These Are The 5 Best Stocks To Buy And Watch Now By Investors Business Daily

The best market gains often come in the first several weeks after a correction or bear market ends, so investors should be looking for stocks with good fundamental and technical performance, ones capable of staging successful breakouts. More quality stocks are also breaking out now. On a technical basis, look for stocks with rising relative strength lines.

Nevertheless, things can quickly change, so investors should keep a close eye on the market trend.

Best Stocks To Buy Or Watch

Now let’s look at Lululemon Athletica stock, Datadog stock, Entegris stock, Monolithic Power Systems stock and Ollie’s Bargain Outlet stock in more detail. An important consideration is that these stocks all boast impressive relative strength. Several of these stocks feature on the IBD Leaderboard.

Lululemon Stock

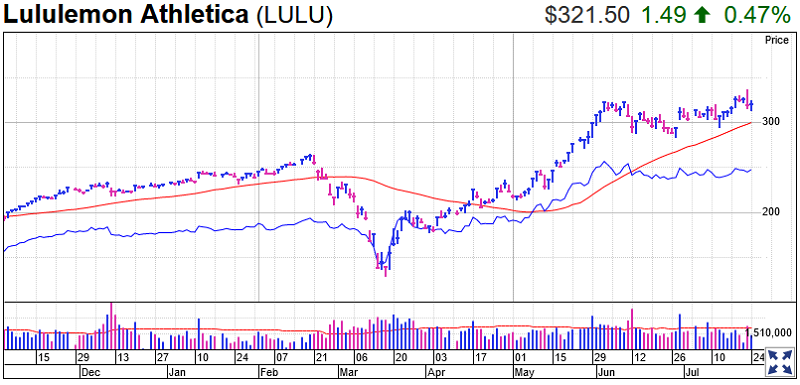

Lululemon stock has built a flat base with a buy point of 324.80, MarketSmith analysis shows. There was an early entry around 319. LULU stock cleared entry points on July 20, but reversed from a record high on Thursday to below those buy points. On Friday, Lululemon stock rebounded from its 21-day line to 321.50.

The relative strength line for Lululemon stock is also modestly encouraging. While it is moving upwards as decisively as it had during an aggressive post-coronavirus crash rally that started in mid-March before taking flight at the end of April, it looks to be on the march once again.

Lululemon stock has a strong IBD Composite Rating of 90. This puts it in the top 10% of stocks tracked. The Stock Checkup Tool shows earnings growth is very strong, if not quite as impressive as its stock market performance. While EPS was battered recently to the coronavirus crisis, over the longer term it very impressive. Earnings have grown by an average of 35% over the past three years.

Lululemon has also been working to make sure it keeps connecting with consumers. It has focused on hosting live workouts on social media platforms such as Facebook (FB) Live and Instagram. In China, Lululemon’s coronavirus lockdown strategy used WeChat, which is owned by Chinese internet behemoth Tencent (TCEHY).

Classes include free online “sweat sessions,” and CEO Calvin McDonald has said the first week of store closures saw nearly 170,000 users log on for live classes. Meanwhile, digital sales surged more than 40% in the latest quarter as yoga mats and blocks sold strongly.

Last month McDonald said he believes at-home fitness will be important in the future, adding that Lululemon recently launched a digital education service where customers can chat via video with educators about products and home workouts.

Lululemon stock popped on June 30 after the firm doubled down on its commitment to at home fitness. The yogawear maker has agreed to acquire Mirror for $500 million. Mirror offers thousands of on-demand workouts, weekly live classes and one-on-one personal training sessions. LULU initially invested in Mirror last year.

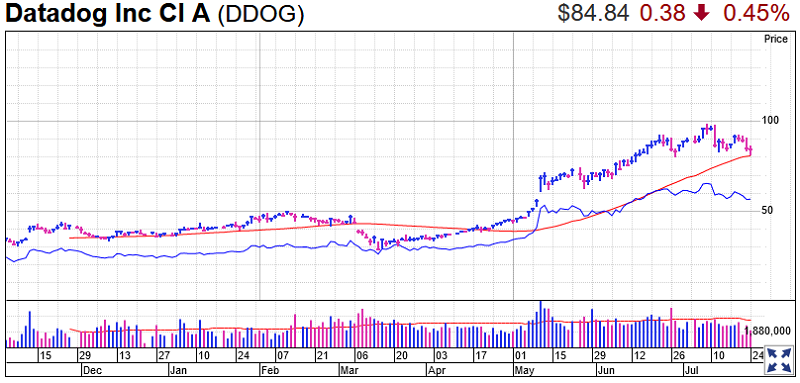

Datadog Stock

Datadog stock is buyable after it rebounded off its 50-day and 10-week moving averages on Friday. The fact the IPO stock found support at these key benchmarks is a good sign.

