How to Sell the High or Better By Van Tharp Trading Institute

Last year, I wrote an article for the VTI Weekly Newsletter (April 8, 2020) entitled “Same Trades, Different Views. Improve Your Results with Positive Reversion”. In this article, I introduced the concept of the Excursion Ratio, which I now call the Capture Rate. The Capture Rate uses two different inputs. The first is Maximum Favorable Excursion (MFE) which is the furthest the trade went in your favor during the life of your trade. The second input is the actual profit (or loss). When we take the profit and divide it by the MFE, we get the Capture Rate. The Capture Rate measures how effective you were in capturing the move that benefitted your trade. If you take advantage of positive reversion entries and exits, you dramatically improve your Capture Rate.

Of course, this ratio measures the fantasy of every trader. The dream revolves around the perfect trade in which you get long, take no heat, and exit at the high tick of the move before watching the trend implode after you exited. We all know that’s not possible right? There is no way to sell at the high tick with any regularity. What if I could show you that we could sell at the high tick or EVEN BETTER THAN THE HIGH TICK?!?! What if I could show you how to get a Capture Rate > 100%?!?! You probably want to grab throw the proverbial BS Flag because you know I can’t be telling the truth!

So how do we create Capture Rates greater than one? By using Options!

One of Van’s core principles is you need large wins to be a great trader. Van’s threshold is a minimum of 3R or greater as potential profit for your trade. Large winning trades are the secret sauce of great trading.

“I’m looking for 5:1 (risk /reward).”

“Five to one means I’m risking one dollar to make five. What five to one does is allow you to have a hit ratio of 20%. I can actually be a complete imbecile. I can be wrong 80% of the time, and I’m still not going to lose.” – Paul Tudor Jones.

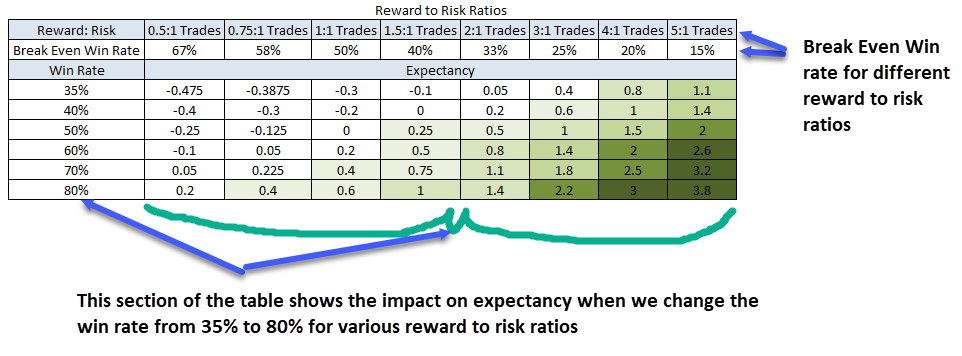

The table above shows the impact of large R winning trades. A system that generates wins that equal its losses must be perfect to have an expectancy of 1.00. However, a system that produces wins 3x its losses only needs to have a 50% win rate to have an expectancy of 1.00. Small R winning systems have a ceiling in performance, whereas large R winning trades have no limit. Large R winners have massive implications for your trading if you embrace the concept.

If we believe that large wins are the secret sauce, then options are the ingredients of the secret sauce. In addition, by creating large R winners using options, we can develop trades where the Capture Rate is >1.

In addition to focusing on large R winners, Van preaches two key concepts:

Know Your Objectives

Options give the ability to trade with much greater precision, which supports you to create positions in alignment with your objectives, in a way that isn’t possible with stock or futures alone.

Know Your Market Type

Options give you the ability to maximize Van’s Six Market Types by creating positions that make money when:

The market doesn’t move.

Make more money when the market rallies slowly (Bullish Quiet) than long stock/futures alone.

Make more money when the market rallies fast (Bullish Volatile) than being long stock/futures alone.

This concept is vital because when you anticipate direction AND volatility, you can pick an option structure that can massively outperform underlying alone.

This combination of all three concepts leads to a powerful schematic that creates trades where the capture rate is greater than one.

