July 2021 Market Update Strong Bull Quiet Market Type By Van Tharp Trading Institute

Part I: The Big Picture

The Big Picture to me centers on the impact of huge government spending. You need to ask yourself the following questions:

- What will the impact of that spending be on the value of the dollar? COVID-19 and Trump produced a huge deficit. COVID-19 and Biden will produce a bigger deficit. Deficits to improve infrastructure are generally very good but only a trillion of Biden’s 6 trillion deficit is for infrastructure.

- If Biden increases taxes on the wealthy and corporations, it will probably have a significant negative impact on the economy. For example, raising capital gains to about 43% for those making over a million will probably impact about 75% of all stock market transactions. In addition, raising corporate taxes to 28% starts to make the US less competitive but Biden is trying to get all countries to raise minimum corporate taxes to the same level of 15% and that’s not bad at all.

- How will the stock market react to Biden’s second 100 days? The stock market had its best 100 days ever for a new president so that’s probably good news for Biden. He’s done a great job lessening the impact of the pandemic, however, I’m not sure what the impact of his second 100 days will be on the country. A $6 trillion budget is not sustainable.

- What is the impact of stimulus money? People get the money based upon their income, not based upon whether they need it or not. So, for those Americans who have not lost their jobs, it was just an extra bonus. Many said they would invest their stimulus money. They have now received three checks (plus, for most people, their regular income).

- What is the impact of the super-rich getting much richer and many more Americans becoming new millionaires?

- How will the huge political divide affect the country and the economy? The current divide has split this country and has no comparable magnitude since the 1920s –the last time there was a huge gap between the super-rich and the poor. Politicians are playing conspiracy games with misinformation and each of the two parties generally votes as a block against the other one. For example, the Republicans win if minorities are less likely to vote – and they are if restricted from voting. The new bill that failed to exit the Texas legislature would have made Texas one of the most difficult states to vote in. And the conservative supreme court has upheld Arizona’s strict voting rights changes.

- Democrats win when more people vote. Therefore, Democrats would love to add Washington DC as a state, but Republicans know it will add more political power for the Democrats. So, are politicians really interested in what is good for the country long term or for the population long term or are they thinking, “What is good for me as a politician?” The answer to that question is easy.

- What is the impact of few big corporations folding? When the pandemic is over, those companies that survive might be great investments. Many of the most restricted companies have already gone up substantially.

- What is the longer-term impact of the Trump corporate tax cut? Corporations can now earn as much money trading as they can in their normal business. Will Biden undermine it? If so, how?

- What will help more, keeping corporate taxes low or building infrastructure?

- Gold and silver seem to have lost their luster while cryptos have been booming. And then suddenly, crypto had a 50% crash in a very short period of time. What’s the impact of that?

- We are getting a new BTC buy signal. Does this mean a new boom, or will this be our 4th losing trade out of 13?

- What will the long-term impact of COVID-19 be now that that is happening? About 60% of the US population has now been vaccinated with at least one dose and everyone 12 years of age and over can now be vaccinated. About 50% of the population is fully vaccinated. What will be the impact of the delta variant?

- I’m not a big fan of vaccines, but I got the Johnson and Johnson shot (one and done) so that I could start traveling. With the delta variant, my wife wants me to get at least one dose of the Pfizer vaccine. I have no plans to do so.

The following table shows the information that we track regularly on the US Debt Clock website.

What are the most noticeable changes in the numbers since last month? Notice that the number of US taxpayers in the table continues to rise despite the media emphasis on COVID-19 deaths. In addition, the US trade deficit has surpassed $1 trillion for the first time.

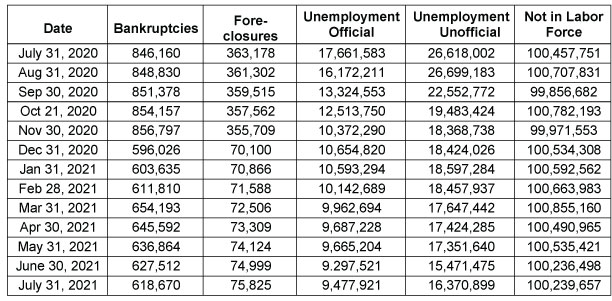

I started tracking debt-related data in two more tables which indicate how severe things are getting. This first table tracks bankruptcies, foreclosures, and employment figures. The prohibition on evictions is ending so I’d expect to see both foreclosures and bankruptcies go up next month.