One reason for caution is the stock’s relative strength line, which has been slipping of late. However it could also be taking a breather after a recent spike that ran from early June until July 10.

Datadog stock has a near-perfect Composite Rating of 97. And while the Stock Checkup Tool shows the stock’s price performance is the big standout, with its RS Rating sitting at 97, it also turned a profit for the past two quarters. This is good for a new issue.

Developers and IT operations teams use Datadog’s cloud-based tools to monitor software applications and computer infrastructure. Customers access its cloud platform via the internet.

Datadog earnings and revenue handily beat first-quarter analyst estimates when it reported back in May. It was boosted by businesses shifting to cloud software among the Covid-19 crisis.

“This crisis has demonstrated the need to be digital-first and agile, has underscored the importance of observability into cloud environments, and reaffirmed the long-term opportunity for Datadog,” Datadog CEO Olivier Pomel said in a news release.

The software maker said it had 960 customers with annual recurring revenue of $100,000 or more as of March 31, an increase of 89% from a year earlier.

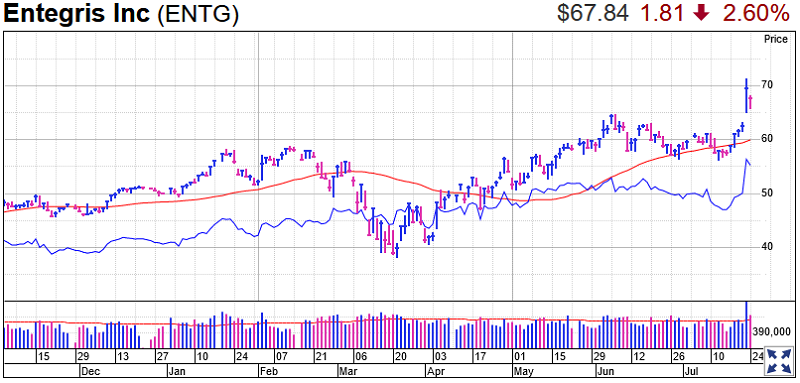

Entegris Stock

After gapping up on on strong earnings Thursday, Entegris stock pulled back in to the 5% chase zone. ENTG stock broke out of a flat base with an ideal entry point of 65. It is now well clear of its 50-day line following its strong report.

The relative strength line for the semiconductor equipment maker is also showing great promise. It is now around all-time high levels. The stock price is up 36% since the start of the year.

Entegris stock has a near-perfect Composite Rating of 98. In this case earnings are actually superior to its stock market performance. The Stock Checkup Tool shows EPS has grown by an average of 27% over the past three quarters. This exceeds CAN SLIM requirements. It also jumped to 54% growth in the most recent quarter.

The firm previously said it is seeing “great momentum” for its advanced solutions for making chips at smaller node sizes, particularly with logic and foundry customers.

More chipmakers are shifting to node sizes of 10 nanometers, 7 nanometers and even 5 nanometers. Circuit widths on chips are measured in nanometers, which are one-billionth of a meter.

