Update on Cryptocurrencies as of October 15, 2021 By Van Tharp Trading Institute

We did not publish a Crypto Update last month in mid-September. My laptop had crashed (the whole motherboard had to be replaced) and we started driving back home to North Carolina from Las Vegas. Thus, I have a lot to catch up on with you this month.

Go Here for Free Financial Forecasts Until November 03

Bloomberg announced in May 2018 that they had formed the Bloomberg Galaxy Crypto Index which was significant for several reasons. First, Bloomberg only caters to institutional clients. An index of this nature was the first step to widespread institutional involvement. The index tracks ten major cryptoassets: Bitcoin (BTC), Bitcoin Cash (BTC), Ethereum (ETH), Ethereum Classic (ETC), Litecoin (LTC), EOS (EOS), Ripple (XRP), and three privacy coins DASH (DASH), Zcash (ZEC), and Monero (XMR).

When it started in mid-2018, the index was at 1,000. It reached a new peak in May this year of 3,539 and then dropped significantly in the following weeks. The index is now close to its all-time high once again.

Bitwise also started a similar index called the HOLD 10 Index in 2017. You can invest directly in the index through Bitwise’s HOLD 10 Private Index Fund. The only difference between the HOLD 10 and Bloomberg’s Index is that the Bloomberg Index holds Ethereum Classic (ETC) while Hold 10 has Stellar (XLM).

Earlier this year, China essentially banned all BTC mining and then more recently outlawed crypto ownership and trading by Chinese citizens. Many of China’s miners have moved their operations to the US (mainly Texas) and major crypto exchanges like Binance have made it very difficult for the Chinese to trade crypto. Of course, trading is still possible for them on peer-to-peer exchanges like Uniswap.

Market Summary

BTC hit a new all-time high of $64,863.10 on March 13th, 2021, dropped to $30,681 on May 19th, then took another month to hit a new low of $28,893 on June 22nd. After that June bottom, BTC rallied 17% in a single day. The lowest close during that June-July period was $31,100 on July 16th. Our Super Trader Bitcoin system signaled an entry on July 30th at $38,895 and the position is up 55% currently with BTC at $61,859.

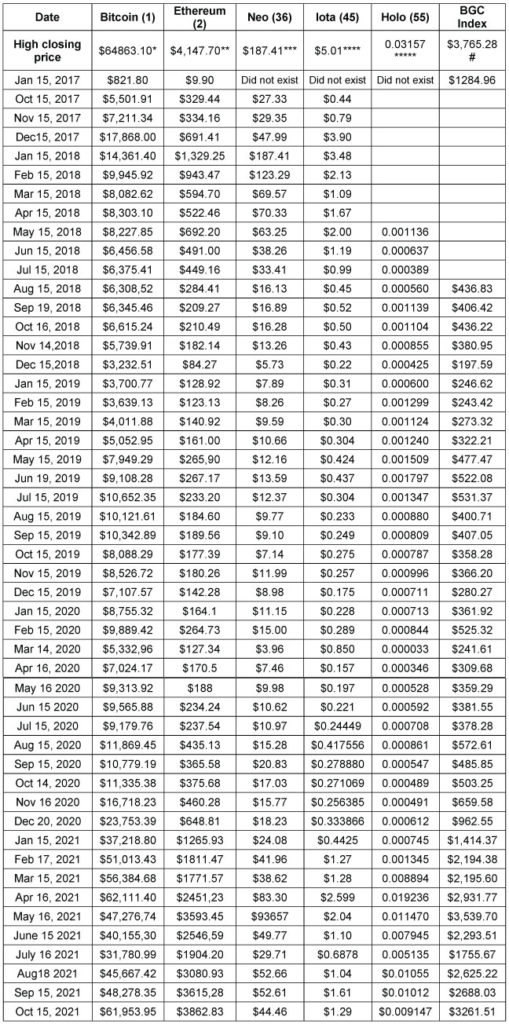

The table below tracks the price of five major cryptoassets across three generations of the technology now along with Bloomberg’s index:

- Bitcoin, a 1st generation cryptoasset,

- ETH and NEO, 2nd generation cryptos,

- Iota, a 3rd generation crypto,

- Holo (HOT), and

- BGCI Index – I’ve also started including BGCI prices in the table.

