Update on Cryptoassets as of July 20, 2021 By Van Tharp Trading Institute

Market Summary

Bitcoin hit a new all-time high of $64,863.10 on March 13th but it has been going down since then and hit a low of $30,681 on May 19th. After moving sideways for a month, BTC hit another low of $28,893 on June 22nd. Then it rallied 17% in a single day and since then, it has been in a channel between $30K and $40K. The following chart shows that quite clearly.

Thus, we are either due for more of the same or it will eventually move out of the band and again test $50,000.

On July 20th, it was again trading below $30,000 but had not taken out the June 22nd low of $28,893.

Here is a short summary of some of our recent actions –

- In July 2020, VTI decided to offer a GBTC promotion for new Super Traders. VTI took all the risk but would credit STs with 79% of any gains. Those who paid $10,000 or more for their tuition were able to cover all of their ST Foundation costs without paying any additional money because of the credit they earned from the gains in just six months. Those who paid the full $25,000 for the ST Foundation level were able to use the gains, in most cases, to fully pay for both ST Foundation and ST Awakening. The crypto price gains were impressive – there was actually a period from October through November last year when the crypto positions gained over $3 million in seven weeks.

- Our attempt to go into cryptos early in 2021 and just hold them for six months was a failure. At one point we had gains of almost 70% but when the May crash happened, I wasn’t willing to go negative, so we got out of all positions. We could easily see a massive resurgence before the end of the year and BTC could go as high as $100,000.

- The Super Trader crypto system BTC position was finally stopped out of its long-time position when BTC closed below $49,081 on May 15th. The system had entered the BTC position at $9,156 on May 6th, 2020. The position was open for 374 days while previously, the system’s longest-held position was for 344 days. The position gained 411% – which was down from its highest point of 590%.

- Interestingly, I wasn’t convinced that BTC was really in a bear market at the time as the ST crypto system suggested. Exiting BTC is often a strong signal to get out of all altcoin positions as well. Again, I thought these coins are in major bull market mode and there was no way should we get out. And then most altcoins plunged about 50% in about 4-5 days.

- Within about two weeks from now, a new entry signal would be below our last position’s exit point and I’m guessing there will be massive buying if BTC goes much above $40,000.

On May 15th I said –

“I think that there are a number of altcoins that could go up 10 times or more during the rest of 2021. Now we might have a decline of 40% or more during the year, but it probably will be short-lived with a very quick recovery”

Well, we’ve had that kind of drop and now the question is 1) should you be on the sideline or 2) are more fast gains ahead of us? As you’ll see in the rest of this report, the answer is that most likely nothing will happen until BTC takes off again.

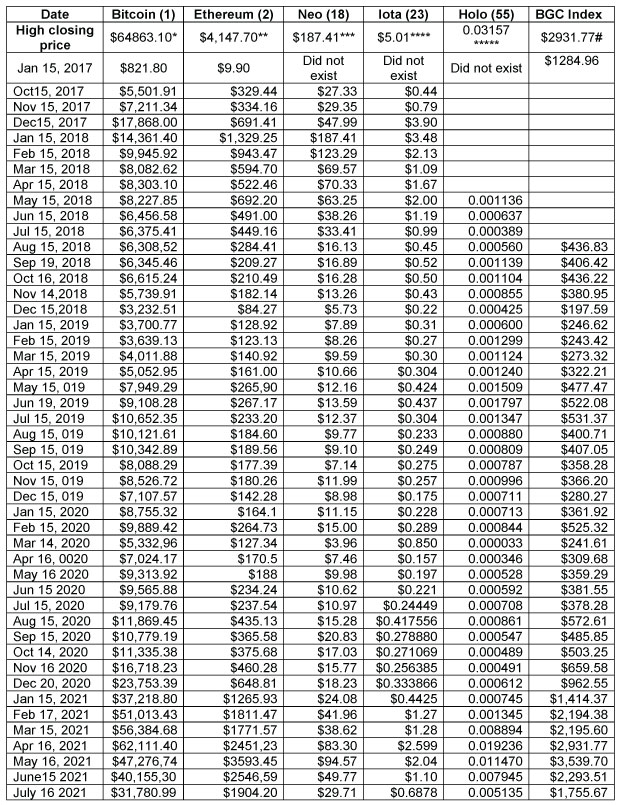

The table below tracks the price of five major cryptoassets across three generations of the technology along with Bloomberg’s index:

