These Are The 5 Best Stocks To Buy And Watch Now By Investors Business Daily

Buying a stock is easy, but buying the right stock without a time-tested strategy is incredibly hard. So what are the best stocks to buy now or put on a watchlist? TopBuild (BLD), Snap (SNAP), Floor & Decor (FND), Idexx Laboratories (IDXX) and Mercado Libre (MELI) are prime candidates. On the App Store is basically pure profit for Apple.

Since the coronavirus bear market, stocks rebounded powerfully. The strong action reflects rising confidence that the economy will eventually recover from the coronavirus.

Covid remains a concern, but cases have tumbled as vaccinations reach more and more Americans. Nevertheless, the rising number of cases of the new Delta variant is an emerging worry.

The major indexes have shown strength by bouncing back strongly from recent challenges. However they have slipped back last week following disappointing jobs data. New producer price index data has also triggered inflation alarms.

Best Stocks To Buy: The Crucial Ingredients

Remember, there are thousands of stocks trading on the NYSE and Nasdaq. But you want to find the very best stocks right now to generate massive gains.

The CAN SLIM System offers clear guidelines on what you should be looking for. Invest in stocks with recent quarterly and annual earnings growth of at least 25%. Look for companies that have new, game-changing products and services. Also consider not-yet-profitable companies, often recent IPOs, that are generating tremendous revenue growth.

IBD’s CAN SLIM Investing System has a proven track record of significantly outperforming the S&P 500. Outdoing this industry benchmark is key to generating exceptional returns over the long term.

In addition, keep an eye on supply and demand for the stock itself, focus on leading stocks in top industry groups, and aim for stocks with strong institutional support.

Once you have found a stock that fits the criteria, it is then time to turn to stock charts to plot a good entry point. You should wait for a stock to form a base, and then buy once it reaches a buy point, ideally in heavy volume. In many cases, a stock reaches a proper buy point when it breaks above the original high on the left side of the base.

Don’t Forget The M When Buying Stocks

A key part of the CAN SLIM formula is the M, which stands for market. Most stocks, even the very best, follow the market direction. Invest when the stock market is in a confirmed uptrend and move to cash when the stock market goes into a correction.

The stock market has suffered a few pullbacks amid inflation fears and concerns about the rise of the delta variant of the coronavirus weighing on the market. The market is currently faltering after a bullish run. However it remain strong overall amid healthy earnings season gains.

The Dow Jones and the S&P 500 fell for five straight sessions last week. The Nasdaq also suffered a three day losing streak. While the Nasdaq and the S&P 500 remain clear of the key 50-day moving average, the Dow Jones has slipped below it.

The market remains in a confirmed uptrend. However it is especially important that investors stay disciplined and stick to sound buy and sell rules amid weak recent action. Err on the side of caution.

Nevertheless, it still is a good time to be buy fundamentally strong stocks that have built sound chart patterns. It is also an ideal time to be adding top stocks to one’s watchlist. The stocks featured below are potential candidates.

But remember, things can quickly change when it comes to the stock market.

Best Stocks To Buy Or Watch

- TopBuild

- Snap

- Floor & Decor

- Square

- Mercado Libre

Now let’s look at TopBuild stock, Snap stock, Floor And Decor stock, Square stock and Mercado Libre stock in more detail. An important consideration is that these stocks all boast impressive relative strength.

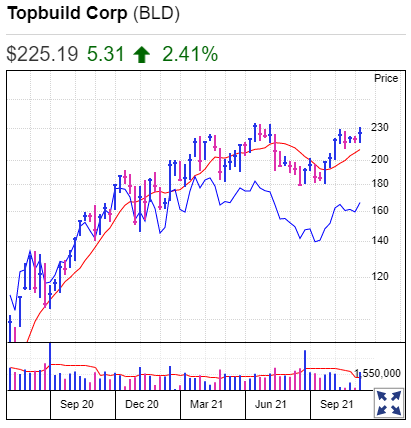

TopBuild Stock

Insulation specialist TopBuild is trying to clear a cup with handle entry of 229.99. It has popped above this level intraday, but has yet to close above it.