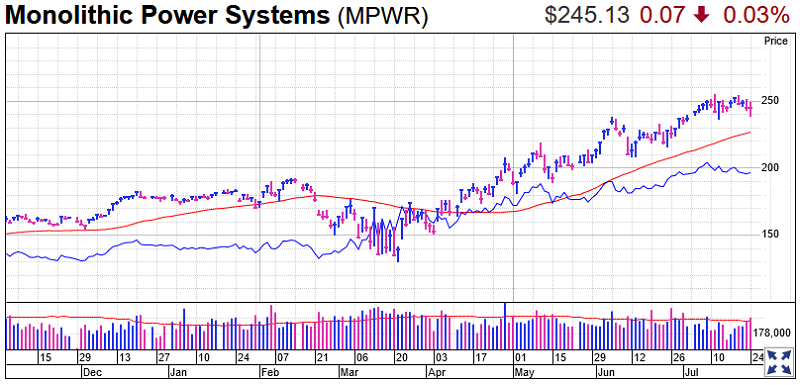

Monolithic Power Systems Stock

Monolithic Power Systems stock has formed an ascending base. This is a rare pattern which often leads to powerful gains. It is looking to hit a buy point of 255.79.

MPWR stock’s RS line has been moving powerfully higher since late February. It has leveled off somewhat of late however.

It has a best possible Composite Rating of 99, with the Stock Checkup Tool showing both earnings and technical performance as excellent.

Monolothic Power Systems is one of the top data-center chip stocks. It provides small, energy efficient, power circuits for systems found in industrial applications, telecom infrastructures, cloud computing, automotive, and consumer applications.

Investment bank Goldman Sachs recently said recent semiconductor data points to an improving market.

“We continue to see choppiness, but an overall trend of recovery,” Goldman Sachs analysts Joseph Moore and Craig Hettenbach said in a July 6 report.

Some chip segments are doing better than others, Moore and Hettenbach said. The first half of 2020 saw strength in semiconductors for personal computers and cloud computing data centers, fueled by work-from-home and learn-at-home trends stemming from the coronavirus pandemic.

A possible catalyst for the stock is fast approaching, with MPWR set to report its Q2 results after the market closes on July 28. If Monolithic Power stock breaks out before earnings, it would be risky to buy.

An approach highlighted by Investor’s Business Daily is to use options as a strategy to reduce risk around earnings. It’s a way to capitalize on the upside potential of a stock’s move around earnings, while reducing the downside risk.

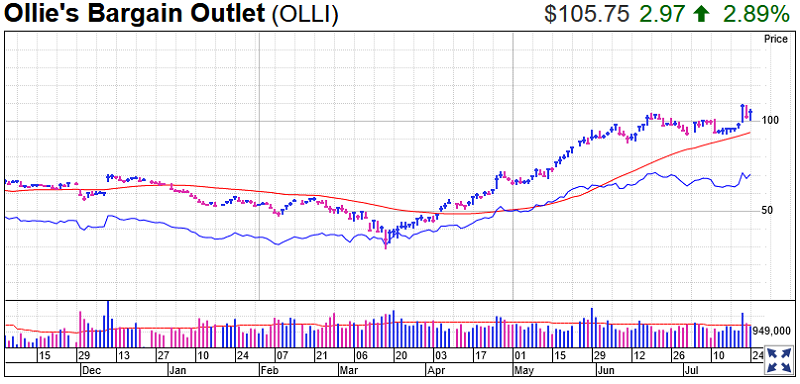

Ollie’s Bargain Outlet Stock

Ollie’s stock jumped 10% to close at a record-high 108.81 on the stock market Wednesday, after the close-out retailer announced huge preliminary same-store sales growth for the second quarter. While the Leaderboard stock slipped back it managed to close above its buy point of 105.30 from a short consolidation pattern Friday. Ollie’s stock also had a 101.91 early entry.

Ollie’s stock was already buyable after staging a bullish rebound from the 10-week line on Tuesday, MarketSmith analysis shows.

Shares also trade well above the 50-day moving average, and the relative strength line has spiked, nearing recent highs, after taking a breather following a very powerful move that kicked off in early March.

Ollie’s stock has a near-perfect IBD Composite Rating of 98. It boasts an attractive mix of stock market and earnings performance. It boasts an EPS Rating of 92 and an RS Rating of 94.

The IBD Stock Checkup tool underlines its strong earnings track record. Over the past three years, earnings per share have swelled by an average of 28%

Piper Sandler senior analyst Peter Keith, who rates Ollie’s stock as overweight with a price target of 123 a share, told Investor’s Business Daily he believes things are lining up for the IBD Leaderboard player.

“The prospects look very good for Ollie’s. We think we’re probably entering one of the greatest closeout retail environments that the U.S. will have ever seen,” he said.