Date of the All-Time High Closes:

*Apr 14, 2021 ** May 11, 2021 ***Feb 12, 2021 **** Jan 15, 2017 ***** Apr 5, 2021 # May 7, 2021

Notice the huge gains in everything since mid-September.

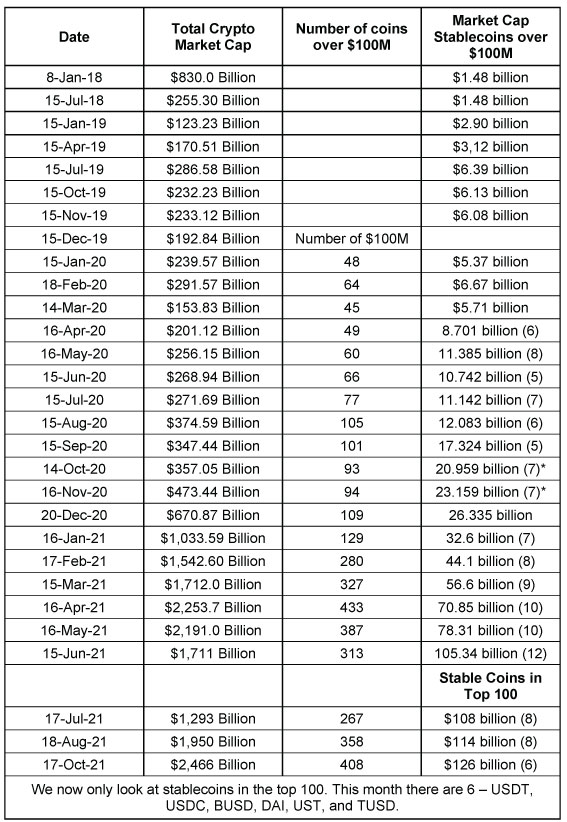

The following table tracks the amount of money in stable coins in the top 100 or which have a market cap of over $100 million. The percentage of the total crypto market cap indicates one measure of health for the crypto market.

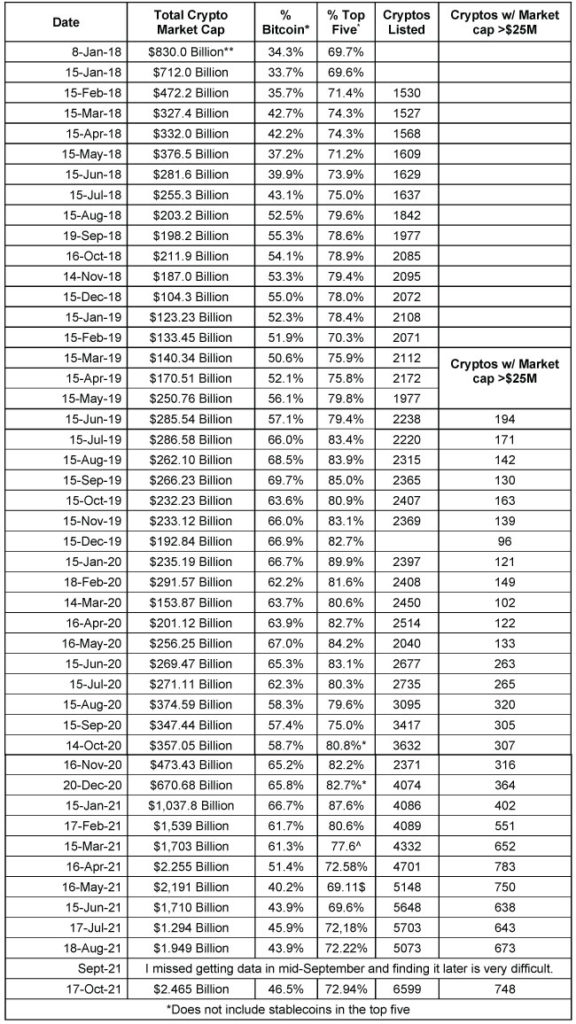

The next table tracks data about the market cap for crypto. Notice the big jump in market cap and total cryptos listed since mid-August.

