Lululemon, Fortinet Lead 5 Top Stocks In Or Near Buy Zones By Investors Business Daily

Lululemon stock, Inphi (IPHI), Costco Wholesale (COST), Fortinet (FTNT) and Amedisys (AMED) are top stocks to watch near buy points in the coronavirus market rally.

Lululemon Athletica (LULU), Inphi stock, Fortinet stock, Costco stock and Amedisys stock are all leaders, with relative strength lines rising to or just below recent highs. An uptrending RS line means these stocks are outperforming the S&P 500 index. The RS line for Lululemon stock looks especially bullish, well off coronavirus market lows.

Stock Market Rally: Watch The RS Line

The relative strength line is a quick way to spot winners in any market — up or down.

The Relative Strength At New High stocks list at investors.com is a great place to look for quality names with strong RS lines. IBD’s stock research platform MarketSmith has a screening tool that identifies stocks with RS lines making new highs.

In addition, the best growth stocks have an IBD Composite Rating of 90 or better. Fortinet stock leads this group with a perfect Composite Rating of 99, followed by Inphi stock with a 98, AMED stock at 93, Lululemon stock at 90 and Costco stock with 86. The Composite Rating combines five separate proprietary IBD ratings, based on key fundamental and technical criteria, into one easy-to-use score.

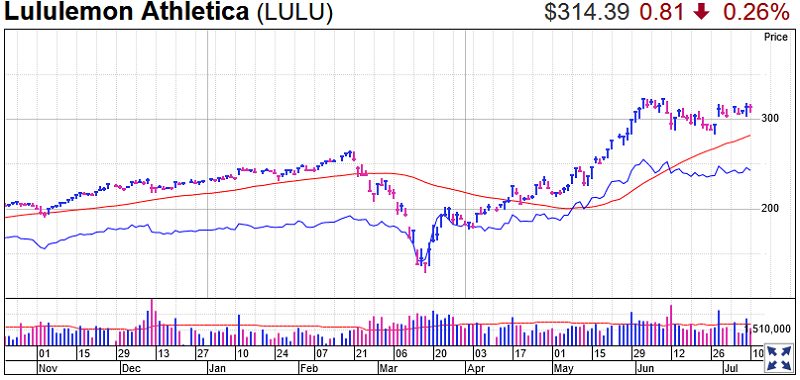

Lululemon Stock

Shares of the yoga and athletic casual wear maker and retailer have a new flat base, according to MarketSmith chart analysis. LULU stock rose 3.2% to 314.39 last week — 3.2% below the 324.86 buy point. Investors could get an early entry just above 319.

The relative strength line for Lululemon stock, in a multiyear uptrend, is the blue line in the chart shown.

Lululemon ranks No. 1 among stocks in the shoe and apparel retail group, the IBD Stock Checkup tool reveals. But the Retail-Apparel/shoes/accessories group ranks a dull No. 104 out of 197 industry groups tracked by IBD.

Lululemon stock has an IBD Relative Strength Rating of 92. That means it has outperformed 92% of all stocks over the past 12 months.

On June 30, Lululemon shares popped after the company agreed to acquire Mirror, an at-home fitness company, for $500 million. Amid the coronavirus pandemic, the firm expects store closures in the U.S. and Europe to last longer than in China.

Digital sales boomed during coronavirus shutdowns, with physical locations closed. Most Lululemon stores are now open, though that could change with the recent spike in new cases and deaths.

Lululemon has an EPS Rating of 81 out of a best-possible 99. Earnings per share growth averaged 35% over the past three years, above the 25% or higher you would want to see. Analysts expect Lululemon earnings to fall 14% in the current fiscal year, with a return to growth in 2022. But Wall Street’s estimates should be taken with a pinch of salt given the coronavirus market uncertainty.

The retailer grew sales 20% annually over the past three years.

Lululemon stock is on SwingTrader.

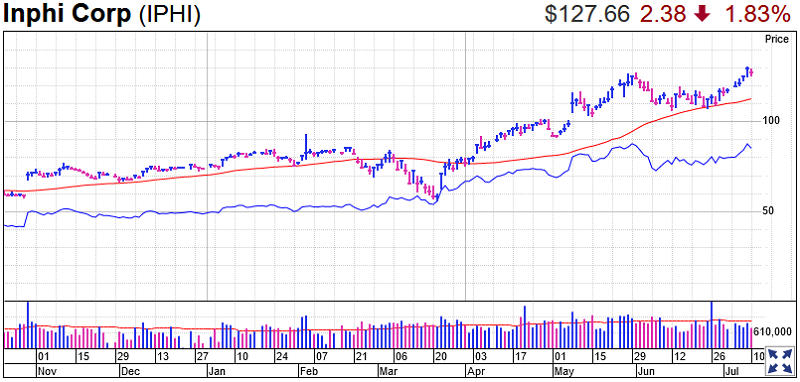

Inphi Stock

The data-center-chip maker broke out of a short consolidation on Thursday that was not quite long enough to be a proper base. But the 127.88 buy point was still actionable. On Friday, IPHI stock dipped back to 127.66, but the entry is still valid. The RS line is right at record highs.

Prior to its breakout, Inphi stock rebounded bullishly from its 10-week moving average.

IPHI stock was one of the first breakouts of the coronavirus market rally, hitting a buy zone in early April and running to the end of May.

The chipmaker is getting a boost from strong cloud computing demand for its products that move data at high speeds. Inphi was featured in a recent IBD Stock of the Day column.

