before the outbreak, many companies were shifting to cloud-based contact-center software.

Five9 rents space in internet data centers to host its business communications software. According to Five9, its clients can deploy new customer services agents in any geographic location. All the human agents need is a computer, headset and broadband connection.

In May, Five9 announced a deal to partner with Zoom Video Communications (ZM) in providing live agent support. It also announced a marketing deal with AT&T (T), which has been a partner of RingCentral.

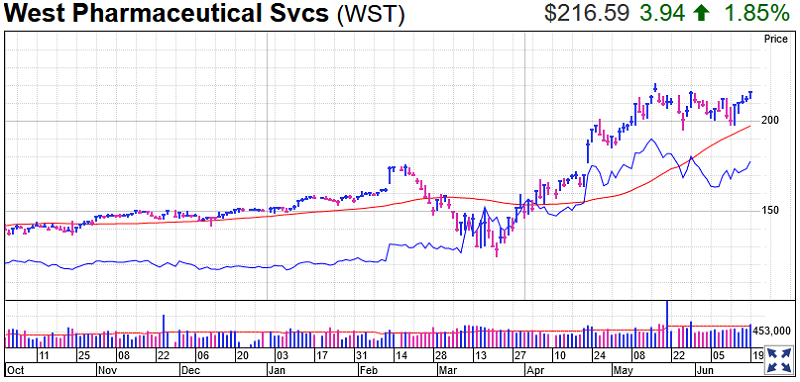

West Pharmaceutical Services Stock

The former IBD 50 stock has formed a flat base. It is shooting for a buy point of 222.06. West Pharmaceutical stock leapt 7.9% last week to 216.59. It rebounded from its 10-week line, but now is a little extended from that level.

Another encouraging sign is the relative strength line. While it is mildly off highs, it has been moving powerfully upward since late January. Given the Covid-19 crisis, it makes sense a medical supply stock would be faring well.

It has a near perfect Composite Rating of 98. The Stock Checkup Tool shows this is due to an attractive mix of earnings and price performance.

The company’s earnings have grown from $1.17 a share in 2011 to $3.24 in 2019. That marks a compound annual growth rate of 13.6%. Sales have climbed every year except one over the past nine years. In 2015, the top line slipped 2%. In all the other years since 2011, growth held steady between 4% and 8%.

West is currently the top ranked stock in the competitive Medical-Supplies industry group. Due to its strong performance, the stock was recently added to IBD’s Long-Term Leaders Watchlist.

IBD Long-Term Leaders stabilize your portfolio but quietly deliver stellar long-term gains. To qualify as a Long-Term Leader, a stock has to have stable earnings, stable price outperformance and high-quality institutional sponsorship. These stocks can be bought on pullbacks or on breakouts.

West is a manufacturer of packaging components and delivery systems for injectable drugs and health care products. Among its products are vial containment solutions, self-injection platforms and cartridge systems and components. It also manufactures specialty components.

Its main segments include Proprietary Products and Contract-Manufactured Products. Proprietary Products emphasizes on product offerings to biologic, generic and pharmaceutical drug customers.

Its Contract-Manufactured Products segment is an integrated business that focuses on the design, manufacture and automated assembly of various devices. These are aimed primarily at pharmaceutical, diagnostic and medical device customers.