* Bitcoin was as high as 90% of the market cap of all cryptos at the beginning of 2017 to as low as 32% at the top of the market. Part of the difference is that there are now over 12,800 cryptocurrencies (but more than half are not on exchanges and don’t have a market cap) and the number keeps going up. BTC is up to 44% dominance and ETH is now up to 18.2%.

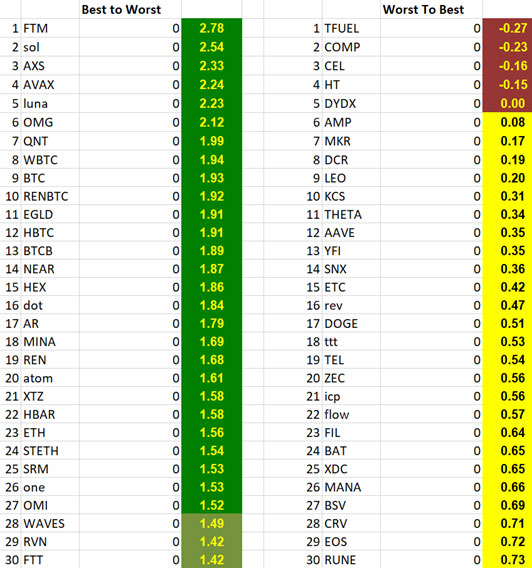

The table below shows the 30 best and 30 worst cryptos ranked by the Market SQN (100 days) for the 100 cryptos that we track.

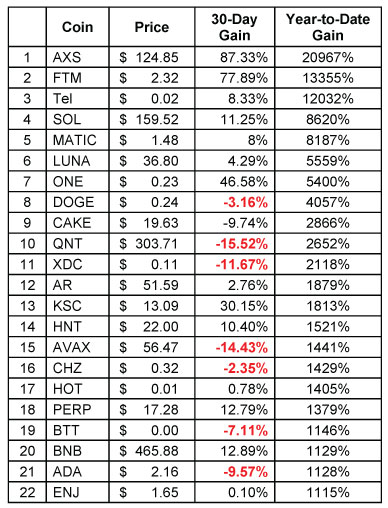

The table below was taken from Coin Market Cap and ranked by the year-to-date percentage returns. There are three coins up over 10,000%, there are 22 up over 1,000%, and another 12 up over 500%. That is, 37 coins in the top 100 market cap are up over 500% in 2021. There are another 40 coins up over 100%. Thus, over 77 of the coins in the top 100 in Coin Market Cap are up over 100%. Only one coin in the top 100 in Market Cap is down on the year – NEM (XEM) which is down 23.86%. Also, six of the top 100 cryptos are stable coins so they have no change in value over the year.

Top Performing Coins of the Top 100 in Market Cap

On Oct 1st, I sorted the first seven pages of coinmarketcap.com by the year-to-date return. That means I sorted the top 100, the top 200 (101-200), the top 300, etc. All the way up to the cryptos with a market cap of at least $25 million. Here are the number of cryptos in each grouping with year-to-date gains of over 1,000%. But remember this was on October 1st, 2021.

BTC “Volatility” and Gold’s Relative Performance

People talk about BTC being volatile and risky. But where can you find something that has made over 1,000% in 3 of the last 12 years, over 100% in 8 of those years, and had only two losing years? There is only one other asset class besides BTC with anywhere near equal performance – other cryptoassets. And despite the bloodbath that began on May 19th, it’s again up over 100% in 2021.

If you can tolerate 50% and larger drawdowns, buy and hold has provided huge returns. Our Super Trader BTC system beats buy and hold and eliminates those big drawdowns but we have to pay taxes on our profits because we are in and out of positions.

While gold has been viewed traditionally as a path to safety, it has underperformed during the pandemic and with the probability of additional trillions in massive government spending. The gold price certainly doesn’t reflect a big devaluation of the dollar as some newsletters are promoting. Many people cling to the belief that gold is the asset to hold to preserve value but that may no longer be the case now that the world has a new form of money/value.

Earlier in 2021, gold had about 40 times the market cap of cryptos. Now, even though cryptos are worth $2.4 trillion, gold still has about 5 times more market cap. If all the money in gold were to go into BTC, BTC’s price would reach about $370,000.

Cryptocurrency News

Here is what some with investing savvy are saying now about cryptos and BTC.