However aggressive investors can take advantage of a mini trend line within the handle generates an early buy point near 221.

The relative strength line is picking up again after talking a pause during its consolidation period. This gauges a stock’s performance compared to the broader S&P 500. Investors will want to see it maintain its momentum.

Earnings performance is the stock’s strongest suit, though market performance is also strong.

Since the start of the year BLD stock has gained more than 22%. This beats the S&P 500’s gain of less than 19%.

TopBuild has seen its earnings accelerate for the past four quarters in a row, most recently topping out with 64% growth.

Strong growth is seen continuing, with Wall Street expecting full year EPS to grow 49% in 2021 and 19% in 2022.

TopBuild was spun off by home improvement and construction products giant Masco (MAS) in 2015. The company provides insulation and building material services across the U.S. through its TruTeam and Service Partners businesses.

TruTeam is its installation segment. As well as insulation, it also installs products like rain gutters, glass and windows, fire proofing and garage doors. It counts for the bulk of its revenue. Service Partners provides distribution, and accounts for the rest.

The firm consistently posts double-digit earnings growth. Stephens analyst Trey Grooms previously told Investor’s Business Daily there are reasons to be optimistic .

“They’re best in breed for a housing play, where you’re going to get outperformance on the top line relative to what the housing market’s doing but also have some operating leverage there and margin expansion,” he said. “So the earnings growth should far outpace what you see in starts.”

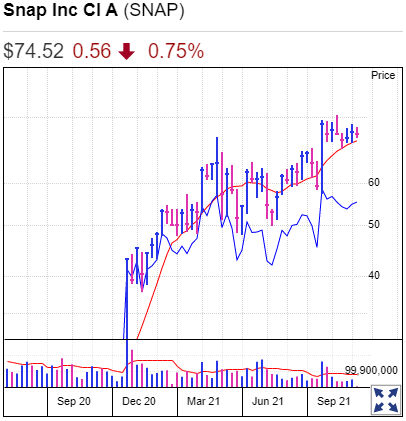

Snap Stock

The stock aggressively gapped above a long consolidation buy point of 73.69, and is currently trading in the buy zone above this entry. Snap stock also previously rebounded from its 10-week line.

Investors may want to focus more on a new short flat base with an 80.95 buy point. Snap stock could have an early entry from breaking above a short trend trend line, using last week’s high of 76.84 as a specific trigger.

The relative strength line is trying to move higher again after taking a breather following a sharp post-earnings spike. Investors will want to see it build momentum here.

Snap has a strong Composite Rating of 93. At the moment stock market performance is far more impressive than earnings, with the firm yet to turn an annual profit. Since the start of the year, SNAP stock is up around 51%.

Institutional support is solid for Snap stock. It boasts eight consecutive quarters of increasing fund ownership, and an Accumulation/Distribution Rating of C. In total, 50% of stock is held by funds.

When the firm posted results July 23 it reported adjusted earnings of 10 cents on revenue of $982 million. Analysts expected Snap to report a loss of 1 cent on revenue of $845 million. Revenue jumped 116% from the year-ago period.

Daily active users jumped 23%, or 55 million, to 293 million, above estimates of 290 million.

“Snap delivered very strong second-quarter results and provided an excellent third-quarter outlook,” Monness Crespi Hardt analyst Brian White said in a research note. “The results demonstrate that Snap has dramatically improved its operational execution over the past couple of years, successfully leveraged new innovations, and enhanced its ad tech stack to capitalize on a greatly improved digital ad-spending environment.”

The social media firm claims it is the best way to reach millennials and teenagers. Big consumer brands have increasingly spent more of their digital advertising dollars on Snap’s platform.

The company, recently featured in the New America, continues to develop new products, an important consideration for the CAN SLIM cognoscenti.

