BigCommerce IPO Looking Like A Big Debut In Hot E-Commerce Market By Investors Business Daily

The initial public offering of BigCommerce Holdings (BIGC) plans to raise $198 million and is drawing heightened interest from investors in a hot e-commerce market. The BigCommerce IPO prices Tuesday and starts trading Wednesday under the ticker BIGC.

The company provides a cloud-based platform used by businesses to create online stores. Moreover, this includes a platform for launching and scaling e-commerce operations, including store design, catalog management, hosting, and checkout.

“Our software-as-a-service platform simplifies the creation of beautiful, engaging online stores by delivering a unique combination of ease-of-use, enterprise functionality, and flexibility,” said the BigCommerce IPO filing.

“The transition from physical to digital commerce constitutes one of history’s biggest changes in human behavior, and the pace of change is accelerating,” it said.

BigCommerce Compared To Shopify

Austin, Texas-based BigCommerce draws comparisons with Shopify (SHOP), a top-performing stock that held its IPO five years ago and has soared in value since then.

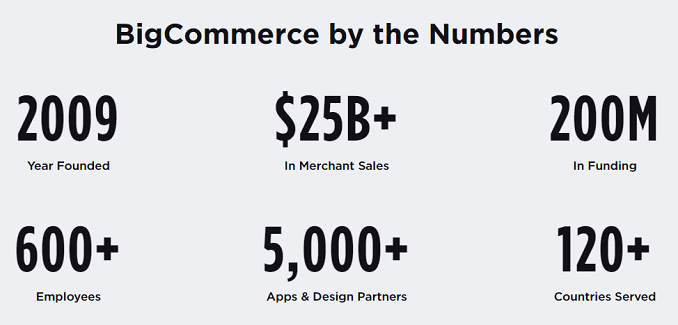

BigCommerce helps manage approximately 60,000 online stores across industries worldwide. Its customers include Avery Dennison (AVY), Ben & Jerry’s and Sony (SNE).

As an indication of heightened investor interest in the BigCommerce IPO, the company on Monday raised the value of its IPO by 53%, in terms of proceeds. It did so after Shopify turned in a huge June quarter that smashed estimates.

BigCommerce increased the number of shares it’s planning to offer to 9.02 million, from 6.85 million. And it raised the estimated price range to $21 to $23 per share. That’s up from the original range of $18 to $20 The BigCommerce IPO will receive an estimated market value of $1.7 billion, fully diluted.

In 2019, the company reported revenue of $112.1 million, up 22% from the prior year. It showed a net loss of $42.6 million vs. $38.9 million.

First-quarter revenue jumped 30% to $33.2 million, with a net loss of $4 million, vs. $10.5 million.

BigCommerce IPO Gets Top Rating

Research and advisory firm IPO Boutique is giving the BigCommerce IPO its highest rating of 5. It says the offering is “many times oversubscribed,” suggesting strong demand for shares by institutional investors.

“This company’s financials are very good with strong growth and improving gross margins,” IPO Boutique said in a note to clients.

Lead underwriters are Morgan Stanley, Barclays and Jefferies In addition, investment firm Tiger Global Management has indicated it is interested in purchasing up to 20% of the shares in the offering.

In addition to the BigCommerce IPO, also trading Wednesday is cloud company Rackspace Technology.

Shopify stock dipped 0.28%, closing at 1,080 on the stock market today.

August 12 How Big Money Trades: A Key Aspect of Systems Thinking Workshop