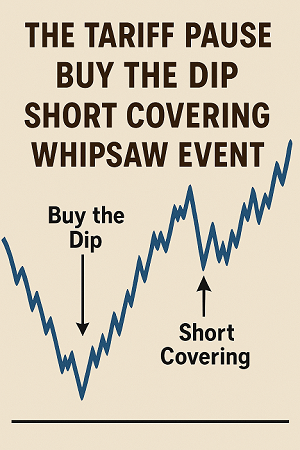

We’ll Call It “The Tariff Pause Buy the Dip Short Covering Whipsaw Event”

Whipsaw describes the movement of a financial instrument when price is moving in one direction but then quickly pivots to move in the opposite direction. In this case a huge amount!

April 10, 2025 saw U.S. stock markets experienced a massive rebound, starting with Trump issuing a 90-day pause on his widespread reciprocal tariffs, then most likely driven by a combination of dip buying and short covering. The major indices rocketed higher with the S&P 500 closing 9.52% up , Dow Jones Industrial Average closing 7.87% up, and Nasdaq Composite closing 12.16% up.

One Day Move Not A New Trend

A one day move does not make a new trend. New trends are a normally a process that takes time of days and weeks. Not only just one day.

Dip Buyers Enter the Market

Traders seeking to capitalize on lower stock prices commonly referred to as “buying the dip” started adding to the beginning of the market’s gains after the tariff pause. This strategy involves purchasing stocks that have declined in value and anticipating a price rebound. The influx of dip buyers provides support to the market’s upward trajectory.

Short Covering Fuels Rally More

In addition to the potential dip buying, the recent downturn had led to increased short positions across various sectors, especially in the hot tech artificial intelligence sector. After the tariff pause short sellers rushed to cover their positions, contributing to the upward momentum. This phenomenon is known as a short squeeze and occurs when short sellers are compelled to buy back shares to close their positions, further driving up stock prices.

Market Bottoming: A Gradual Process

While the day’s rally was a positive development in the near-term, it’s important to recognize that market bottoming is typically a protracted process rather than a single day event. Historically markets have experienced multiple fluctuations before establishing a definitive bottom. For instance during the early 2000s, the Dow Jones Industrial Average reached a low of 7,286.27 on October 9, 2002, following a prolonged decline from its peak in January 2000. Similarly the Nasdaq Composite experienced a significant drop of 79% from its peak in March 2000 to its bottom in October 2002.

Is Whipsaw Trading Low-Risk High-Reward?

Whipsaw trading is definitely not low-risk. It’s usually considered high-risk, potentially high-reward, but only for very experienced traders.

Here’s why it’s risky:

Whipsaws happen when the price moves sharply in one direction and then quickly reverses often stopping out traders or triggering bad entries. You can get faked out multiple times trying to chase intraday trends. It’s tough to tell if a intraday move is the real deal or just noise.

Some traders try to profit from it by: Using tight stop-losses and quick exits. Reacting fast to market reversals of very short timeframes. Relying on algorithms or very disciplined strategies.

For most especially if you’re not a seasoned day trader, trading whipsaws is more like navigating a storm in a rowboat. If you’re still curious there are whipsaw trading strategies but only recommended for active experienced traders.

Continued Caution Advised

Given the complex nature of market recoveries, investors traders are still advised to exercise caution currently and conduct thorough analyses before making any new investment trading decisions right now. While short-term rallies can offer potential opportunities, they may not necessarily indicate a sustained upward trend where it would simply be a waste of your precious time, energy and money. Understanding historical market dynamics and patterns is crucial for profitable investing and trading short-term and long-term.