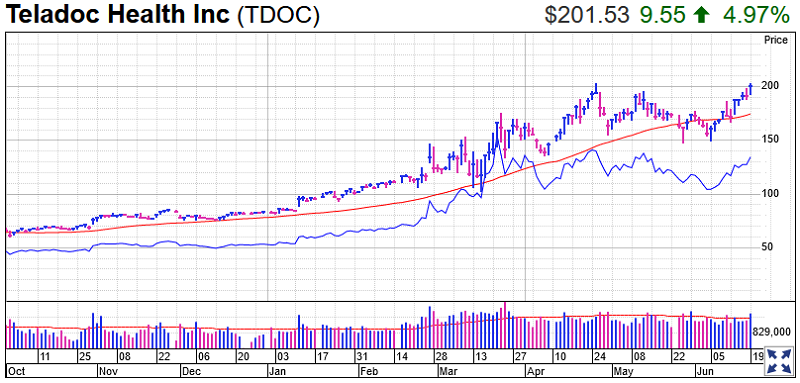

Teladoc Health Stock

Teledoc stock has been consolidating for the past eight weeks. It is sitting just below a 203.95 entry. TDOC stock vaulted 17% last week to 201.53, rebounding from its 50-day and 10-week lines. Ideally, Teladoc stock would pause, perhaps form a handle, before breaking out.

In addition, the relative strength line has been staging an advance for the past few weeks.

Teladoc stock has a strong Composite Rating of 88. But the Stock Checkup Tool shows earnings have yet to come up to scratch, with the firm yet to turn a profit. Sales are growing at a rapid clip, rising by an average of 64% over the past three years.

But the market seems to believe in the stock, with its price performance is far outpacing earnings.

Interest in telemedicine companies has skyrocketed amid the coronavirus pandemic. According to Atlas VPN, online searches for the keyword “telemedicine” hit a record in April. Its popularity soared 525% from January.

That interest has given a big boost Teladoc stock, helping it more than double so far in 2020. Teladoc is the only publicly traded telemedicine company, and began trading in 2015.

“If your grandparents or parents hadn’t been on Skype or a FaceTime call, they’ve been on one now,” Teladoc CEO David Sides told Investor’s Business Daily. “I think, with so many people quarantined, it’s made virtual care a necessity.”

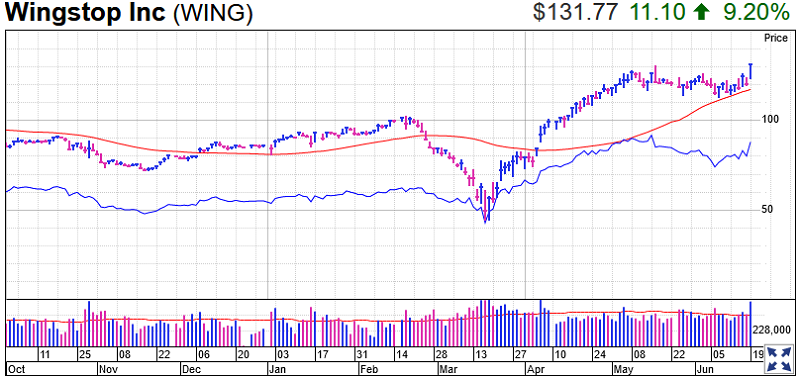

Wingstop Stock

Wingstop stock is in buy zone after breaking out of a short consolidation with a 126.74 entry. Adding to the upbeat picture is the fact it managed to bullishly bounce off its 50-day line.

The relative strength line for WING stock has spiked after sagging since mid-May.

Wingstop has a strong Composite Rating of 89, and has been improving in this metric. Solid earnings have also won it a solid EPS Rating of 87. One caveat is the Stock Checkup Tool shows Wingstop EPS has only grown by an average of 3% over the past three quarters, though it jumped by 23% in the most recent quarter.

The recent IBD Stock Of The Day has benefited from the shift to delivery due to the coronavirus crisis. Analysts say digital ordering and delivery are two businesses that analysts say Wingstop is built for.

Wingstop’s fiscal first-quarter domestic same-store sales rose 9.9%. The company’s fiscal first quarter, also reported in May, ended on March 28.

CEO Charlie Morrison said the second quarter was off to a “very strong start” in the company’s first-quarter earnings release. April domestic same-store sales growth surpassed 30%, he added. Since the chain closed its dining rooms in mid-March, digital orders had made up nearly 65% of sales.

Recently Removed Stocks

Microsoft (MSFT), Epam Systems (EPAM) and Cloudflare (NET) were trimmed after becoming extended above their buy zones.

Trading Education Online Courses

TracknTrade Trading Software Free Trial