Liquidity Set to Dry Up: What That Means for Investors By Elliottwave International

The liquidity boom which has helped to drive the price of financial assets higher is set to end. One reflection of that is the new drive to cut unnecessary government spending. The new Elliott Wave Theorist has this to say:

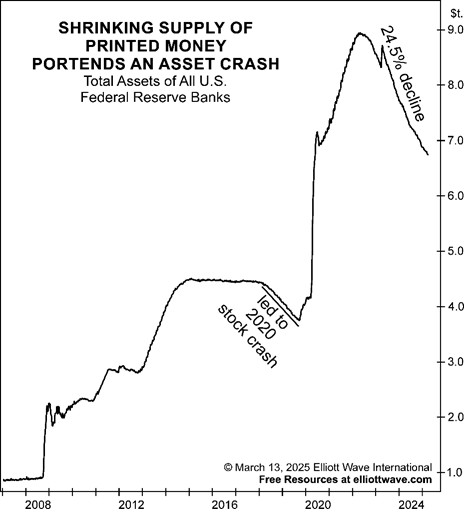

Another cylinder in the liquidity engine has been debt monetization by the Federal Reserve. That trend, however, ended three years ago. The chart below shows that over the past three years, the Fed has shed $2.2 trillion worth of bonds and mortgages, bringing the total value of its balance sheet down from $8.97 trillion in April 2022 to $6.76 trillion in March 2025. That is a decrease of 24.5%.

The Fed has never before decreased its balance sheet by that large a percentage. From January 2015 to August 2019, it reduced its balance sheet by 16%, A few months later the “covid crash” of Q1 2020 occurred in the stock market.

When liquidity dries up, assets go down. When a reduction in liquidity is systemic, all assets go down together:

The pattern of investor psychology swings from extreme optimism to the depths of pessimism. Our flagship services, including The Elliott Wave Theorist, show you where the markets stand in that spectrum to help you make informed decisions. Tap into our detailed analysis now.

Learn how financial markets really work. Read Chapters 1 & 2 of Robert Prechter’s landmark book, The Socionomic Theory of Finance, free.