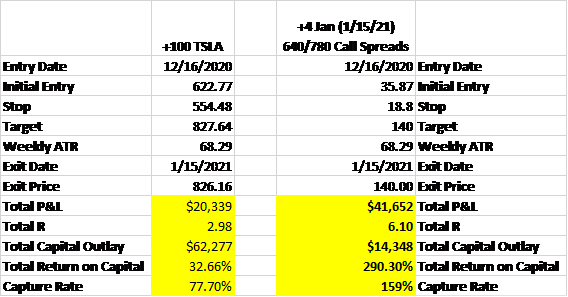

Example – TSLA Long

In this example, we get a signal to go long in our REED$TRADER Mechanical System. We can buy 100 shares of TSLA and risk 1 Weekly ATR for our stop. Instead, we buy 4 of the January 640/780 Call Spreads. Both trades have equal directional exposure at the time of initiation. The Mechanical System captures about 78% of the move, which is excellent. However, the options strategy ends up realizing its full value. Because we have four times as many spreads on vs. long stock, the trade ultimately performs much better than being long stock.

How do we calculate the Capture Rate using options? We will take the realized P&L of the options strategy and convert it back to an effective exit price in stock. In this example, we make $41,652 on our TSLA Call Spreads. We take that number and divide it by 100 to give us total points of profit.

$41,652/$100 = $416.52

We will add $416.52 to our entry price of $622.77 to give us an exit price of $1,039.29

$622.77 + $416.52 = $1,039.29

Our Capture Rate uses this number as our exit price.

Capture Rate = (Exit Price – Entry Price)/(MFE – Entry Price)

Capture Rate = ($1,039.29 – $622.77)/($884.49-$622.77) = 159%

By making this conversion, we can see that we exited our TSLA 159% better than the MFE of the trade. We not only sell synthetically at the top; we actually sell 59% better than the high.

In our Options Matrix Workshops, we teach option strategies and context for their implementation to create trades with Capture Rates > 1. We help the trader understand how to define their objectives and structure their trades in alignment with those objectives. The effort spent to master these strategies will have massive implications on your future trading success.

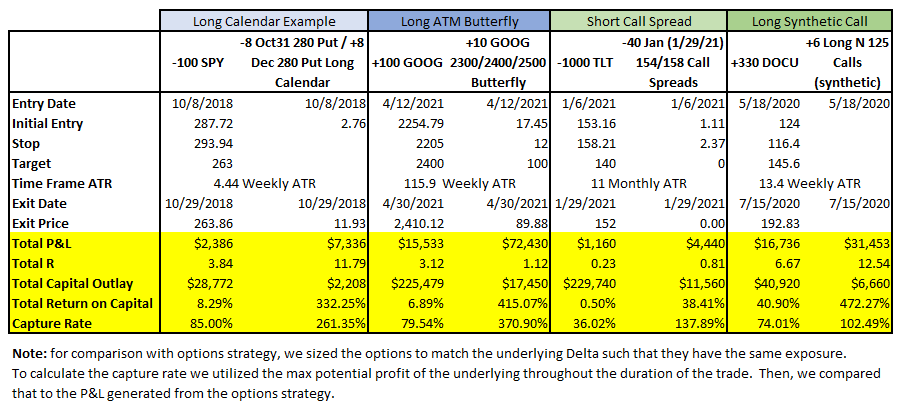

In the table below, four different option strategies are shown that outperformed the MFE. Each example utilizes a different options strategy in a different context. However, you can see this outperformance can happen consistently if the right strategy is chosen.

Example

Dr. Van Tharp always says Psychology is an essential aspect of your trading success. In addition, Van often says we trade our beliefs. What I find so interesting is how many people see these concepts repeatedly but still have resistance to embracing the concepts that will ensure their success.

How about you? Ask yourself honestly, are you embracing the concepts of hunting large R-winning trades? Do you clearly understand your objectives for each trade? Are you willing to embrace using option structures to create trades with capture rates > perfection? This is your wake-up call. This is your opportunity to adopt these concepts to improve your trading radically. This is time to take the Red Pill!

Van Tharp Trading Institute Peak Performance Course for Investors Traders