AMD, Qualcomm Lead Five Chip Stocks Are At Or Near Buy Zones By Investors Business Daily

AMD (AMD), Teradyne (TER), KLA Corp. (KLAC), Qorvo (QRVO) and Qualcomm stock are top chip-sector companies to watch. Some topped buy points recently but undercut those entries amid Thursday’s sell-off and Friday’s volatility.

AMD stock, Teradyne stock and KLA stock are all leaders, with relative strength lines rising to or near record highs. That means these stocks are outperforming the S&P 500 index. The RS lines for Qorvo stock and Qualcomm (QCOM) are less impressive.

Stock Market Rally: Watch The Rising RS Line

The relative strength line is a quick way to spot winners in any market — up or down.

The Relative Strength At New High stocks list is a great place to look for quality names with strong RS lines. IBD’s stock research platform MarketSmith has a screening tool that identifies stocks with RS lines making new highs.

In addition, the best growth stocks have a Composite Rating of 90 or better, as all five chip stocks on this list do. The Composite Rating combines five separate proprietary IBD ratings, based on key fundamental and technical criteria, into one easy-to-use score.

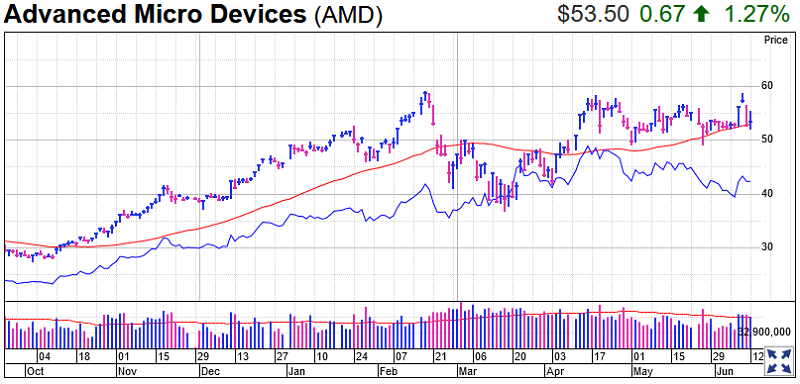

AMD Stock

Shares of the chip giant are 9.2% below a cup-with-handle buy point of 58.73 briefly cleared on June 10, according to IBD MarketSmith chart analysis. They are also below an early entry of 57.08.

AMD stock is testing the 50-day moving average but remains well above the 200-day line. The RS line has pulled back from highs since May but not by much. It’s in a multiyear uptrend and is the blue line in the chart shown.

AMD ranks No. 1 among 30 stocks in the fabless semiconductor group, the IBD Stock Checkup tool reveals. IBD’s Electronics-Semiconductor Fabless group ranks a solid No. 10 out of 197 industry groups.

AMD stock has an IBD Relative Strength Rating of 93. That means it has outperformed 93% of stocks on the market over the past 12 months.

Data center stocks are hot right now. But while AMD stock has done OK relative to the market, it’s lagged relative to peers such as Nvidia (NVDA).

AMD was IBD Stock of the Day Wednesday as it topped two buy points, but it closed the week only slightly higher.

AMD has both a Composite Rating and EPS Rating of 99, the highest possible score. AMD earnings per share growth averaged 179% over the past three quarters, above the three-year average of 173%.

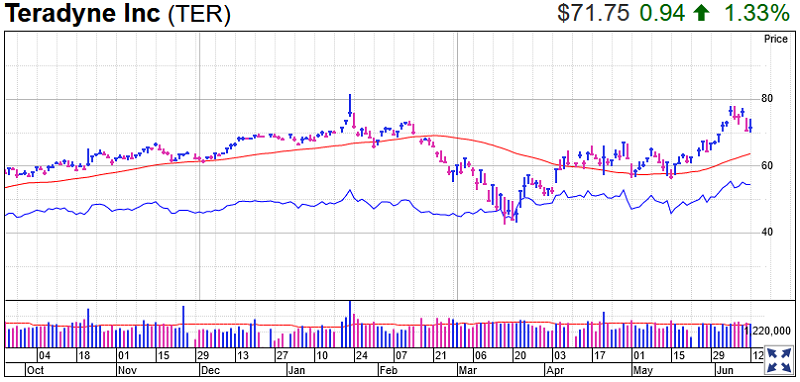

Teradyne Stock

The semiconductor test equipment maker just formed a handle on its cup base, giving it a lower 78.29 entry. Teradyne stock is 8.4% below that new buy point.

Shares flashed an aggressive buy area at 67.64.

Teradyne stock, rising as chip spending rebounds, is above the 50-day line, and its RS line looks healthy.

Teradyne, which sells advanced testing equipment for semiconductors and wireless devices, ranks No. 48 on the IBD 50 list of top-performing growth stocks. It also has an unbeatable Composite Rating of 99, near-perfect EPS Rating of 98, and a solid RS Rating of 90.

Earnings growth averaged 44% over the past three quarters, well above the three-year average of 17%. Sales growth sped up too in the latest two quarters.

