Teladoc Dexcom Lead Five Medical Stocks In Or Near Buy Zones By Investors Business Daily

Your stocks to watch for the week ahead include medical stocks Teladoc Health (TDOC), Dexcom (DXCM), Vertex Pharmaceuticals (VRTX), West Pharmaceutical Services (WST) and Seattle Genetics (SGEN).

Some of those names, like Teladoc stock and West Pharmaceutical, have run higher due to the coronavirus pandemic, with investors seeing gains from more people taking doctor appointments from home and the need for equipment to help administer a potential vaccine.

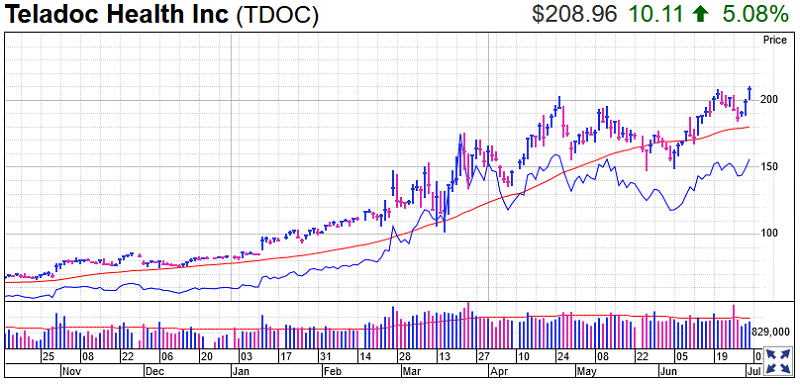

Teladoc Health Stock

The telemedicine leader rose 5% to 208.89 in Thursday’s stock market trading, just above a 208.73 high handle entry. Teladoc stock also cleared a short trendline entry around 200. TDOC stock has an 89 Composite Rating and a 40 EPS Rating. As with other medical stocks here, Teladoc stock is a Leaderboard member.

Shares found support at their 50-day line last month and have added to gains off that level since. Teladoc’s relative strength line, which measures a stock’s ability to outpace the S&P 500, has been choppy since April. Teladoc was a recent IBD Stock of the Day.

Teladoc stock is up around 150% this year, as more people sheltering in place during the coronavirus pandemic conduct doctors’ visits via videoconferencing or audio conferences.

“While the surge is expected to ease in the second quarter, it is expected to settle at a permanently higher level vs. pre-Covid,” JPMorgan analyst Lisa Gill said in a recent research note.

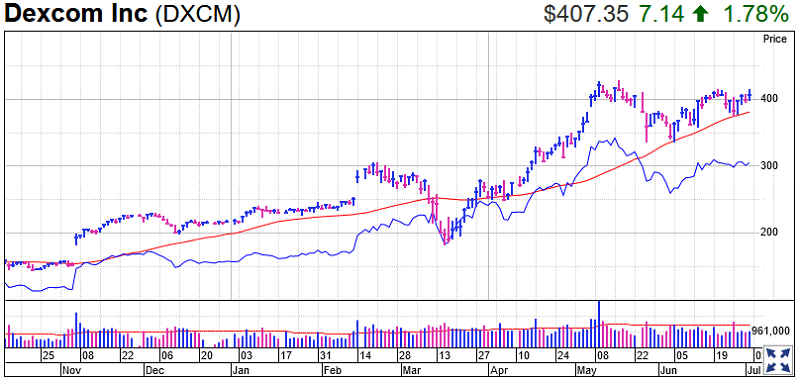

Dexcom Stock

Dexcom, which makes glucose monitoring systems for people with diabetes, is near a 415.59 cup-with-handle buy point. DXCM stock climbed 1.8% to 407.35 on Thursday, hitting 415.48 intraday. Dexcom stock was also Thursday’s IBD Stock Of The Day.

Competition between Dexcom and Abbott Laboratories (ABT) has grown. But some analysts say Dexcom still has an advantage.

Dexcom stock has a strong 98 Composite Rating. IBD recommends investors seeking top performers focus on stocks with Composite Ratings in the 90s.

DXCM stock has a 76 EPS Rating. The relative strength line is not too far off the May peak, after rising for several months. Dexcom stock, like Teladoc stock, is a Leaderboard member.

