How the Price Action of Stocks Defies “Conventional Wisdom” By Elliottwave International

Let’s start with shocking news from nearly 60 years ago which is relevant to the subject at hand, namely, how the stock market defies presumed conventional assumptions.

Robert Prechter’s landmark book, The Socionomic Theory of Finance, showed this chart and said:

The first arrow shows the timing of President Kennedy’s assassination. The market initially fell, but by the close of the next trading day, it was above where it was at the moment of the event, as you can see by the position of the second arrow.

Conventional wisdom says the market uptrend since mid-1962 would have been severely derailed by this historic shock.

Yet, after a short-lived emotional reaction, the market’s uptrend picked up where it left off.

In other words, “something” besides news is driving the trend of market prices. That “something” is mentioned in our September Global Market Perspective, which offers a current example of how the stock market behaves differently from widespread expectations:

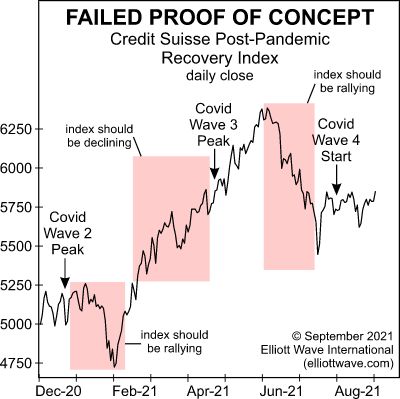

The Credit Suisse Post-Pandemic Recovery Index comprises stocks “whose performance is expected to be negatively correlated with Covid case counts.”

Notice, however, the arrow at left, which marks the December 20, 2020, peak in Covid-19 cases in Germany. Not only did the recovery index fail to rise as intended, but it actually dropped 10%. After bottoming in February 2021, the index rallied alongside the third wave of the pandemic (again against expectations), and it kept on rallying until June 2021, essentially ignoring the pandemic’s third wave. The fourth wave of coronavirus began after a 13% decline in the index…

Ignore the pandemic and focus on the waves of social mood that actually drive stock prices.

You see, social mood fluctuates in waves of optimism and pessimism. If social mood is positive, stocks will trend upward, despite bad news. If social mood is negative, stocks will trend lower, despite good news.

The Elliott wave model directly reflects the repetitive patterns of social mood. This repetition makes U.S. Stock Markets and around the globe predictable.

Get our insights into stock markets around the globe by following the image link below.

Here’s How Most Global Investors Cope with Stock Market Uncertainty

They do what they’ve always done: look to others for clues as to what to do next. In other words, they herd.

Problem is — the crowd is almost always wrong at major turns — whether the stock market is in the Asian-Pacific, Europe, the U.S. or elsewhere.

By contrast, instead of joining the crowd, our Elliott wave experts track the crowd’s patterned behavior.

These patterns have repeated throughout market history. This repetition of recognizable investor patterns brings predictive value.

Until November 03 Free Financial Markets Forecasts