An Auspicious Anniversary – What’s Next? By Van Tharp Trading Institute

During the past few weeks, the media has been reporting loads of “How life has changed” reports commemorating the first anniversary of the initial pandemic lockdowns.

Yesterday marked another key milestone in the markets: the one-year anniversary of the low tick in the fastest 30%+ crash in U.S. market history. So in a way, today marks the first anniversary of the start of the fastest recovery to a bull market in history. And it is a bull that rages on with the S&P 500 sitting a mere 1.1% below all-times made just last week.

With a year-old bull market, where do the probabilities lie for future movement? Three indicators say that this bull has more room to run.

1 – Recoveries After Big Drops

First, some data from the folks at LPL Financial about previous recoveries after 30%+ pullbacks:

The graphic provides three takeaways:

- The five previous recoveries all had strong first years and the second years continued to follow through to the upside. All but one had double-digit gains.

- The second year in 3 out of 5 had a correction.

- There are only five points of data. Yes, I know but we are looking for tendencies here, not statistical certainty…

2 – Lower Volatility

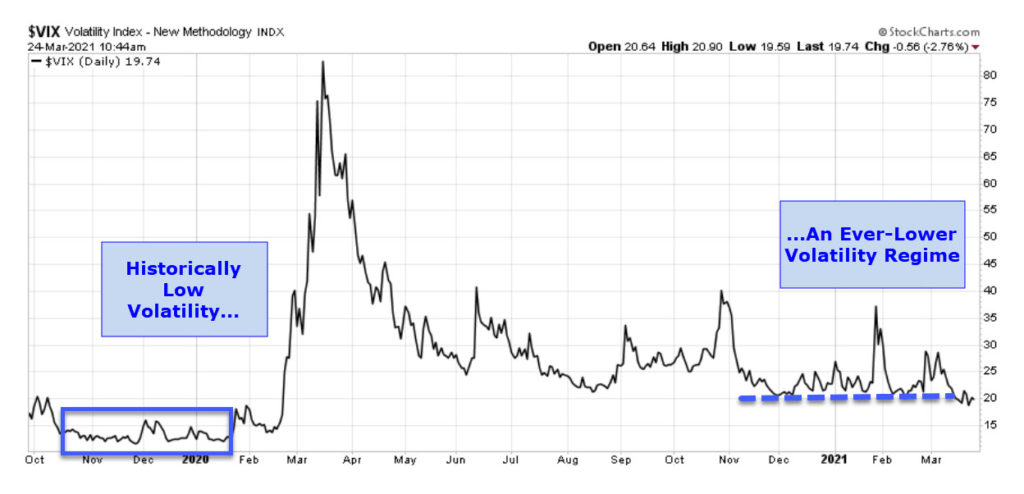

The second point supporting a continued bull run is the return to low volatility – or at least lower than the last twelve months. Here’s the VIX chart:

Takeaways from the chart:

- The run-up to the February 2020 market highs saw historically low levels of volatility – an earmark of a long-running, grinding bull market.

- Since the March 24, 2020 low, volatility has made a year-long pattern of lower lows.

- The current volatility breakdown below 20 shows progressively lower premiums being charged by option sellers despite a series of individual days with big moves to either the upside or the downside.

3 – Breadth

Lastly, let’s look at one of my very favorite index trend confirmation tools – the cumulative breadth indicator.

As a refresher, it’s calculated this way: Each day, the NYSE reports an “advance-decline” number, which is simply the number of stocks that closed higher today than yesterday minus the number of stocks that closed lower.

This number is also called the market “breadth.” If you add all of those individual breadths or advance-decline numbers together, you get a cumulative number. In these articles over the years, we have looked at this chart many times with a simple premise: When the market makes new highs, there is little danger of a massive selloff if the cumulative advance-decline line also makes new highs. And that’s where we find ourselves now:

Takeaway – Market breadth is still advancing telling us that lots of stocks are helping push the market to new highs. While this indicator moves slightly slower than some others, it has been consistently very reliable.

With these three indicators aligning with the massive monetary and fiscal stimulus adding continued fuel for the upside, I remain bullish.

Of course, there are risk factors that could derail this bull run. In a future article, we’ll look at some of those risks.

April 01 2021 Van Tharp Trading Institute Day Swing and Hybrid Trading Systems Workshops

Van Tharp Trading Institute Peak Performance Course for Investors and Traders