Chip-equipment makers typically have big up and down cycles for earnings and sales, but Teradyne earnings and sales growth is relatively consistent.

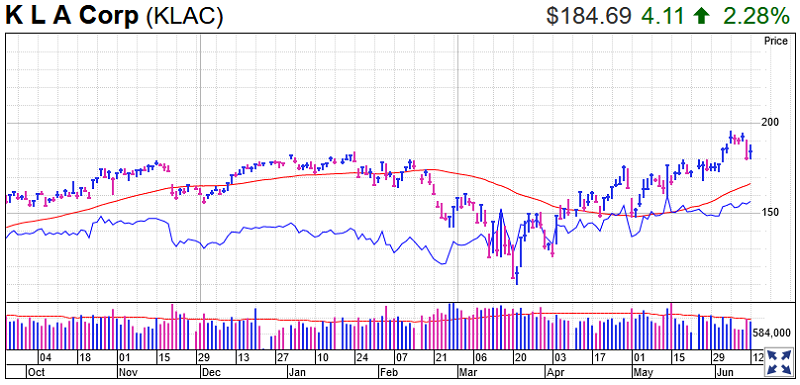

KLA Stock

The semiconductor equipment maker found support near its 180.43 buy point as well as its 21-day line and remains in buy range. KLA stock closed the week at 184.69, above the left-hand side of its base. The RS line has been hitting record highs.

KLA makes technology that monitors production and increases yield for chipmakers. KLA stock has a CR of 99 and EPS Rating of 96. EPS growth accelerated nicely in the latest quarter, but averaged just 15% over the past three quarters and 16% over the past three years. Sales growth picked up briskly in the latest two quarters too.

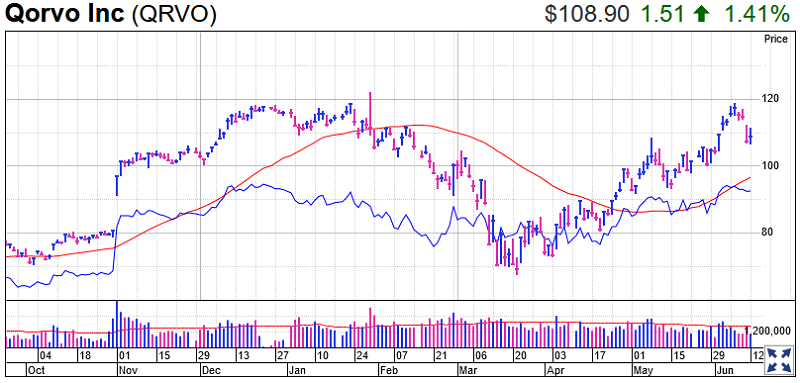

Qorvo Stock

The wireless chipmaker is just above a 108.88 cup-with-handle buy point, rebounding from its 21-day line on Friday. Qorvo stock broke out on June 2, but tumbled 6.5% on Thursday to dip below its entry

A 5G stock, Qorvo is above a rising 50-day line with an RS line back near a multiyear high.

Qorvo stock, gaining from the 5G wireless transition, has a CR of 96, EPS Rating of 79 and RS Rating of 91. Both earnings and sales growth surged in the latest quarter. But EPS growth averaged 15% in the latest three quarters, roughly in with the three-year average of 16%. The three-year sales growth rate is also 16%.

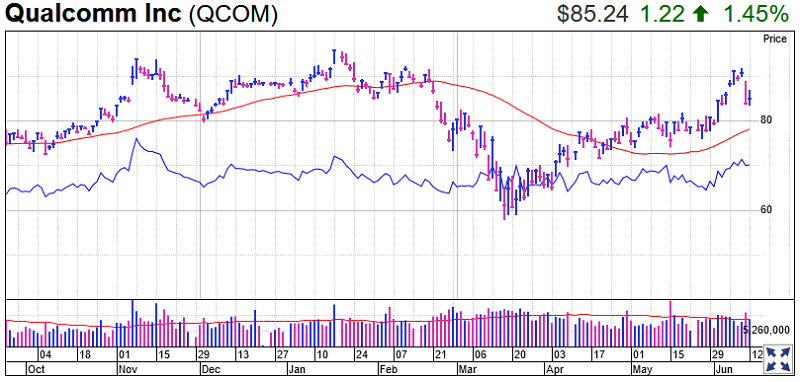

Qualcomm Stock

Another wireless chipmaker and 5G stock, Qualcomm has formed a handle on a weekly chart with a 92.24 buy point. It’s 7.6% below that entry for now. On a daily chart, which does not yet show a handle, the QCOM stock buy point is 96.27.

Qualcomm stock is above a rising 50-day line but the RS line has moved sideways for months, an uninspiring sign.

The San Diego-based chip giant, a key Apple (AAPL) iPhone supplier, has a CR of 91, EPS Rating of 80 and decent RS Rating of 79.

Qualcomm returned to earnings and sales growth in the latest two quarters after five quarters of declines. EPS growth averaged 20% over the past three quarters, above the three-year rate of 12%. The top line bears watching.

Trading Education Online Courses

TracknTrade Trading Software Free Trial