Short Selling: Why Torpedoes Signal Institutional Selling By Investors Business Daily

For investors accustomed to playing the stock market on the long side, short selling can at first be like a disorienting parallel universe. There are many rules and clues to follow, similar to the strategy of going long. In either case, one must always cut losses short. And one rule of buying stocks seem to be inverse to another rule in selling short.

The “inverse similarity” can be found in how one watches for heavy, institutional-scale trading activity.

On the long side, you want to see powerful buying in the form of hundreds of thousands, or millions, of shares. This movement is caused by large funds, banks and insurance companies moving into a stock.

In the short selling game, you sell shares of a stock borrowed from your broker, then hope to cover the position later for a profit by buying back those shares and returning them to the broker at a lower price.

In such an exercise, you are also watching weekly charts for similar signs of heavy institutional activity.

Watch for a former leading stock to dive 5%, 10% or more in trade that towers above its previous activity. These torpedoes of selling action — best seen on a daily or weekly chart — reveal big money moving out of the stock, not into it. They help set up the cue for smaller players to jump in.

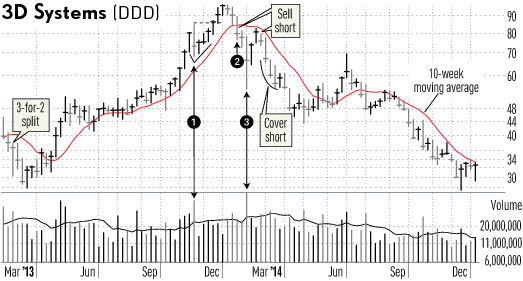

A good example of such torpedoes that helped set up a good short sale came from 3D Systems (DDD) in 2013. The stock had climbed more than 500% in the prior two years, proving it was once a huge winner.

Amid its big run, 3D reversed from an all-time high and dropped nearly 9% in the week ended Nov. 22 (1).Trade spiked above 49 million shares, more than double its weekly average and a weekly record.

This torpedo sell-off gave a clue that a short-sale signal may be approaching.

It was a perfect time to begin looking for a head-and-shoulders pattern, or a failed breakout from a late-stage base — the two basic patterns to time a short entry (see the prior two stories in this column for more on these patterns).

After rallying to new highs, 3D topped. Then the stock cut below its 10-week moving average in heavy trade on Jan. 24, 2014 (2). This should have been a final sell signal for investors with long positions. It was also a good time to sell short near 79. Why?

The weekly chart showed that 3D had broken out of flawed, V-shaped base at 84.95 and was failing fast. The base was late stage. The 7% stop-loss sell rule would have forced buyers to exit the stock at 79.

Two weeks later, 3D gapped down on Feb. 5; one could have covered the short for a gain of 20% to 25% or more. That week produced a fresh torpedo sell-off, a 14.5% drop in the week ended Feb. 7, 2014. Volume hit 66 million shares (3).

3D rebounded in weak trade over the next two weeks, ahead of Q4 2013 results. On Feb. 21, 2014, 3D failed to overcome resistance at its 10-week moving average. The 5% drop in strong trade the next day to 76.39 gave a second legitimate short-sale entry point.

On Feb. 28, 3D shares spiked 7%, then trimmed that gain to just 1.7% after the company reported mixed results for its fourth quarter. 3D collapsed 43% over the next 10 weeks, giving plenty of chances to cover the short for a handsome gain.

Sell-Short and Buy-Long Stock Trade-Plans Issued Daily