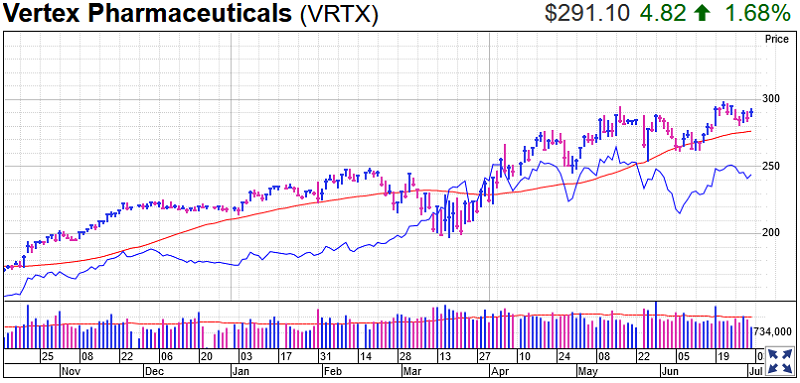

Vertex Stock

Vertex stock rose 1.7% to 291.10 on Thursday, putting the biotech company just below a flat-base buy point of 295.65. Investors looking at medical stocks could also buy the stock at 299.31, or 10 cents above the high the stock reached late last month.

Vertex has focused on making medications to treat cystic fibrosis. It is also working with Crispr Therapeutics on a gene-editing blood-disease treatment.

Vertex stock has best-possible 99 Composite and EPS Ratings — making it the highest rated of the medical stocks to watch for the week ahead. It also holds a spot on IBD’s Leaderboard.

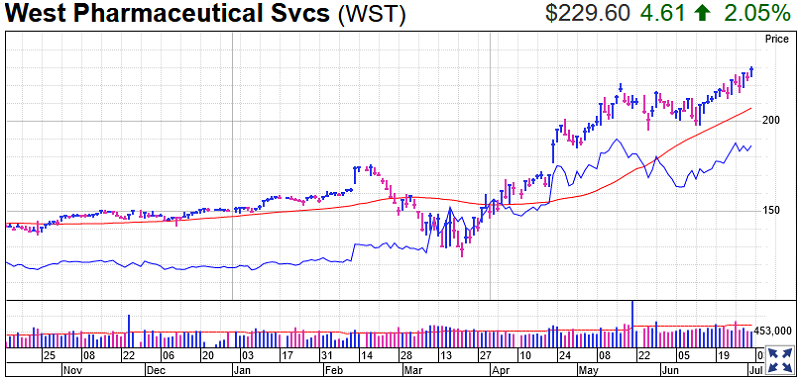

West Pharmaceutical Stock

West Pharmaceutical Services, which makes components needed for medicine injections and other medical devices, rose 2.4% to 230.46 on Thursday. WST stock is still in buy range of a 222.06 flat-base entry. West Pharmaceutical is also on IBD’s Long-Term Leaders watchlist.

West Pharmaceutical stock’s products are expected to play a part in giving people any potential coronavirus vaccine, according to the latest New America story published Thursday.

Companies working on vaccines for the coronavirus have a “heavy bias toward injectables, West Pharma’s wheelhouse,” Jefferies analyst David Windley said in a research note.

West Pharmaceutical stock has a 97 Composite Rating and a 95 EPS Rating.

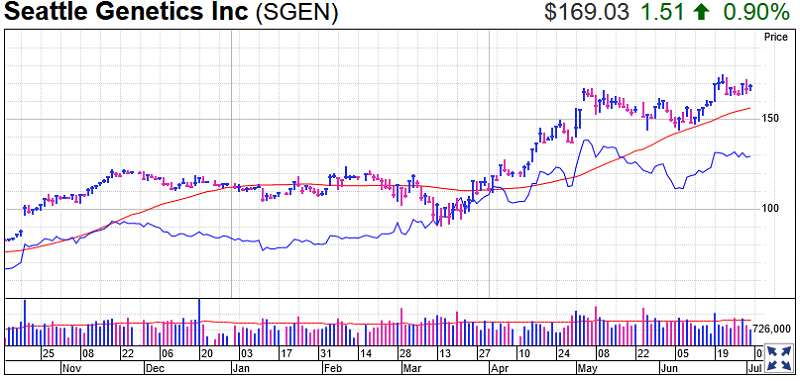

Seattle Genetics Stock

Seattle Genetics stock climbed 0.9% to 169.03 Thursday, back above a 168.20 buy point of a flat base. Investors could buy shares of the biotech now, but also at 175.74 — 10 cents above a high reached on June 23.

Trading Education Online Courses

TracknTrade Trading Software Free Trial