In mid-May, Snap introduced its first augmented-reality smart glasses called Spectacles. The company previously released camera-embedded sunglasses under the same name.

“Snap has continued to differentiate with unique content and innovative experiences for users,” Third Bridge Group analyst Scott Kessler told IBD. “Our experts say Snap has done the best job in terms of social media AR/VR features and functionality, even though Facebook bought Oculus, a leader in this area, some seven years ago.”

The new Spectacles aren’t for consumers yet. The company is making them available to software developers to see what sorts of applications they can create with them.

It also recently introduced an augmented reality shopping feature called “TrueSize.” The likes of Nike (NKE), clothing company Farfetch (FTCH) and watchmaker Piaget are fans of the feature.

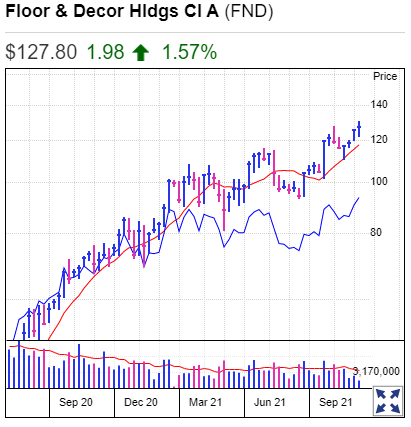

Floor & Decor Stock

Floor & Decor stock broke out past the 128.60 buy point of a flat base on Friday, but pared gains to close just below that entry. FND stock is in range from an early entry of 12.84.

The RS line for FND stock is looking bullish, and has been spiking higher since mid August. Indeed it just hit a new high, which is a bullish sign.

It holds a best-possible IBD Composite Rating of 96. It also boasts a perfect EPS Rating of 99, while price performance is also strong. The stock is up around 38% since the start of the year.

Floor & Decor has benefited from consumers investing in their homes among coronavirus lockdowns. Over the past three quarters earnings have grown by an average of 214%. This is almost nine times the 25% growth sought by CAN SLIM connoisseurs over this period of time.

However analysts believe earnings growth will continue. Full year EPS is seen jumping 64% in 2021, and swelling by a further 17% in 2022.

Its performance has made it the toast of Wall Street, with around 70% of stock now being held by institutions.

The Atlanta-based retailer operated 133 warehouse-format stores and two design centers across 31 states at the end of 2020.

It specializes in hardwood, tile, wood and natural stone flooring. Floor & Decor also offers decorative accessories and installation services. Floor & Decor is still a young stock, as it went public in April 2017.

During the firm’s most recent earnings call, CEO Tom Taylor said demand remains robust, even as consumers are spending more time out of their homes.

“I think, certainly, consumers are getting back out. They’re out of their homes. They’re back into restaurants. They’re back traveling. And some of that share of wallet, certainly, it’s going to shift,” he said. “But overall, the demand in the business is still pretty good.”

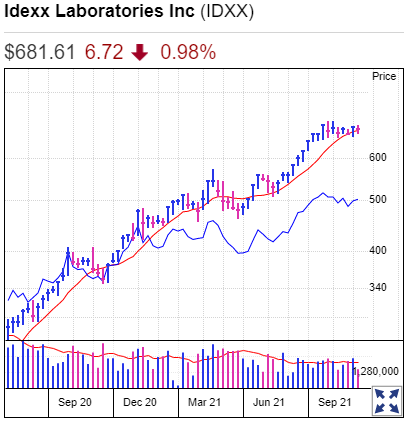

Idexx Laboratories Stock

The animal health stock has build a new flat base. It is currently trading under a buy point of 705.05. It is also offering up an early entry from a bounce off its 10-week line bounce. The entry here is 695.28.

It has been finding support at its 50-day moving average during its consolidation period. This gives it a platform to launch above its entry.

The relative strength line is also beginning to move upwards again. Investors will be looking to see the RS line move higher still as it tries to break out.

