Inflation Concerns: What Are Traders and Investors to Do? By Van Tharp Trading Institute

A month ago we addressed inflation concerns that had pushed the markets down to key support levels in an article entitled “Is Inflation Transitory and Can the S&P 500 Hold the Line?”

Here is the original “hold the line” chart:

And now we have the answer to that question:

The line held, coinciding directly with the reduction in inflation fears. Today I’m going to run you through a “chart-heavy” look at some inflationary forces and make the case that market participants are betting, for the near to intermediate-term, that inflation is of a more transitory nature.

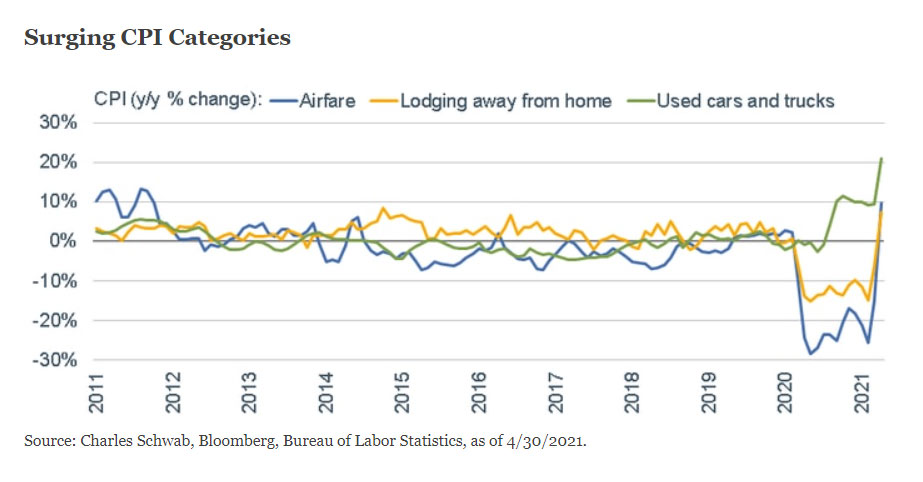

First, we have a chart showing categories within the Consumer Price Index (CPI) that have been driving higher:

These categories have been written about all over the place, as auto production lines have been slowed, or shut, due to a semiconductor shortage. This has made used car prices soar. And as I wrote to you back in May, it is clear that not only travel prices have been soaring, but pent-up demand has pushed up costs for travel across the board.

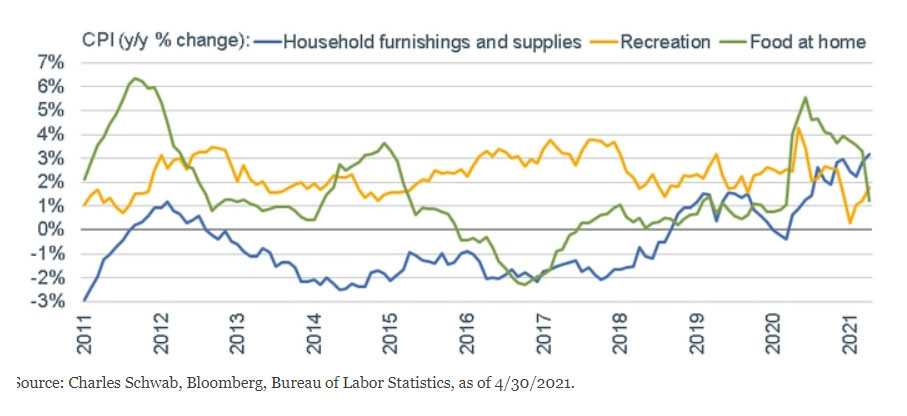

But not all prices are taking off. Here are some categories that have remained relatively benign. Note that the scale here is almost an order of magnitude smaller than the one above:

Again, no real surprises here except that home furnishings have remained stable. I went to the local LA-Z-BOY showroom and every custom piece had a nine-month backlog (not a typo). Apparently, home furnishers have held the line on pricing in the face of demand.

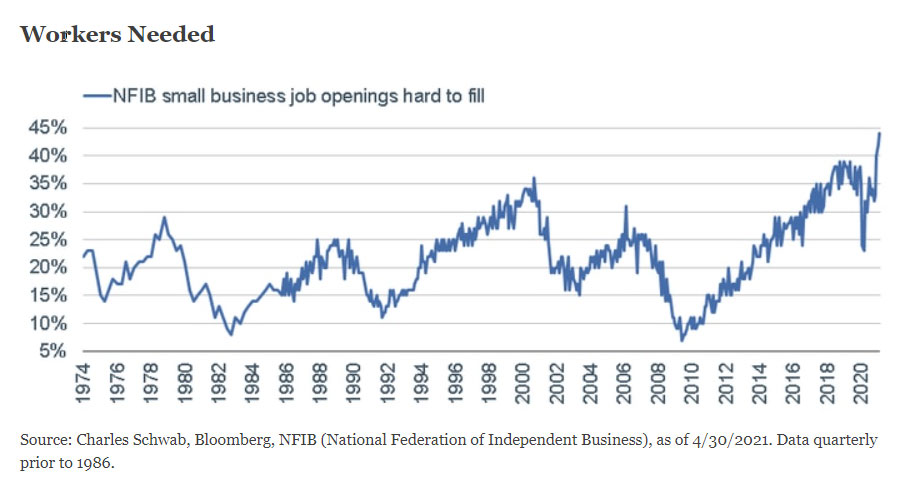

Next, it’s pretty clear that wage inflation has landed (whether it is “transitory” remains to be seen…). Along with that, wage inflation is a current reason for the jump up, with too many jobs facing too few “willing” workers:

Peak Performance Course for Investors Traders from Van Tharp Trading Institute