A Look at the Perilous Psychology of Financial Bubbles By Elliott Wave International

Investors acknowledge a market bubble but optimism prevents them from seeking financial safety.

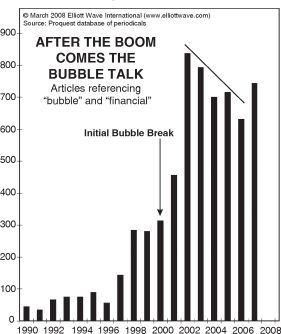

The months before the 2000 and 2007 stock market peaks saw a measurable rise in news stories that used the phrase “financial bubble.”

But instead of selling, many investors kept right on buying.

The logic went something like this: “This bubble could burst one day — but not just yet.”

The March 2008 Elliott Wave Financial Forecast, a monthly publication which provides analysis and forecasts for major U.S. financial markets, showed this chart and said:

The bars on the chart show that the number of financial bubble articles boomed as the bear market began in 2000. When the mania re-ignited, the bubble talk receded briefly, only to re-emerge last year [2007] as the housing crash started to bite and the credit market imploded. The … bubble of 2003-2007 should be over, because bubble references are once again rising fast.

Indeed, the worst of the 2008-2009 stock market debacle was just ahead.

Fast forward to 2020 and this Sept. 7 news item from CNBC:

‘We’re certainly in a bubble,’ strategist warns — but don’t expect it to pop anytime soon

Is it rational to stay in the market, even after acknowledging something as potentially financially dangerous as a bubble?

Here’s a classic quote from an Elliott Wave Theorist, a monthly publication which offers insights into financial and social trends, and is written by Robert Prechter, the president of Elliott Wave International:

The case for rational bubbles rests on the idea that investors are consciously making risk assessments and deciding that the gamble of buying high — to sell even higher — is worth it. But a bubble is fueled by more buying, which is propelled by new buyers and by increased conviction among those already invested, so few bubble investors actually do sell higher. Instead of buying high and selling higher, most of them do only the first half.

You deserve an independent perspective on financial markets, and Elliott wave analysis can bring you just that.

If you’re unfamiliar with Elliott wave analysis, read this quote from the book, Elliott Wave Principle: Key to Market Behavior, free online copy by Frost & Prechter:

In the 1930s, Ralph Nelson Elliott discovered that stock market prices trend and reverse in recognizable patterns. The patterns he discerned are repetitive in form but not necessarily in time or amplitude. Elliott isolated five such patterns, or “waves,” that recur in market price data. He named, defined and illustrated these patterns and their variations. He then described how they link together to form larger versions of themselves, how they in turn link to form the same patterns of the next larger size, and so on, producing a structured progression. He called this phenomenon The Wave Principle.

Discover more about the Wave Principle by reading the entirety of the online version of this Wall Street classic for free.