- Bitcoin, a 1st generation cryptoasset,

- ETH and NEO, 2nd generation cryptos,

- Iota, a 3rd generation crypto,

- Holo (HOT), and

- BGCI Index – I have also started including BGCI prices in the table.

Date of the All-Time High Closes

*Apr 14, 2021 ** MAY 11, 2021 ***Feb 12, 2021 **** Jan 15, 2017 ***** Apr 5, 2021 # April 16, 2021

Notice that nothing is up from last month and NEO, IOTA, and HOT are all down about 40-50%.

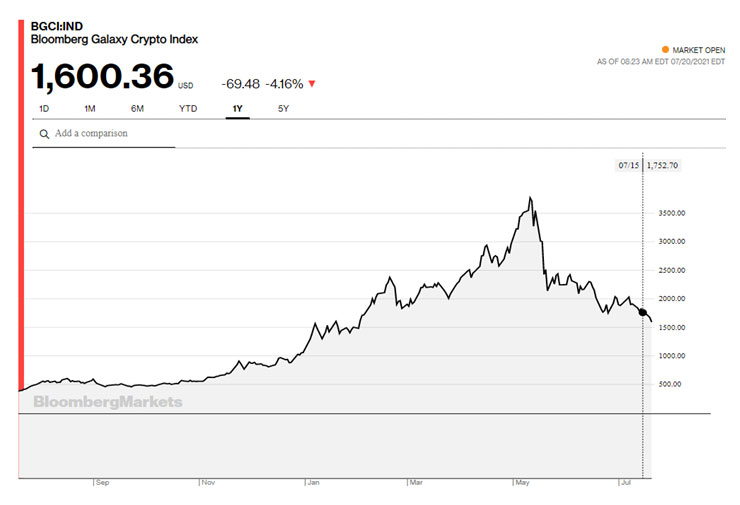

The chart below shows the Bloomberg Galaxy Crypto Index. Does the chart suggest to you that we are in a bear market or that cryptos are in danger? Around May 15th the crypto market looked strong. By May 19th, four days later, a bloodbath had started. The latest result on the chart below clearly shows it.

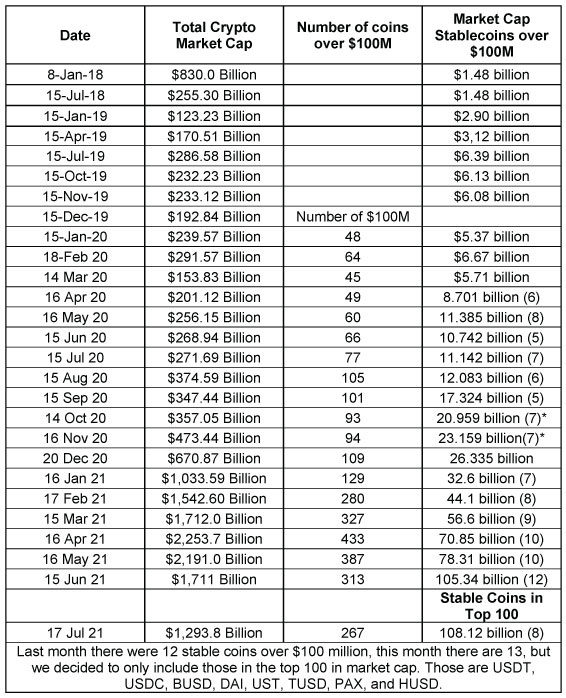

The following table tracks the amount of money in stable coins in the top 100 or which have a market cap of over $100 million. The percentage of the total crypto market cap indicates one measure of health for the crypto market.