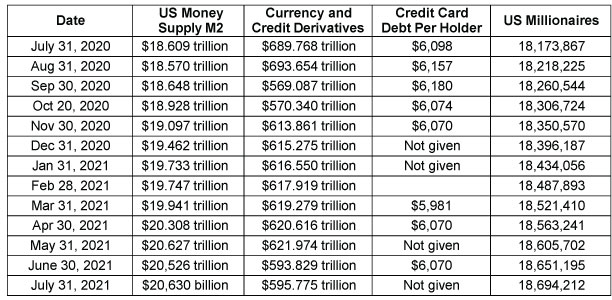

The second table tracks money supply figures, credit card debt, and the number of millionaires. We have 255,008 more millionaires in the US than we did at the beginning of the year, and they make up about 5.6% of the US population. I know some of our clients have moved into that status because of cryptocurrencies, but could the US Debt clock know that?

Notice that the number of US millionaires has gone up every month in the table.

Part II: The Current Stock Market Type Is Strong Bull Quiet

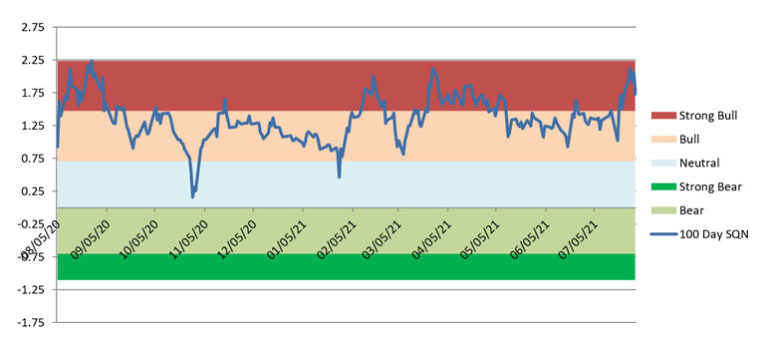

I monitor the Market SQN for timeframes from 5 weekly bars to 40 weekly bars. If you look at the price chart patterns for each of those periods, you can probably tell the direction —

- 200 days – Strong Bull, and now Strong Bull,

- 100 days – Bull last month, Strong Bull now,

- 50 days – Bull last month, Bull again,

- 25 days – Bull last month, and Bull now.

So now our measured periods range from Strong Bull for the two longest periods while the shorter time frames are both bull.