Inphi owns an EPS Rating of 82. Annual EPS almost halved in 2018 but has since rebounded. Analysts say that Inphi earnings per share should swell 66% in the current fiscal year.

Sales growth averaged 5% the past five years, which isn’t great. But Inphi revenue soared 70% in the latest quarter.

Inphi stock is on SwingTrader.

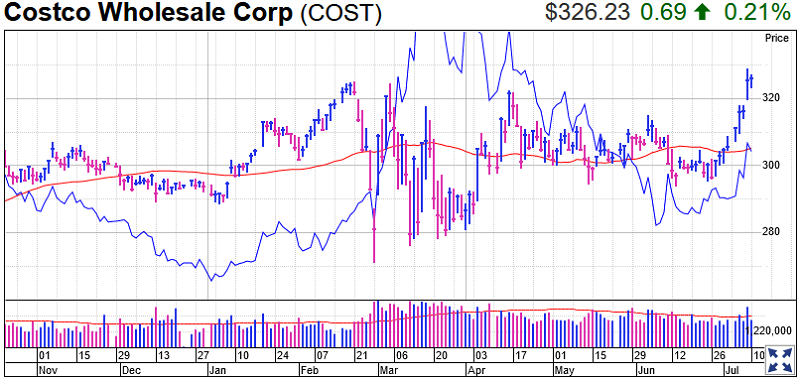

Costco Stock

The retail warehouse giant rose 6.7% to 326.23 last week, just above a 325.36 buy point on Friday from a consolidation going back to late February. Costco stock jumped Thursday on strong June sales, making it that session’s IBD Stock of the Day.

Investors also could have used 314.45 as a Costco stock entry.

Because Costco stock consolidated for several months as the coronavirus market rally ran higher, the RS line is lagging. COST stock performance looks even worse vs. the Nasdaq and the rally’s true leaders.

Costco stock sports an 88 EPS Rating. The retailer averaged 18% EPS growth over the past three years and 7% sales growth, which are solid enough for such a large-cap stock. Analysts see Costco earnings per share rising 4% in the current challenging fiscal year, as e-commerce sales hit their stride.

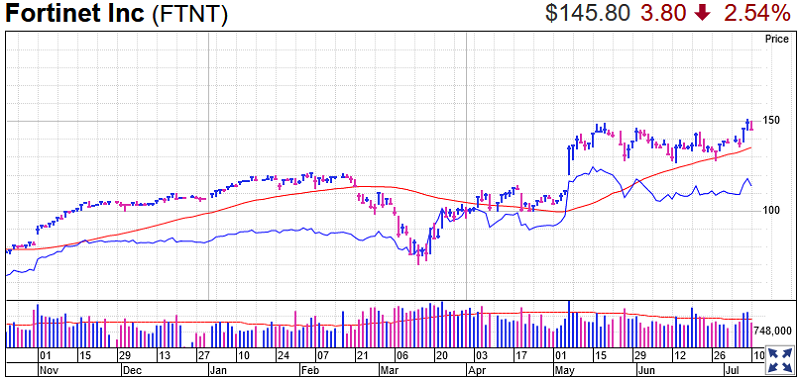

Fortinet Stock

The “firewall” and other cybersecurity technology provider rose 5.3% to 145.80 last week, rebounding powerfully from its 10-week line. Fortinet stock hit 151.95 intraday Thursday, but never closed above the 149.79 consolidation buy point. Aggressive investors could use 144.60 as an early entry.

Fortinet has benefited from strong demand for its products as more people work from home during the virus outbreak. It was a Stock of the Day in late June.

FTNT stock has an unbeatable 99 EPS Rating. The company averaged an impressive 51% EPS growth over the past three years and 19% sales growth. Fortinet earnings are seen rising 14% this fiscal year.

Fortinet stock is on IBD Leaderboard, SwingTrader and the IBD Long-Term Leaders list.

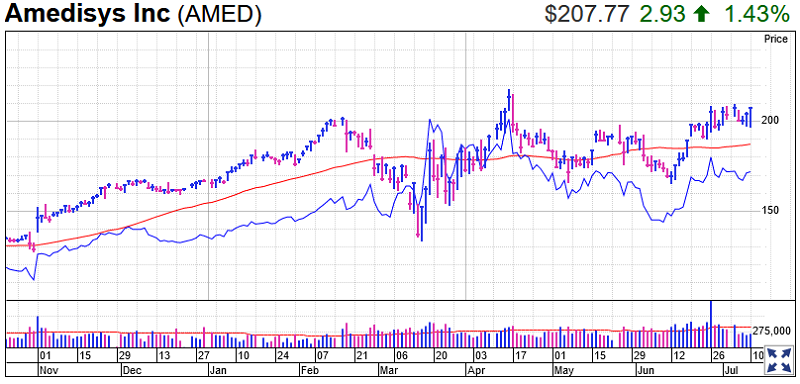

Amedisys Stock

The home health care provider is 4% above a 198.58 double-bottom buy point, meaning shares are still in buy range. Investors may want to focus on 209.34 as a handle entry within the consolidation. Amedisys stock closed the week at 207.77.

As coronavirus infects the economy, institutions have been gobbling up Amedisys stock.

The EPS Rating is 88. The company averaged 42% EPS growth over the past three years and 12% sales growth. Amedisys earnings per share are expected to tick up 4% in the current year.

AMED stock also is a Long-Term Leader.

Trading Education Online Courses

TracknTrade Trading Software Free Trial