Since last month, the crypto market cap is down $417 billion to just under $1.3 trillion. And, despite only using those stable coins in the top 100 we have $3 billion more there.

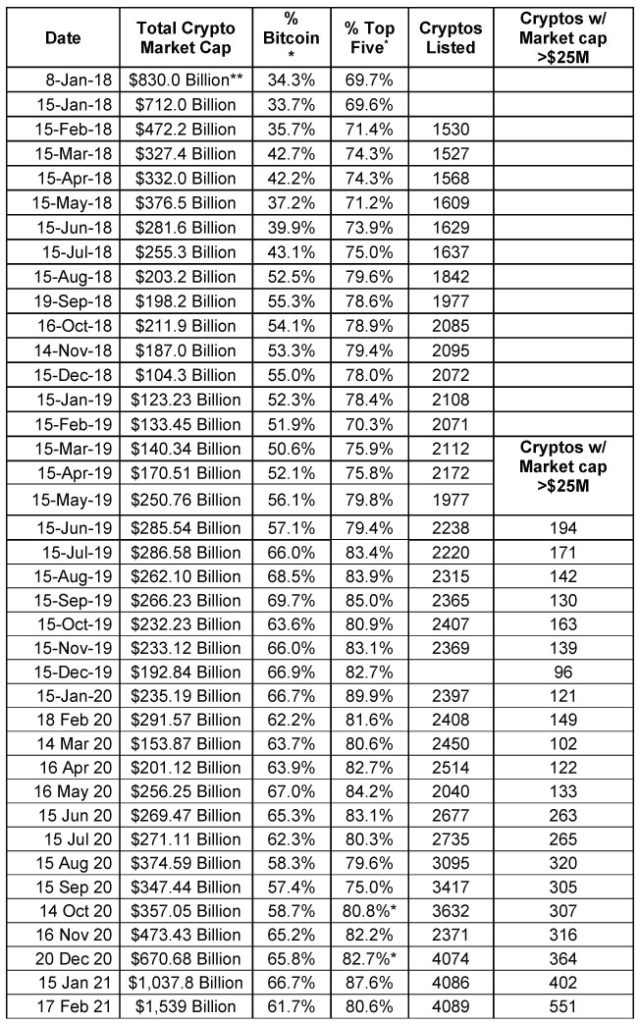

* Bitcoin was as high as 90% of the market cap of all cryptos at the beginning of 2017 to as low as 32% at the top of the market. Part of the difference is that there are now over 10,000 cryptocurrencies (but more than half are not on exchanges and don’t have a market cap) and the number keeps going up. BTC is up to 45% dominance and ETH is now up to 17.2%.

As I have mentioned previously, initial coin offerings were all the rage in 2017 until the SEC decided that cryptos were securities and ICOs were illegal. The new rage now is Decentralized Finance and this group includes these new coins in the top 75: Wrapped BTC (WBTC), AAVE, UNI, DAI, YFI, COMP, SNX, UMA, CEL, LRC, and SUSHI. I’m sure some of these coins will become buzzwords in the near future[1].

I used to say that I only trusted those coins in the top 50-100, however, from June 2020 to the present, many coins fell out of the top 100. Some of them did not fall far but some of them even fell out of the top 500.