Idexx Labs is on the IBD Long-Term Leaders list due to its long run of outperformance vs. the S&P 500 index.

IDXX stock has a near-perfect Composite Rating of 98. While stock market performance is strong, earnings are even better. It boasts a top-notch EPS Rating of 96 out of 99.

Over the past three quarters earnings have grown by an average of 50%. Longer term EPS growth also meets CAN SLIM requirements.

One negative for Idexx stock is its Accumulation/Distribution Rating of D+, which represents slightly more selling than buying among institutions over the past 13 weeks. Institutional support is a key ingredient for winning stocks.

The firm manufactures diagnostic products an services for the veterinary markets. Sales of veterinary products increased year to date

Credit Suisse analyst Katie Tryhane, who rates Idexx stock as a buy, expects the strength to continue. During its recent Investor Day, the company guided to 10% top-line growth over the next five years.

Idexx also expects its operating margin to expand, driven by highly profitable recurring revenue, price increases, efficiencies in its reference labs and direct sales efforts. The company further called for profit growth of 15%-20%. That’s consistent with its previous long-term view.

Earlier this month, Idexx launched its newest hematology analyzer, dubbed ProCyte One. Better-than-expected placement of ProCyte One at veterinary clinics could also drive upside, according to Tryhane. After the company’s Investor Day, she raised her price target on Idexx stock to 760 from 735.

Diagnostic use is growing at veterinary clinics. As people spent more time with their pets during the pandemic, it helped them notice new health issues. Working from home also makes it easier to take a pet to the vet. These trends have bolstered Idexx stock.

Mercado Libre Stock

Mercado Libre stock has retreated below its buy zone after breaking out of a a cup with handle base. The ideal buy point here is 1,899.43. The stock closed down 5% last week, and is now looking for support at its 21-day exponential moving average.

The relative strength line took a breather as it formed its handle, but is now trying to move higher again.

With earnings returning after two quarters of losses, stock market performance has been a strength. This is reflected in its Relative Strength Rating of 89.

The stock’s case is bolstered by its most recent earnings report. Adjusted earnings jumped 23% to $1.37 per share, crushing views for 11 cents. Revenue doubled to $1.7 billion.

Based in Buenos Aires, Argentina, Mercado Libre is the largest provider of e-commerce services in Latin America, and has a big leg up on industry behemoth Amazon.com (AMZN), at least in its own backyard.

As of April, Mercado Libre received nearly 668 million monthly visits within Latin America, according to researcher Statista. Amazon was a distant second for that region, with 169 million.

Mercado Libre provides an e-commerce marketplace for buyers and sellers. Moreover, it hosts platforms where users can create online stores. It also provides financial services technology.

E-commerce sales jumped 96% to $1.14 billion in the second quarter. Revenue from financial technology services grew 89% to $560.4 million. It processed $7 billion in gross merchandise volume, up 46%. Active users climbed 47% to 75.9 million.

The recent IBD Stock Of The Day gets about 93% of revenue from Argentina, Brazil and Mexico. The remaining 7% comes from Colombia, Costa Rica, Chile, Venezuela and Ecuador, among other countries. In total, Mercado Libre operates in 18 countries.

“We believe that our business is showing tremendous momentum despite immense volatility in our key markets due to the frequent closing of physical retail across Latin America,” Chief Financial Officer Pedro Arnt said during a conference call with analysts after the earnings report. “Additionally, three of our top markets — Brazil, Argentina, and Mexico — were listed among the top five growth markets globally.”

Mercado Libre’s financial business, called Mercado Pago, allows customers to make contactless payments, pay utility bills, make peer-to-peer transactions and pay for transportation tickets. Mercado Pago faces competition in digital payments from Brazil-based PagSeguro Digital (PAGS).

Forecasts On U.S. Stock Indexes Bonds Gold Silver U.S. Dollar Market Psychology and Cultural Trends

Forecasts On Bitcoin Ethereum Litecoin Bitcoin-Cash XRP EOS Monero