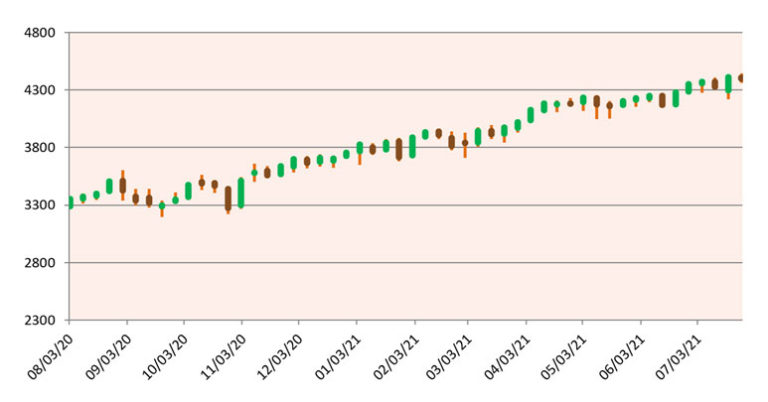

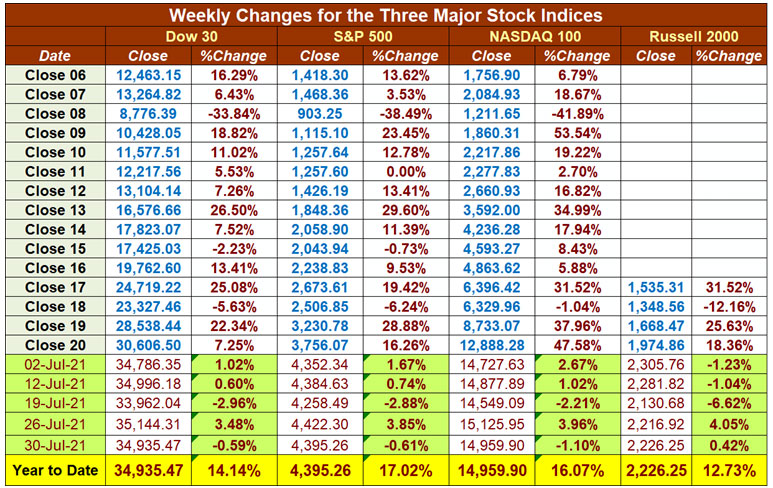

Let’s take a look at the weekly bar chart below for the S&P 500. The market made about a $7 trillion recovery since the bottom and has been setting new highs again. It had 7 new all-time high prices in July.

This is my visual definition of a bull quiet market for the last year. Slow steady upwards movement which is what the Market SQN score also reports with nearly all of the last twelve months in the bullish ranges.

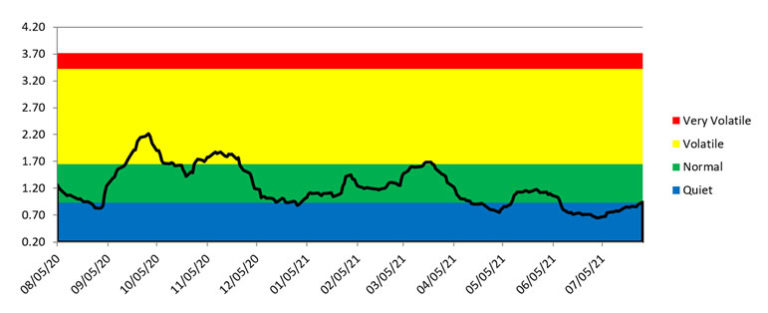

The next chart shows the volatility measurement for the last twelve months. We have been mostly in the normal range since last summer. The historic levels of volatility from early 2020 have now left the chart.

The next table shows the weekly changes for the four major stock indices for the last month and recent annual closing prices. Now, most of the major indices are up strongly for the year. The Russell 2000 is up 12.3% and is the weakest index. The NASDAQ is up 16%, while the Dow is up 14%. Hopefully, your liquid assets are up around 14% this year. If not, you are probably losing money to inflation.

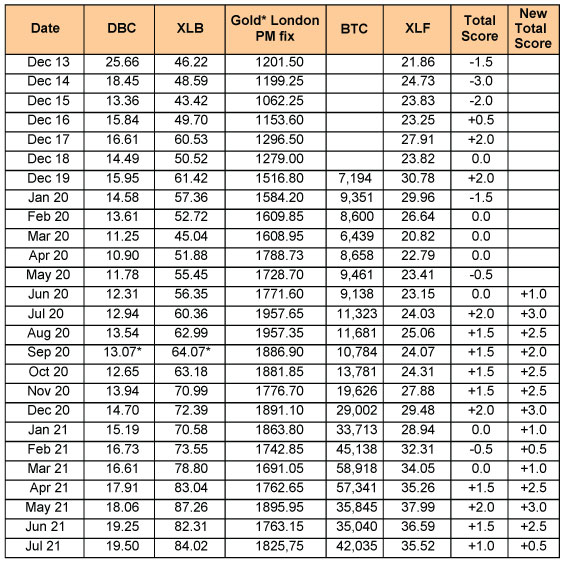

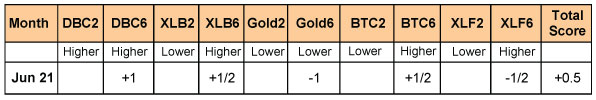

Part III: Our Four-Star Inflation-Deflation Model

Since June 2020, the model has shown strong inflation in most months and if you add BTC as another component, then all months have been positive.