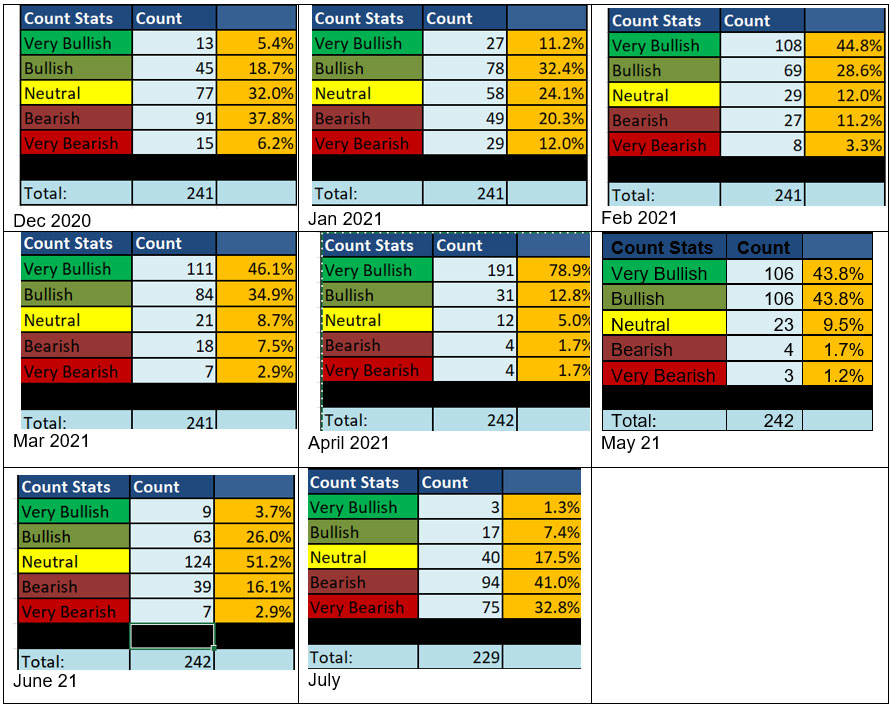

We now follow 229 coins in our crypto model. Twenty cryptos are currently in bear territory and another 40 cryptos are neutral. The remaining 169 are bearish. In April and early May, over 200 coins were bullish.

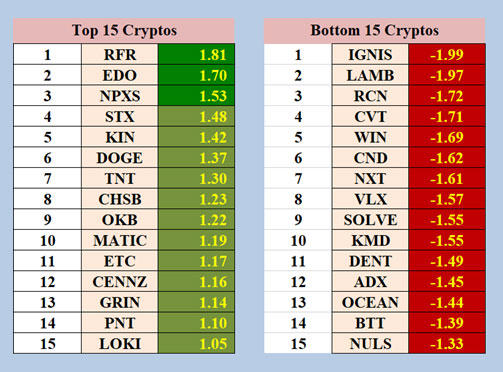

Here are the top and bottom 15 cryptos in terms of their Market SQN®. I’ve never heard of the top three coins this month and DOGE is junk. At its high, MATIC was up over 80 times in 2021 and now it’s only up 40 times its January 1, 2021 price. MATIC fell 41% over the last 30 days.

One of my favorite coins, CND, is now low enough that you can get all of the coin’s predictions for under $10,000. I believe CND has huge upside potential but who knows, it might go down more.

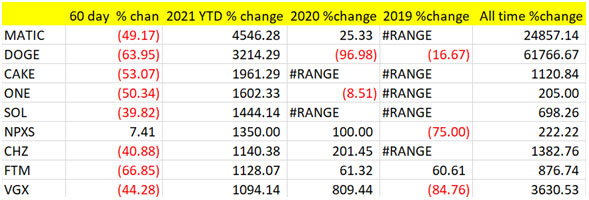

The next data show the top-performing cryptos of those we track. In this case, top-performing means gaining over 1,000% since the start of 2021. The table below shows a comparison between this month and last month. I didn’t include DOGE last month because it’s a dangerous coin. Notice that some of the coins from last month are no longer up by 1,000%.

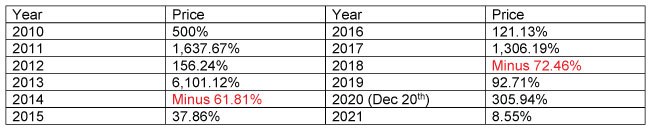

The following table shows the BTC change per year since January 2010.