- Have you heard about the hamster named Mr. Goxx? He is “trading” cryptocurrencies and outperforming the S&P. But let’s see. The S&P 500 is up about 19% on the year. When 77 of the top 100 cryptos in market cap have more than 100% gains, I would hope a hamster could beat the S&P.

- Soros Fund Management, George Soros’s family office fund with $27 billion in AUM, confirmed it owns BTC.

- BlackRock, with nearly $9 trillion in assets under management, announced it will use a blockchain platform to track trades.

- Grayscale is readying a request for approval to convert GBTC to an ETF. If you own GBTC, that means the negative premium would disappear and the fees would probably be lower.

BTC News

- ProShares now has the first SEC-approved ETF holding cryptoassets. BITO started trading on October 19th and will hold BTC futures, not BTC directly. This development is bullish short-term for cryptos but it also gives institutions another tool to manipulate BTC prices so I have no idea what the long-term impact will be.

- The SEC approved an ETF application from Volt Equity, not for holding BTC but for holding the stocks of 30 companies associated with the crypto industry including Tesla, Twitter, Square, Coinbase, and PayPal.

- VanEck filed a prospectus for a BTC futures mutual fund with the SEC. It will invest in BTC futures contracts, exchanged traded products linked to BTC, and pooled investment vehicles.

- Invesco launched two ETFs on the CBOE. One index fund includes companies that develop infrastructure solutions for the crypto industry and for mining companies. The other ETF will include companies not directly related to cryptos.

- The president of El Salvador announced that he is introducing a fuel subsidy for those who pay with BTC from the Chivo wallet. And as a result of BTC growth, El Salvador now has a budget surplus of $4 million which will be invested in new projects.

- Some vulnerabilities were discovered in the Rocket Pool and Lido staking protocols in Ethereum 2.0. This will delay the ETH proof of stake transition for another six months.

- As a result, the number of active addresses on Polygon (MATIC) surpassed those on the ETH network for the 1st time. Polygon has low commissions, and it took only six months for the number of addresses to grow to 568,000.

- A lot of unknown factors in the spending bill(s) in Congress may affect cryptos. First, the Senate passed bill places an unfair onus on BTC miners, stakers, and several other groups by regulating anyone who facilitates the transfer of crypto as a broker. These “brokers” will have to report all of their transactions to the US Government. The House version of the bill has amendments about the issue but who knows if the bill will even come up for a vote. In addition, the House is looking at a bill to massively regulate crypto and who knows what happens when the government starts to regulate cryptos heavily. All of this huge uncertainty makes for a poor environment for big gains in cryptos, at least for now. Given what’s going on in Congress, I’d be surprised if either the $1.5 trillion economic bill or the $3.5 trillion infrastructure bill passes this year.

ETH News

- Ethereum is making a major shift to ETH 2.0 and this was scheduled to be introduced in December 2021. As mentioned earlier, however, testing found a major issue so ETH 2.0 will probably not be online until June 2022. When that does happen, ETH 2.0 will be running on the Beacon chain which will use proof of stake rather than proof of work – solving a big problem for ETH transactions.

- Even though ETHE (Grayscale’s ETH trust) has overtaken GBTC in popularity already, I think ETH will still overtake BTC but not until 2022-2023.

The Four Shining Areas of Cryptoassets Right Now

The major trends in cryptoassets are coming from four different areas – NFTs (nonfungible tokens), Blockchain games, Ethereum killers, and DeFi (which is not as strong right now). Let’s look at some of the best coins in each area.

- NFTs – Solana, ETH, Enjin Coin, and Chiliz

- Blockchain Games – Enjin Coin, Axie Infinity, Decentraland, Illuvium, Alice, Meme Lordz, and Crypto Blades

- Ethereum Killers – Solana, Cardano, Polkadot, and Binance Smart Chain

- DeFi – Luna, 1inch, Pancake, Sushi, Uniswap, Compound, and Aave. Luna is the absolute leader here, but good luck trying to find it if you are a US citizen.

Overall Commentary

This is a free newsletter for the VTI community. It makes no recommendations about buying or selling anything. Instead, it’s about understanding how money can be made in cryptoassets. In full disclosure, I personally own about 100 different cryptoassets, including many of those mentioned in this letter.