The original model assumed gold is a major hedge for inflation (and a hedge for catastrophic times) but Bitcoin may be replacing gold for that role. Think about it — would you rather have bitcoin or gold in your portfolio right now? Hedge Funds Manager, Ray Dalio, said he would rather have BTC than a government bond, but when everyone holds that opinion, then BTC is in trouble.

Commodities have always boomed during inflation and look at what they’ve done over the last 9 months.

Shadowstats.com adjusts the GDP by the original inflation calculation and suggests that we have been in a recession since 2000 with just one-quarter of non-recession. GDP got much worse in 2020, but it is starting to recover nicely and it is at about 4% officially. Shadowstats.com shows real inflation at about 14% right now based upon how inflation was calculated in 1980. The government with their statistical manipulations shows inflation at just over 5%. And their charts for the money supply growth show the biggest changes in history. Shadowstats.com also shows the GDP at about -12.5% right now – versus the government statistics of about -3% right now.

Part IV: Tracking the Dollar

On July 31st, the USD was at 92.09 – just slightly below the June 30th number. Our World Market Model (see the SQN Report article below) has the US dollar ETF (UUP) in yellow and it is no longer one of the worst performers in the whole model.

For most of you reading this, the US Dollar is your base currency. Donald Trump oversaw an increase in our debt of about $8 trillion during his administration, $6 trillion of that was in his last year. Will Biden be any better? Not at the current rate. Biden’s infrastructure bill, which I think is essential at some level, will make sure of that and it’s currently proposed at $1 trillion for 2021. In addition, if the delta variant continues to spread, we may see more stimulus money.

Conclusion

Let’s look again at a few possible scenarios that might play out in 2021. I ranked these from most likely to the least likely.

1) BTC will take over from Gold as the primary protector from fiat currency. This is really not so hard to judge because it is already happening. Huge movements are happening in crypto which we’ll summarize in the newsletter on June 16th. I think institutional FOMO will take hold over BTC in 2021. We’ve had a $30,000 drop from the peak, but big institutional whales are buying, not selling. The Super Trader system we track in our newsletters just provided another buy signal in BTC.

2) Altcoins have had a big crash but could still move up again in 2021.

3) COVID-19 will be around for a few more years, but my sense is that the impact will go down fairly quickly in 2021. I got vaccinated in early March and after a month took two driving trips and two airport flights. COVID-19 won’t be over this year due to variants. More than one-third of the US population hasn’t gotten the vaccine and the whole world won’t get vaccinated as fast as the US.

4) Marijuana is now legal in both Mexico and Canada. My understanding is that there is currently a 163-page bill up for passage to do the same in the US which will allow states who wish to prohibit it to still do so. It will also impose a federal tax on marijuana and authority over it would be transferred from the DEA to the FDA. This could be huge for all of the small marijuana startup companies. The public comment period on the bill is through Sep 1st, so it won’t pass until the fall.

5) If COVID-19 is around for a few more years, then –

- BTC will have another 300% year in 2021 — which could happen anyway.

- Other cryptos such as ETH and some of the DeFi coins will take off.

- Industries that have been just hanging on (Airlines, Cruise Lines, Rental Cars, Hotel Chains, and other tourism/entertainment-based industries) will go bankrupt. Many more brick-and-mortar businesses will disappear.

- The rich will get richer and the divide between the rich and poor will become even wider.

- There will be much more social unrest.

6) In the last scenario, COVID-19 vaccines prove effective, and we reach herd immunity levels this year. World unrest and economic malaise will improve. This is the least likely because of those who refuse to get vaccinated are so numerous that we won’t get to herd immunity and because of new variants appearing such as Delta.

All of this uncertainly from most people worldwide still being unvaccinated and needing to stay at home makes this the best time possible to get a financial education and work on yourself. We are here ready to help with books, eLearning courses, and online workshops.

Van Tharp Trading Institute Peak Performance Course for Investors and Traders