People talk about BTC being volatile and risky. Where can you find something that has made over 1,000% in 3 of the last 12 years, over 100% in 7 of those years, and had only two losing years? There is only one other asset class besides BTC with anywhere near equal performance – other cryptoassets. Despite the bloodbath starting on May 19th, BTC is still up in 2021.

Cryptocurrency News

Here are what some with investing savvy are saying now about cryptos and BTC.

- Elon Musk. Tesla sold 10% of its BTC but will consider accepting BTC as payment when Musk can confirm at least 50% of miners are using clean energy.

- Paul Tudor Jones increased his BTC allocation from 2% to 5%.

- MicroStrategy plans to buy $488 million more BTC from the net proceeds of a bond sale. Its existing portfolio has 92,079 BTC or $3.7 billion worth.

- Ray Dalio says, “I’d rather have BTC than a bond. However, when most people believe that, then the government will want to do something about BTC.”

- George Soros, with $27 billion in AUM, approved BTC for trading.

- BlackRock, with nearly $9 trillion under management, plans to develop a blockchain strategy for Aladdin, its flagship portfolio management system.

- Morgan Stanley bought 28,289 shares of the Grayscale Bitcoin Trust (GBTC) for its Europe Opportunity Fund with $1.3 million at the time of sale.

- Goldman Sachs will offer ETH options and futures to their clients soon.

- Citigroup has launched a new business unit, Digital Assets Group, that is dedicated to cryptocurrencies and the blockchain.

- Hedge Funds plan to hold about 7.2% of their assets in cryptos within the next five years. That means $312 billion in demand for additional crypto market cap.

- SkyBridge Capital has launched a private ETH fund and said they will also apply for an ETH ETF.

- A $22 billion multi-strategy hedge fund, Point72 Asset Management, plans to add significant institutional capital based upon crypto trading.

- VanEck filed a prospectus for a BTC futures mutual fund with the SEC. It will invest in BTC futures contracts, exchange-traded products linked to BTC, and pool investment vehicles.

- Many newsletters that use fear and greed sales tactics and are saying that there will be a new world reserve currency starting soon which will devalue the US dollar officially by over 30%. Gold, however, is doing nothing relatively speaking. Is that a sign that these newsletters are just hype or is it a sign that gold is no longer a disaster hedge? Perhaps it’s some of both?

- PayPal and Square are now buying enough BTC to replace demand from India which proposed a trading ban on crypto. In the past 12 months, investments in cryptos there grew from nearly $200 million to around $40 billion. In India, a ban on something just means people will need to bribe someone to be able to get it. Indians currently hoard about 25,000 tons of gold.

- Ricardo Pliego, Mexico’s third-richest man, recently said that all fiat currencies are fraud and that if he had to hold a single asset for the next 30 years, it would be BTC. He said every investor should own BTC.

- Andreessen Horowitz launched a new $2.2 billion crypto fund, saying, “We’ve been investing in cryptoassets since 2013 and we are more excited today about what comes next than ever before.”

- BTC miners are moving out of China and many of them plan to set up shop in the US. In addition, some of them are looking to form public companies, and if they do, they’ll probably keep the BTC they mine.

- El Salvador, despite opposition from the IMF, has declared BTC a legal currency and plans to mine it using volcanic power.

- Canada approved two ETH ETFs in one day. Meanwhile, the US still doesn’t have one BTC ETF. The company that has those ETFs is Galaxy Digital which is listed on the Toronto stock exchange and can be traded over the counter in the US. It trades under the bulletin board symbol BRPHF on US exchanges and it trades at GLXY.TO on the Toronto exchange.

BTC News

- Despite a 50% decline in the value of BTC over the last 3 months, most of the long-term whales are holding their BTC and have been buying on the dip. The decline was caused at first by rumors (e.g., Elon Musk tweets) and new whales from the institutional community selling to take profits. The most sophisticated whales, however, are not selling (Soros, Dalio, Paul Tudor Jones, etc). Look what the big investment banks are doing now in the crypto news section.

