To Buy or Sell or Hold? That is the Question. And Elliott Wave Has the Answers By Elliottwave International

Big Board stock in focus: Bank of America BAC

If you’ve been having trouble making big decisions for oh, say, the last 3 years, you’re not alone. According to a string of recent articles, the pandemic has given rise to a different kind of contagion; namely, decision paralysis.

That never-ending fire hose of questions — Do I exercise inside or venture into a crowded park? Do I teach my children at home or send them back to school? Do I stay or leave this job, relationship, city, or couch where I’ve built a 3-story blanket fort for binge-watching Game of Thrones? (Hypothetically speaking, of course.)

Our ability to discern the right choice has been shot to 7 Hells (sorry, GOT reference there!), as these recent news stories reveal:

- “A Psychologist Offers 3 Tips to Tackle Decision Paralysis” — Jan. 18 Forbes

- “Another Pandemic Malady: Decision Fatigue” — Feb. 7 LA Times

- “14 Strategies for Combatting Decision-Making Paralysis and Anxiety” — March 30 Newsweek

The world of finance is no easier on the noggin’s discretionary faculty. Every day traders are confronted with a multitude of opinions, from those claiming to be experts, no less, about where the stocks they follow are going. Take, for example, the recent history of the second-largest US financial institution and Big Board listee Bank of America Corp. (BAC).

Back in February, mainstream pundits were as divided on the future of BAC as the House of Lannister and House of Stark over the fate of the universe. (Okay, last GOT nod, I promise!) These headlines from the time capture the conflicted views of BAC from the popular disseminators:

- Bullish: “Bank of America: Further Upside Likely” — Feb.16 Seeking Alpha

- Bearish: “Wall Street Turns Most Bearish on Bank of America Since 2015” — Feb. 7 Bloomberg

- Bullish: “Strong interest rate tailwinds going into 2023 that could drive [BAC] shares even higher” Feb. 28 Seeking Alpha

- Bearish: “Sell Your Bank of America Shares Now, Says KBW” — Feb. 9 Morningstar

These BAC predictions have one thing in common: They’re all driven by “fundamental” factors,” which are often not great predictors of things to come.

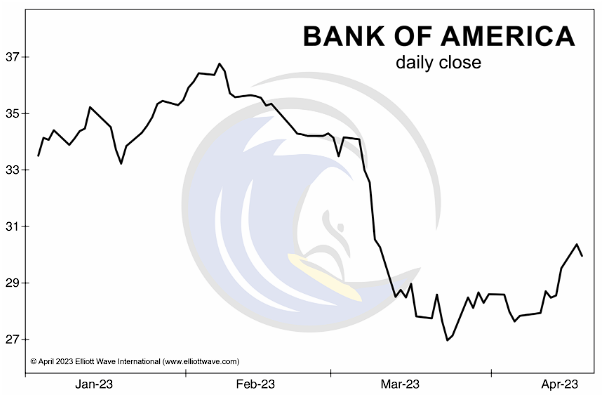

Our alternative: Elliott wave analysis, which is an objective, pattern-driven model of market trends. Here, on February 21, our Trader’s Classroom editor Robert Kelley picked BAC out of his daily chart lineup and identified a clear Elliott wave set-up underway. The set-up was a bearish, third wave decline.

From the February 21 Trader’s Classroom:

“…there’s good chance of continued decline in wave 3 to much lower levels. A break of this B wave low at 32.29 would signal hat wave C of 3 down is in play.”

And from there, Bank of America turned into sank of America, falling to its lowest level since November 2020 on March 22.

Once again, on April 4 Trader’s Classroom revisited BAC to assess the next likely path for prices. There, Robert updated his wave count and said: “It looks to me like a wave 3 down is complete,” and called for a fourth wave bounce.

Since then, BAC has indeed trended higher to above $30. But the question is, how high will the stock go?

You can find plenty of conflicting answers from the usual sources.

Or, if you subscribe to Trader’s Classroom, you can pull up the comprehensive library of video lessons and watch the April 4 recap on BAC. There, Robert reveals the exact price level BAC must stay below to confirm an ongoing decline, one that could take prices into the teens.

Update: On April 18, BAC hit Robert’s cited upside price window, and turned down in a precipitous drop just as the April 4 Trader’s Classroom outlined. Get the complete picture today!

Trading Lessons (Plus, Market Opportunities): 2 for 1

3 times a week, press “Play” and watch the instructor Robert Kelley explain in comprehensive detail how to recognize the relevant Elliott wave patterns (and supporting technical indicators) underway now and in the future.

This is every Trader’s Classroom video in a nutshell: a lesson, often with a new opportunity.

Here’s how to watch the latest lessons now.