- BTC is still very early in the adoption phase. Berkshire Hathaway can’t outperform BTC so Warren Buffet labeled it “rat poison squared” in 2018. According to the Economic Times on June 24th, 49% of investment firms still agree with Warren Buffet and only 10% of the firms surveyed by JP Morgan trade cryptocurrencies.

- Inflation is taking off again. It was officially 5.4% in June, but unofficially, it’s over 10%. Housing prices have gone up 10.8% in the past year and the cost of building materials has gone up much more. Even used car prices have soared. Gold has lost its inflation hedge status, in my opinion, to BTC.

- The Lightning Network might really improve the status of BTC. Right now, BTC is an inflation hedge because fewer coins are minted over time. BTC also acts as an alternative currency free of government control. Lightning is a blockchain network that sits on top of the existing BTC network and promises a much faster, more efficient way for people to transact BTC. Lightning Network channels are turned into a single transaction that is then settled on the Bitcoin Core Network. As I mentioned, El Salvador adopted BTC as an official currency and is looking for ways to adopt the Lightning Network. Lightning’s growth is going parabolic growing 20% in the last 30 days across 56,000 channels.

- The first BTC upgrade in four years, called Taproot, has been approved by miners. It won’t result in a fork but it will result in a major upgrade. It will mean trader transaction privacy and efficiency. But BTC, under Taproot, promises to be more than just an alternative currency. Currently, smart contracts can be created both on BTC’s core protocol level and on the Lightning Network. They will enable BTC to be used to build applications and businesses on the blockchain. The BTC community has agreed to a rollout but due to the amount of testing involved, the upgrade probably won’t happen until November 2021.

ETH News

- In case you were not aware of it, there is an Enterprise Ethereum Alliance. The founding members include Accenture, Banco Santander, BlockApps, BNY Mellon, CME Group, ConsenSys, IC4, Intel, JP Morgan, Microsoft, and Nuco.

- There will be a hard fork in ETH in the next month so if you own ETH now, you will own two coins after the fork. The change, called EIP (Ethereum Improvement Protocol 1559) will split the gas fees structure of Ethereum in two. It will include a tip from the sender (to the miner) and a base fee that will be burned (meaning the ETH in the new fork will start to shrink). I personally think this is a great upgrade because I have wanted to get out of some ERC-20 tokens at times but on UniSwap, the gas fees were almost equal to the value of the coins. This hard fork, called the London Hard Fork, should launch on August 4th and I’ve heard predictions that ETH will go over $3,000 by the end of August.

- Then in December this year, Ethereum has a bigger shift—to ETH 2.0. ETH 2.0 will run on the proof of stake Beacon chain. Right now, both ETH and BTC run on proof of work blockchains where miners solve a computational problem. Beacon will get rid of miners effectively and it has already been running for months in tests. At first, it will exist separately from the ETH main network, but eventually, the two networks will connect. ETH will still be the basis for smart contracts – that won’t change but the new proof of stake network will use 99.95% less energy.

Overall Commentary

This is a free newsletter to the VTI community. It makes no recommendations to buy or sell anything. Instead, it is educational and about understanding how money is made.

The two leading cryptos each have one major change happening this year:

- As soon as ETH becomes a Proof of Stake token and the costs of transactions go down substantially, my beliefs are that ETH could reach a trillion in market cap. After all, ETH is the backbone of the Decentralized Finance Movement.

- BTC’s major upgrade later this year will turn it from a 1st generation cryptocurrency to a 2nd generation with the addition of smart contracts. That should also be huge.

If BTC continues to go down from $30,000, I’d expect that by the end of the bear market, big institutions will own a major share of BTC, ETH, and many of the upcoming new crypto assets.

August 19 Infinite Wealth 2: Practical Strategies Through the Five Pillars of Wealth